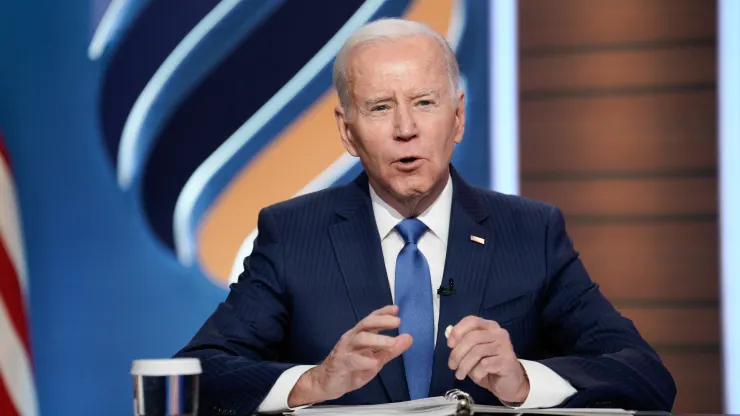

WASHINGTON — President Joe Biden on Thursday urged federal regulators to take up a set of reforms to safeguard the banking system, following the collapse of Silicon Valley Bank and Signature Bank.

Biden Calls for Banking Regulations After Silicon Valley Collapse

The White House said in a fact sheet Thursday that Biden’s proposals fit into his recent effort “to strengthen oversight and regulation of larger banks so that we are not in this position again.” The administration wants regulators to take a range of steps to reinstate safeguards for banks with assets between $100 billion and $250 billion and bolster supervision over financial institutions.

“Each of these items can be accomplished under existing law,” the White House said.

The administration’s proposed reforms include:

- Raising liquidity requirements for mid-sized banks;

- Updating liquidity stress tests to take into account high-speed digital withdrawals, and the ability of social media to spread information among depositors at a much faster pace than ever before;

- Increasing the frequency of stress tests for mid-sized banks;

- Requiring mid-sized banks to submit plans to regulators explaining how they would close down in the event that they fail, without transmitting added stress to the financial system;

- Updating stress tests to account for novel situations not accounted for in current models, like the effect of rapid interest rate hikes on banks with high rates of low-yield, long-term debt;

- Limiting which banks must contribute to replenishing the Deposit Insurance Fund, which the government used to bail out Silicon Valley Bank’s uninsured depositors.

Several of the proposals the White House endorsed are already under consideration, according to bank regulators who testified this week before two congressional committees. As Republicans, who are more skeptical of regulation than Biden’s Democratic Party, control the House, the administration has pushed for potential fixes that would not require new legislation.

Among these are stricter rules for measuring liquidity in mid-sized banks, those with over $100 billion in combined assets, but under $250 billion.

While the Trump-era deregulation bill passed in 2018 limited regulators’ ability to impose liquidity demands and stress tests on small banks, it gave agencies broad discretion as to how to tailor bank capital requirements for mid-sized banks like SVB.

In responding to the bank failures, GOP lawmakers have criticized the Biden administration and regulators rather than bank executives. They have said federal officials had the tools they needed to prevent the collapses, but did not act properly.

In a statement Thursday, Rep. Patrick McHenry, R-N.C., chair of the House Financial Services Committee, accused the Biden administration of politicizing the banks’ failures and questioned whether the proposed fixes would have prevented the crisis.

“As we heard from Biden’s own regulators at our hearing yesterday, supervisory incompetence was the leading cause of the failures,” McHenry said, referencing the Wednesday event with banking regulators. “There is no evidence that the original Dodd-Frank would have prevented these bank runs.”

McHenry added that recent stress tests do not account for “current economic conditions” that contributed to the banks’ collapse.

“Instead of giving more authority to regulators who were asleep at the wheel before these bank failures, we should hold them accountable for their inability to utilize their existing supervisory tools,” he said.

Meanwhile, Democrats are forging ahead with new legislation. Since SVB collapsed in mid-March, members of Congress have introduced a half-dozen bills intended to penalize bank executives and to help stabilize the financial system going forward.

On Wednesday, a group of Democratic senators, led by financial regulatory hawk Sen. Elizabeth Warren, D-Mass., sent a letter to bank regulators demanding stronger bank capital requirements. Warren and Sen. Catherine Cortez Masto, D-Nev., introduced legislation Wednesday that would require federal regulators to claw back all or part of compensation earned by executives in the five-year period preceding a bank failure.

Rep. Maxine Waters, D-Calif., ranking member of the House Financial Services Committee, also announced this month that she will create a bill to enhance accountability for bank executives at failed firms, through tools including clawbacks and penalties.

USA News Group is your Trusted publisher for top news and stories headlines