If you looked at the price of digital assets seven days ago, promised yourself to not look again until a week passed and then looked at their prices Thursday, you’d likely think that nothing significant had occurred.

Bitcoin and ether prices changed only mildly, with BTC down 0.57% and ETH down 2.52%. Trading activity was orderly, with overall volume trailing the 20-day moving average for both assets.

This week was anything but uneventful, however, with the Federal Open Market Committee (FOMC) announcing another interest rate hike, the banking industry trying to avert a meltdown and U.S. regulators ratcheting up their scrutiny of the crypto industry.

Even the Biden administration was viewing the crypto industry more sharply this week. Its “Economic Report of the President” led with comments that the design of crypto assets “frequently reflects an ignorance of basic economic principles that have been learned in economics and finance over centuries, and this inadequate design is often detrimental to consumers and investors.”

Still, much of the economic turmoil this week is tied to the bond portfolios of traditional banking institutions. Those bond values have declined sharply following the most rapid increase of interest rates in history.

The Federal Open Market Committee ultimately raised interest rates by 25 basis points as expected, and said that it expects to continue doing so as inflation, the result partly of a two-year long, 0% interest rate environment, remains too high.

FOMC raised its Core PCE inflation estimates for 2023 to 3.3% from 3.1%, but the ultimate interest rate projection of 5.1% remains.

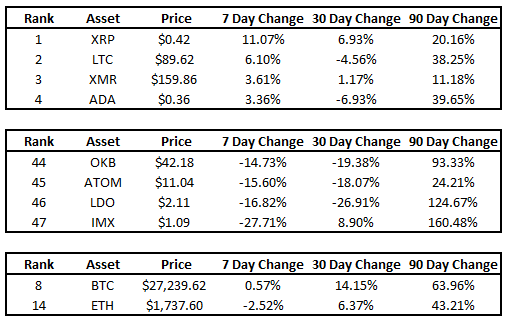

Among crypto assets with market capitalizations of $1 billion or more, BTC and ETH were eighth and 14th, respectively, in this week’s CoinDesk Indices price performance chart.

Asset Performance 03/24/23 (Messari)

XRP led the group rising 11.1%, while immutable X (IMX) and its 27.7% decline was the laggard. Looking ahead to next week, key points on the economic calendar include the quarterly GDP data on March 30, and core personal consumption expenditure (PCE) data on March 31.

Investors’ focus may also shift to whether BTC and ETH retrace to their 20-day moving averages or ascend higher. Another key item to watch is whether ether will gain ground versus bitcoin.

Year to date, ETH has underperformed BTC by 12%, despite their traditionally tight correlation.