Overview: Time for a satellite tune up

It may be time to service your satellite.

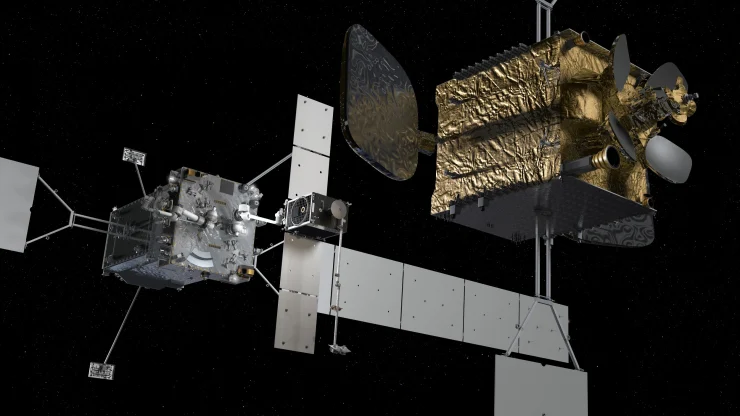

A division within Northrop Grumman has in recent years become the world leader in extending the life of valuable satellites that are already in orbit. Like any tune-up, it involves a mechanic, but this one’s robotic and performing a delicate dance far above Earth.

The company is building further on that business model. But how big is the market for satellite servicing, really, in an age where spacecraft are built and launched more cheaply and frequently than ever before?

I chatted this week with Jean-Luc Froeliger, senior vice president of space systems at Intelsat, whose company announced an order from Northrop Grumman’s Space Logistics unit for its latest service technology iteration.

A quick step back: In 2020, Northrop Grumman’s robotic spacecraft MEV-1 successfully docked with an old Intelsat satellite and extended its life by five years, marking an industry first. A year later, the companies took that feat a step further, docking MEV-2 with an active Intelsat satellite.

Northrop Grumman’s latest version of this tech represents a more flexible approach: A larger model, called MRV (or mission robotic vehicle), will carry three MEPs (or mission extension pods), that it plans to deliver and connect with three satellites in 2026. Like before, the targets are big, expensive satellites operating in the distant geosynchronous orbit.

Intelsat ordered one of the MEPs, as did Australian satellite operator Optus. A third is expected to be sold soon.

Froeliger explained that the new approach represents a shift in business strategy for Intelsat from “renting” the MEVs for a certain number of years to owning.

“In the end, it’s all a business decision that depends on the price of the MEP versus the price of a yearly MEV service,” Froeliger said.

While Intelsat has “study contracts with three or four other companies” for future satellite servicing missions, Froeliger noted that Northrop Grumman is the most “advanced” in this space sub-sector.

But the size of the market today largely depends on the number of geosynchronous satellites that would benefit from life extension. Froeliger said about 10% of the 56 satellites in Intelsat’s fleet are candidates – making satellite servicing still a niche market.

“The others we’ll replace with a brand new satellite,” Froeliger said.