According to the Bureau of Labor Statistics, nearly 70% of private industry workers had access to a workplace retirement plan in 2021. Just 51% of them participated in those plans.

It’s estimated more than 100 million Americans are covered by a defined contribution retirement plan. Those plans hold something like $11 trillion.

That’s a lot of money but is it enough to retire comfortably?

Let’s look at two of the biggest retirement plan administrators to get a sense of how people are doing.

Fidelity oversees trillions of dollars for tens of millions of investors in workplace retirement plans.

The company’s latest update shows an average balance of a little more than $100k.

As you would expect, the average balances are higher for older generations and lower for younger generations.

The good news is the average savings rates are in the double digits. I like seeing that.

The baby boomer average balance of nearly $210k doesn’t sound like enough to retire on but you have to factor in the reality that many people have multiple retirement plans from previous employers, IRAs, brokerage accounts and good old Social Security to fall back on.

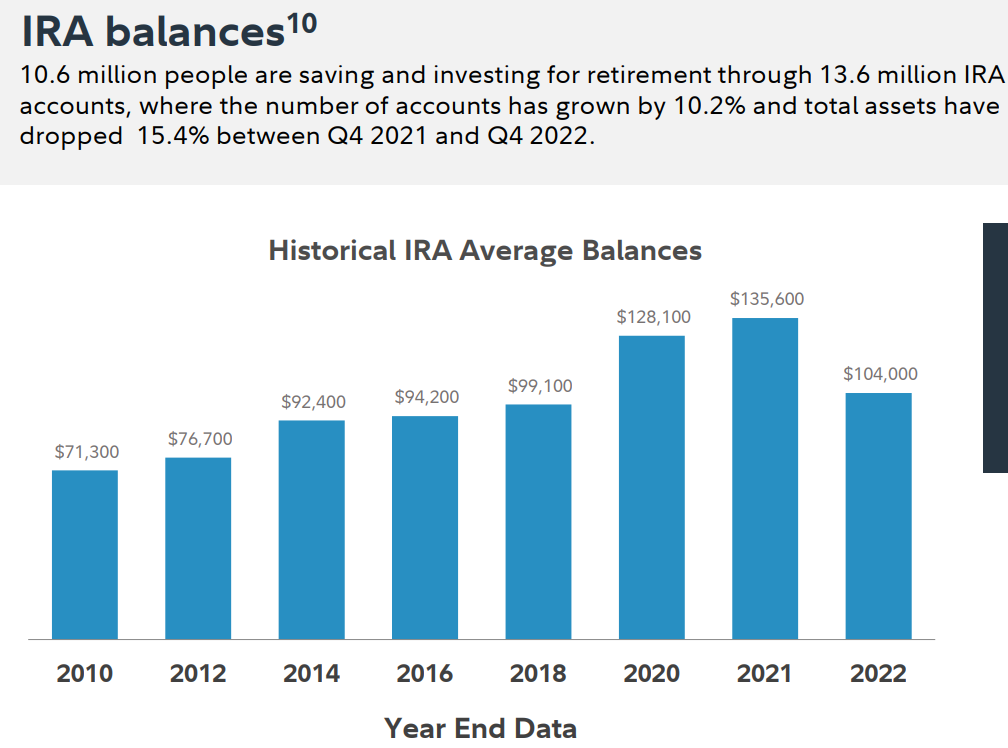

Fidelity also shared data on the average IRA balances:

Coincidentally, the average IRA balance is almost identical to the average defined contribution plan.

Balances were higher at the end of 2021 than at the end of 2022 for obvious reasons (bear markets tend to have the effect).

Add the two together and you get an average balance of roughly $207k. That’s high for some people and low for others depending on the lifestyle.

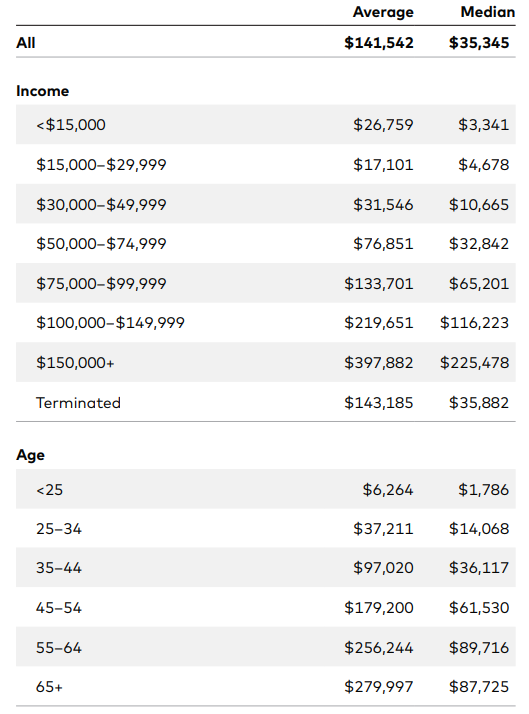

Vanguard covers 5 million participants in their retirement plans. According to their latest figures, the average workplace retirement plan has a balance of more than $141k.

Here are the average and median balances by income level and age:

No surprises here. The higher the income level and age the higher the balance.

The averages are higher than the medians because there are a small number of people with high balances that skew the averages.

Fidelity estimates there are around 280,000 401k millionaires out of 21.5 million accounts, which is a little more than 1% of their total plan participants.

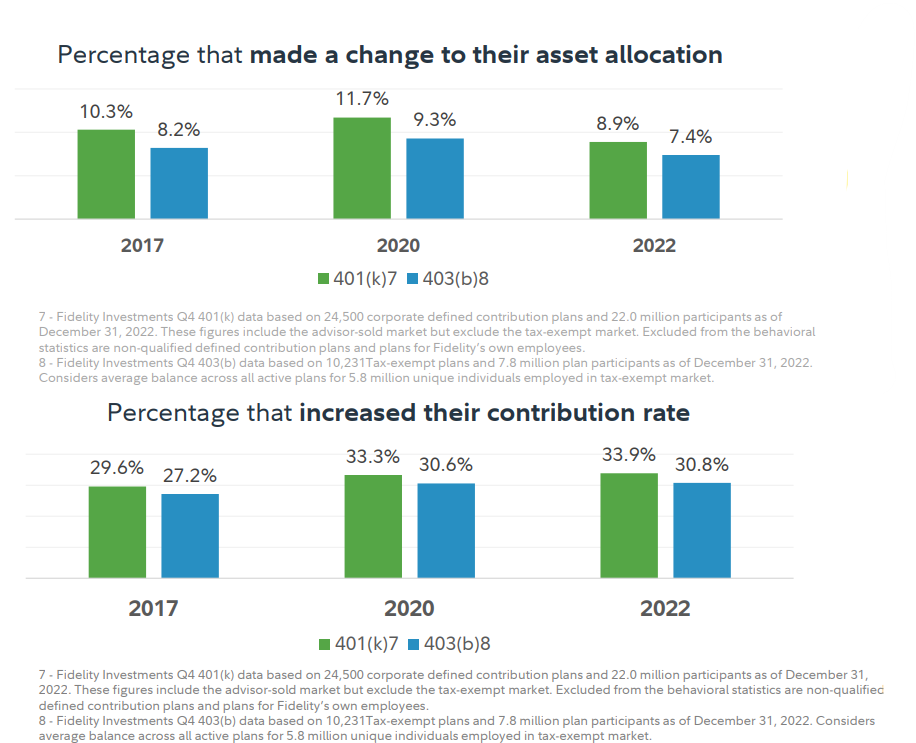

The good news about savers in retirement plans is the vast majority of them seem to be responsible, long-term investors, not degenerate gamblers.

Less than 9% of Fidelity retirement plan participants made a change to their asset allocation in 2022:

It’s also nice to see one-third of participants are increasing the amount they save each year.

Vanguard retirement savers are also well-behaved.

Just 8% of plan participants made changes to their portfolio over the most recent annual period meaning 92% of investors made no changes to their plan. Plus, the investors who did tinker with their portfolios made mostly small adjustments.

The advent of target-date funds has done wonders for diversification purposes.

In 2005, just 39% of retirement savers at Vanguard had a balanced portfolio. By 2021, that number was up to nearly 80% of investors.

Vanguard and Fidelity investors might not be representative of all investors but we’re talking millions of retirement savers and trillions of dollars here.

Whatever the balance in your retirement account there are some lessons we can take away from Vanguard and Fidelity investors:

- A double-digit savings rate is a noble goal for retirement savings.

- Increasing your savings rate over time is a wonderful way to juice your savings.

- Diversification won’t make you rich overnight but a balanced portfolio is one of the best forms of risk management.

- Creating a long-term plan and then generally leaving it alone unless there is a good reason to make a change is a good investment strategy.

A double-digit savings rate combined with an increase in savings over time, a balanced portfolio and a plan that you generally leave alone is a good recipe for retirement success.