MQS Management LLC raised its position in shares of Teradyne, Inc. (NASDAQ:TER – Get Rating) by 82.5% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 6,451 shares of the company’s stock after buying an additional 2,917 shares during the quarter. MQS Management LLC’s holdings in Teradyne were worth $485,000 at the end of the most recent quarter.

Other institutional investors also recently made changes to their positions in the company. Bank of New York Mellon Corp boosted its stake in Teradyne by 1.6% during the 3rd quarter. Bank of New York Mellon Corp now owns 1,584,350 shares of the company’s stock valued at $119,066,000 after purchasing an additional 24,338 shares in the last quarter. Robeco Institutional Asset Management B.V. lifted its position in shares of Teradyne by 8.0% during the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 556,350 shares of the company’s stock valued at $41,811,000 after acquiring an additional 41,092 shares during the last quarter. CVA Family Office LLC lifted its position in shares of Teradyne by 114.2% during the 3rd quarter. CVA Family Office LLC now owns 619 shares of the company’s stock valued at $47,000 after acquiring an additional 330 shares during the last quarter. Teachers Retirement System of The State of Kentucky acquired a new stake in shares of Teradyne during the 3rd quarter valued at $1,107,000. Finally, National Pension Service lifted its holdings in shares of Teradyne by 0.8% in the third quarter. National Pension Service now owns 290,150 shares of the company’s stock valued at $22,391,000 after purchasing an additional 2,168 shares in the last quarter. 97.05% of the stock is owned by institutional investors.

Insider Transactions at Teradyne

In other news, VP Charles Jeffrey Gray sold 686 shares of the stock in a transaction on Tuesday, January 31st. The shares were sold at an average price of $100.00, for a total value of $68,600.00. Following the completion of the transaction, the vice president now owns 23,270 shares in the company, valued at approximately $2,327,000. The sale was disclosed in a filing with the SEC, which is available at this link. In other Teradyne news, Director Mercedes Johnson sold 750 shares of the business’s stock in a transaction dated Monday, January 23rd. The shares were sold at an average price of $100.00, for a total value of $75,000.00. Following the transaction, the director now directly owns 19,737 shares in the company, valued at $1,973,700. The transaction was disclosed in a document filed with the SEC, which is available through this link. Also, VP Charles Jeffrey Gray sold 686 shares of the business’s stock in a transaction dated Tuesday, January 31st. The shares were sold at an average price of $100.00, for a total transaction of $68,600.00. Following the completion of the transaction, the vice president now owns 23,270 shares in the company, valued at $2,327,000. The disclosure for this sale can be found here. In the last quarter, insiders have sold 82,847 shares of company stock valued at $7,452,053. 0.36% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on the company. Loop Capital lowered Teradyne from a “buy” rating to a “hold” rating and reduced their target price for the company from $110.00 to $102.00 in a report on Friday, January 27th. Jefferies Financial Group started coverage on Teradyne in a report on Thursday, January 12th. They issued a “buy” rating for the company. Citigroup upped their price target on shares of Teradyne from $112.00 to $125.00 and gave the stock a “buy” rating in a research note on Sunday, February 5th. Northland Securities upped their price target on shares of Teradyne from $84.00 to $97.00 and gave the stock a “market perform” rating in a research note on Friday, January 27th. Finally, TheStreet raised shares of Teradyne from a “c+” rating to a “b-” rating in a research note on Tuesday, January 24th. Ten analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. According to MarketBeat, the stock presently has an average rating of “Moderate Buy” and a consensus target price of $87.52.

Teradyne Price Performance

Shares of Teradyne stock traded down $4.74 during midday trading on Wednesday, hitting $100.43. The company had a trading volume of 735,364 shares, compared to its average volume of 1,631,908. Teradyne, Inc. has a 1-year low of $67.81 and a 1-year high of $127.29. The business’s 50 day simple moving average is $101.61 and its two-hundred day simple moving average is $90.17. The stock has a market cap of $15.67 billion, a PE ratio of 24.92, a P/E/G ratio of 4.54 and a beta of 1.55.

Teradyne (NASDAQ:TER – Get Rating) last posted its quarterly earnings results on Wednesday, January 25th. The company reported $0.92 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.75 by $0.17. The company had revenue of $731.84 million for the quarter, compared to analyst estimates of $711.84 million. Teradyne had a net margin of 22.68% and a return on equity of 30.09%. The business’s quarterly revenue was down 17.3% on a year-over-year basis. During the same period last year, the business posted $1.37 EPS. On average, sell-side analysts expect that Teradyne, Inc. will post 2.97 EPS for the current fiscal year.

Teradyne Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 17th. Shareholders of record on Friday, February 17th will be given a $0.11 dividend. The ex-dividend date of this dividend is Thursday, February 16th. This represents a $0.44 dividend on an annualized basis and a dividend yield of 0.44%. Teradyne’s dividend payout ratio is currently 10.43%.

Teradyne Company Profile

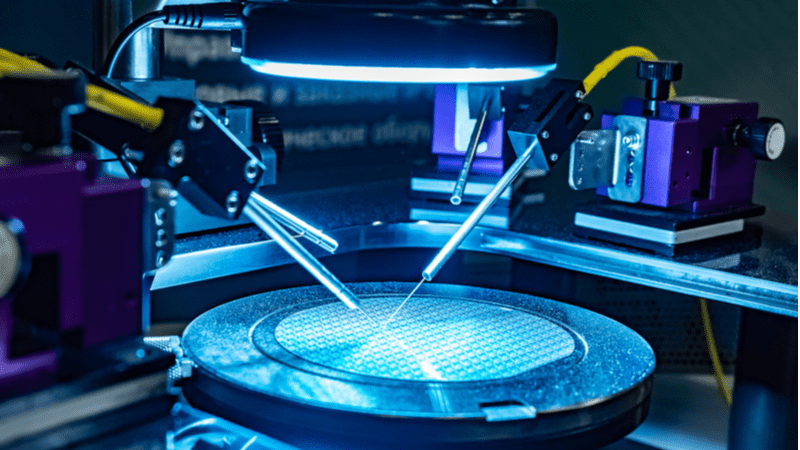

Teradyne, Inc engages in the development and sale of automatic test systems. It operates through the following business segments: Semiconductor Test, System Test, Robotics, Wireless Test, and Corporate. The Semiconductor Test segment designs, manufactures, and markets semiconductor test products and services.