Quite a number of people cast doubts over the long-term relevance of Bitcoin [BTC] Ordinals after it launched in January.

The reason for this was because of the projection that miners would hesitate to work on NFTs within the Bitcoin network. But the recent landmark hit on 9 March, might have put an abrupt end to the skepticism.

BRC-20: The spear opposing the doubting Thomases

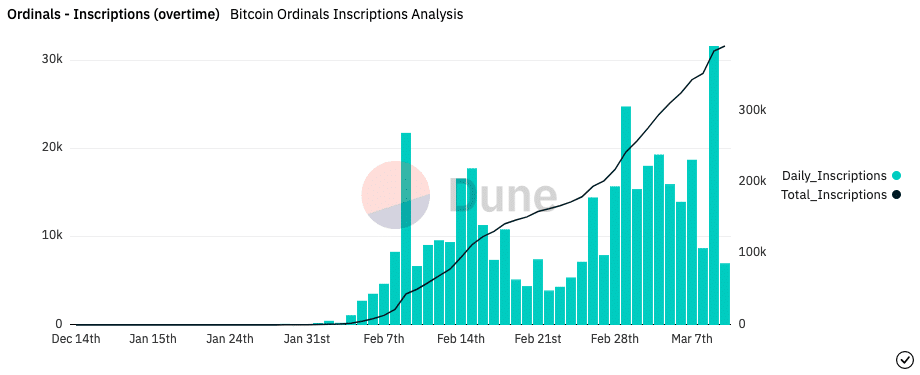

According to Dune Analytics, the number of Ordinals Inscriptions minted on the aforementioned data hit an All-Time High (ATH) of 31.692. The new frontier on the Bitcoin blockchain now has 392, 495 Inscriptions since inception.

These digital assets range from texts, audio, and applications to images. However, Inscriptions was able to reach the milestone mostly because of the text carving dominance.

This was because the information from the public blockchain tracker revealed that others were far off from reaching the share text Inscriptions gained.

Moreso, most of the Inscriptions appeared after the BRC-20 execution. The BRC-20 offers a way for Ordinals users to mint and transfer their assets within the Bitcoin blockchain.

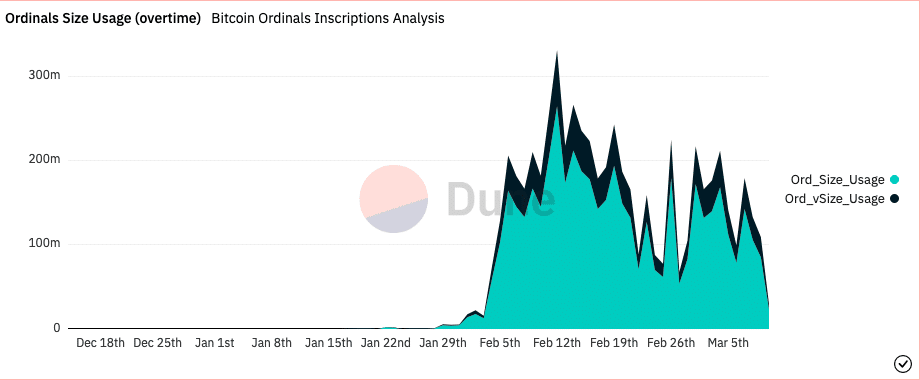

Source: Dune Analytics

This hike meant that the BRC-20 chain on which the NFTs minting takes place has appreciated in user count. Although still in the experimental stage, the BRC-20 is a reflection of the Ethereum [ETH] ERC-20 standard.

Additionally, the rise in adoption could be linked to the public revelation of how to go about minting Ordinals and creating fungible assets on the blockchain.

However, there is a little misconception between Bitcoin Ordinals and Inscriptions. While Inscriptions are metadata that store transactions ran on Bitcoin nodes Ordinals are, however, tiny bits of Bitcoin called satoshis which users can use to apply different rarity traits to individual inscriptions.

At the time of writing, the Ordinals fees generated have risen up to 75.29 BTC. Despite the increase, the overtime size usage had decreased.

Is the race to $5 billion still intact?

Before the milestone, Galaxy Research had developed a whitepaper with details of the Bitcoin Inscriptions. The 3 March analysis from the crypto insight platform noted that the Bitcoin NFTs operate very differently from the collections on the Ethereum blockchain.

Defending its position on a possible $5 billion market valuation in the future, the research paper read,

“From a custody standpoint, inscriptions may actually be better than Ethereum NFTs, at least for institutional investors.”

Despite the success achieved, the BRC-20 developer advised that participants remain cautious and also avoid mass minting.