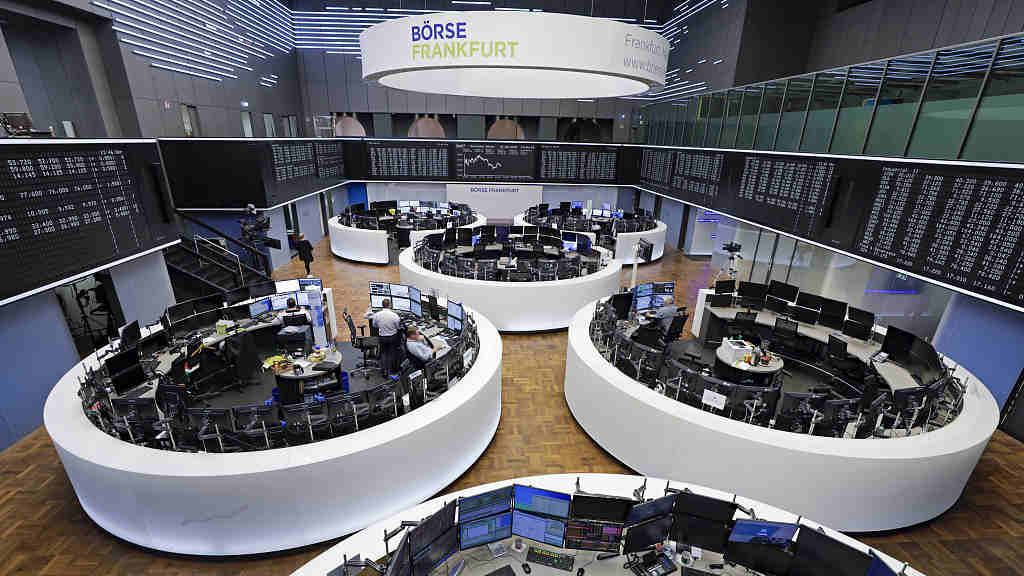

European stock markets closed higher Friday, with the Stoxx 600 logging gains of 7.05% in the first quarter despite a volatile few weeks of trade in the banking sector.

European Stocks Log Gains of Over 7% for the First Quarter

The European benchmark closed down 1.36% for the month.

On Friday, the Stoxx 600 index closed up 0.6% from the previous session after euro zone consumer price rises cooled and a key U.S. inflation print came in lower than expected.

Retail stocks led gains, extending the Thursday rally and ending up by 1.7%, while household goods and financial services both rose 1.2%.

Banks were the sole outlier, closing 0.2% lower despite positive momentum throughout the week. Swedbank was one of the worst-performing European stocks.

Euro zone headline inflation slowed to 6.9% in March, a preliminary reading showed, down from 8.5% in February — the sharpest fall on record, according to Reuters. But core inflation, stripping out energy and food, increased from 5.6% to 5.7%.

European Central Bank policymakers have this week suggested more interest rate hikes are necessary, but may come at a slower pace. The ECB hiked by 50 basis points in March.

Further data releases through the morning showed a drop in German retail sales; while the U.K. economy recorded 0.1% growth in the fourth quarter of 2022, revised up from a first estimate showing no growth.

The U.S. personal consumption expenditures price index, excluding food and energy, increased 0.3% in February, new data showed Friday. The inflation gauge, which came in slightly lower than expected, is closely watched be the Federal Reserve and investors as they chart the path of future interest rate hikes.

“Markets are rounding off the first quarter of 2023 in a positive fashion,” said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

Global tech stocks are up 19% for the quarter, she said, and investors are feeling more confident despite jitters in the U.S. banking space.

“The nearer-term catalyst for further market moves will be the U.S. inflation read later on today. While inflation has been moving in the right direction overall, core inflation remains sticky. There are likely to be positive ripples across the major indices if we see core inflation loosening, because it clears further rubble out the road for risk-on assets to prosper,” she said in emailed comments.

Asia-Pacific markets closed higher on Friday. U.S. stock market news and futures were slightly lower.