Stock Markets

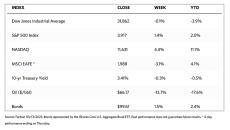

The major indexes closed mixed for the week. According to the Wall Street Journal weekly tally, the Dow Jones Industrial Average dropped by 0.15%; in it, the transportation sector underperformed with a 3.07% loss, while the utility sector outperformed with a rise of 4.02% for the week. The broad-based S&P 500 Index managed to climb by 1.43% and the technology stock-heavy Nasdaq Stock Market Composite surged by 4.41%. The NYSE Composite dipped by 1.98%. In the meantime, the CBOE Volatility index, a risk perception metric, rose by 2.86% which suggests an increase in the level of risk investors perceive in the equities markets.

The lack of direction in the markets reflects the crosscurrents of the banking sectors’ stressors, concerns of a likely harder economic slowdown soon, and speculation that the Federal Reserve will now be compelled to temper or possibly pause their rate-hiking cycle. Within the S&P 500, industry sector returns varied widely. Communication services and technology shares recorded strong gains as evidenced by the Nasdaq surge, while the financial and energy sectors succumbed to significant losses. Performing especially well in this environment were the mega-cap tech shares that generate significant free cash flow that have minimal exposure to the regional banks. The large-cap growth stocks outperformed the value stocks by 580 basis points or 5.80 percentage points.

Over the weekend, the jitters set off by the previous Friday’s failure of Silicon Valley Bank (SVB), that this might spark a repeat of the 2008 financial contagion were calmed, despite the closure on Sunday of New York’s Signature Bank. Signature Bank was another large regional bank, this time with heavy exposure in the cryptocurrency markets. On the same day, the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the Treasury Department jointly announced that all SVB depositors would have full access to funds on Monday morning. To safeguard deposits, the Fed made additional funding available to banks and prepared to address expected liquidity pressures. Furthermore, the Fed announced that it was launching an internal review of its supervision and regulation of SVB.

U.S. Economy

Credit markets were on the receiving end of the fallout of the banking stresses, however, Shorter-duration bonds and bonds issued by regional banks experiences some of the largest fluctuations, while investment-grade credit spreads widened to a four-month high. During the week, no new deals reached the market as volatility sidelined potential issuers. The high-yield market was also mostly quiet.

The Labor Department on Tuesday reported that February’s headline consumer inflation had moderated, in line with expectations, to 6.0% year-on-year. This was inflation’s slowest pace since September 2021. On Thursday, surprise but welcome news emerged that producer prices declined by 0.1%, partly due to a sharp decrease in transport and warehousing costs. Regarding the bonds market, yields have fallen but credit spreads continue to widen. A sharp decline in longer-term Treasury yields has materialized due to lower growth expectations and higher risk aversion. The yield on the benchmark 10-year note touched an intraday low of 3.37% on Thursday, its lowest level since the start of February. This brings bond prices up since bond prices and yields move in opposite directions. Amid balanced flows and lower-than-normal new issuance, technical conditions in the tax-exempt municipal bond market were generally supportive.

It historically takes 12-18 months before Fed hikes impact demand and employment, a window where we are at now. During this cycle, pandemic distortions and other unique factors have helped make the economy less sensitive to rising interest rates, but soon the impacts will set in. Consumers built a cash cushion of approximately $2.1 trillion during the early days of the pandemic, but as of now, these savings have already been reduced by half. Pent-up demand for services that have accumulated during the lockdowns has largely been satisfied already, and spending appears to have returned to its pre-pandemic trend, evidenced by the slow rise of auto inventories after three years of underproduction.

Metals and Mining

The gold market took its cue from the biggest banking crisis since the 2008 Great Financial Crisis that occurred this past week. Gold proved to be the ultimate safe-haven asset that investors run to when an unexpected crisis shakes the markets. Analysts report that gold prices are ending Friday up more than 3% on the session as investors do not want to go home ahead of the weekend sans some protection from the uncertain shocks that are still to take place. It appears that customers are urgently moving their money out of regional banks at an unprecedented rate, in the process creating a liquidity crunch. The regional banks have to sell bonds to raise the capital to meet their customers’ withdrawal demands. However, the aggressive interest rate hikes of the last 12 months that have been pushed by the Feds to control inflation have driven bond prices down to almost nothing, so the banks are selling their bonds at a loss. As a sign of the panic in the financial system, data from the Federal Reserve showed that banks borrowed a record $164.8 billion from the Fed in the week ending March 15, compared to $4.58 billion borrowed the previous week. In the 2008 crisis, the record borrowing was $111 billion.

In the week just ended, gold came from $1,868.26 one week ago to $1,989.25 per troy ounce this week for a gain of 6.48%. Silver ended at $20.54 one week ago and at $22.60 per troy ounce just this past week for a gain of 10.03%. Platinum followed the trend from its week-ago close at $964.88 to last Friday’s close at $978.95 per troy ounce, climbing by 1.46%. Palladium climbed this week by 2.84% from its week-ago close of $1,383.98 to this week’s close of $1,423.30 per troy ounce. The three-month LME prices for base metals generally lost ground for the week. Copper lost by 3.78% from the previous week’s close of $8,853.00 to this week’s close at $8,518.00 per metric tonne. Zinc came from its week-ago close of $2,974.00 to this week’s close at $2,857.50 per metric tonne for a loss of 3.92%. Aluminum ended this week at $2,267.50 per metric tonne, a loss of 2.60% from the previous week’s close of $2,328.00. Tin, which closed the previous week at $23,351.00, ended this week at $22,218.00 per metric tonne, down by 4.85%.

Energy and Oil

The looming bank crisis brought about by the collapse of Silicon Valley Bank has alerted the oil markets to the risks of seeing other U.S. banks going down the drain. This dire prospect has sent the benchmark WTI below $75 per barrel and Brent below the $80 per barrel mark. The oil supply-demand narrative has almost been completely overtaken by news of the macroeconomic situation, to the point that even the few newsworthy events did not attract the attention of investors. OPEC oil demand growth remains at 2.3 million barrels per day and U.S. oil inventories appear to remain relatively stagnant. In the most recent monthly oil market report, OPEC increased its 2023 oil demand growth forecast for China to an increase of 0.71 million barrels per day year-on-year. This is attributed to strong jet fuel and diesel demand hikes of which one-third of this year’s global growth is accounted for by the Asian powerhouse that is China. Meanwhile, the now-failed Silicon Valley Bank has been a major lender to community solar projects, thus its collapse could jeopardize the buildout of smaller than utility-scale solar farms, currently at a capacity of 5.6 GW.

Natural Gas

Based on the report week from March 8 to March 15, 2023, the Henry Hub spot price fell $0.06 from $2.50 per million British thermal units (MMBtu) at the beginning of the week to $2.44/MMBtu by the week’s end. The price of the April 2023 NYMEX contract decreased by $0.112, from $2.551/MMBtu on March 8 to $2.439/MMBtu on March 15. The price of the 12-month strip averaging April 2023 through March 2024 futures contracts declined $0.206 to $3.179/MMBtu. International natural gas futures prices increased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia rose $0.01 to a weekly average of $14.22/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.91 to a weekly average of $14,57/MMBtu. The prices were $36.76/MMBtu in East Asia and $37.95/MMBtu at the TTF in the corresponding week last year (i.e., the week ending March 16, 2022).

World Markets

European shares tumbled this week on concerns that systemic shocks in the financial system in the U.S. may spark contagion in the global markets. The pan-European STOXX Europe 600 Index ended the week lower by 3.84% in local currency terms. Major stock indexes followed the trend with hefty losses. Italy’s FTSE MIB Index plunged by 6.55%, Germany’s DAX Index gave up 4.28% of its value, and France’s CAC 40 Index declined by 4.09%. The UK’s FTSE 100 Index suffered its biggest weekly loss since early June 2020, plummeting by 5.33%. Within the STOXX Europe 600 Index, the sector that declined the most was, not surprisingly, the banking sector. The plunge in share values reflected concerns that Credit Suisse’s challenges could create counterparty risk in the financial system. After the chair of Saudi National Bank announced that it would not invest further capital in the Switzerland-based financial giant, its shares suffered a huge sell-off despite the company having unveiled last fall an ambitious restructuring plan. The development followed on the heels of Credit Suisse delaying the release of its annual report due to “material weakness” in its financial reporting controls. On Thursday, the stock rebounded after news that the Swiss National Bank had offered to provide Credit Suisse with liquidity and that the company had sought to “preemptively” strengthen itself by borrowing more than USD 50 billion from the Swiss National Bank. Medi continued to speculate, however, that further action eventually was needed to follow up on these preliminary steps. Meanwhile, the European Central Bank (ECB) announced that it raised its deposit rate by half a percentage point to 3.0% as part of its ongoing effort to curb elevated inflation.

In Japan, although there is a limited direct impact on Japan’s financial system from the global banking sector, Japanese equities nevertheless went sharply lower. The Nikkei declined by 2.88% for the week while the broader TOPIX Index fell by 3.55%. Losses were buffered by speculation that major central banks could adopt a less aggressive approach to monetary policy tightening in light of the week’s developments and concerns about broader weakness in the global economy. The yield on the 10-year Japanese government bond fell to 0.30%, from 0.42% at the end of the previous week, as growing risk aversion prompted investors to seek out safer assets. The yen strengthened to about JPY 133 versus the U.S. dollar from roughly JPY 135 the previous week, also due to a flight to safety.

Chinese stocks ended mixed after a volatile week as global banking concerns offset optimism about a recovering economy and further monetary support from Beijing. The Shanghai Stock Exchange Index gained by 0.63%, and the blue-chip CSI 300 Index fell by 0.21% in local currency terms. In Hong Kong, the benchmark Hang Seng Index gained by 1%. The People’s Bank of China (PBOC) announced its intention to cut the reserve requirement ratio (RRR) for most banks by 25 basis points for the first time this year in an attempt to ensure liquidity and boost the economy. The PBOC also injected a greater-than-expected RMB 481 billion into its financial system via its one-year medium-term lending facility, compared with RMB 200 billion in maturing loans. The moves follow PBOC Governor Yi Gang’s surprise reappointment for another term after he was widely expected to retire. Yi’s retention appeared to have a calming effect on the markets after the revamp of central government institutions under the State Council (China’s cabinet), the week before. Analysts view Yi’s retention as a bid to maintain financial stability in China’s recovering economy.

The Week Ahead

The Fed rate hike decision and initial and continuing jobless claims are among the important economic data to be released in the coming week.

Key Topics to Watch

- Existing home sales

- Fed interest rate decision

- Fed Chair Powell press conference

- S. current account

- Initial jobless claims

- Continuing jobless claims

- New home sales

- Durable goods

- S&P Global flash U.S. services PMI

- S&P Global flash U.S. manufacturing PMI

Markets Index Wrap Up