First Manhattan Co. lessened its position in shares of Match Group, Inc. (NASDAQ:MTCH – Get Rating) by 0.4% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,156,139 shares of the technology company’s stock after selling 4,085 shares during the period. First Manhattan Co. owned about 0.41% of Match Group worth $54,294,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Zions Bancorporation N.A. boosted its stake in Match Group by 122.3% during the 2nd quarter. Zions Bancorporation N.A. now owns 409 shares of the technology company’s stock worth $29,000 after purchasing an additional 225 shares during the period. SeaCrest Wealth Management LLC purchased a new position in shares of Match Group in the 2nd quarter valued at about $30,000. Mine & Arao Wealth Creation & Management LLC. purchased a new position in shares of Match Group in the 3rd quarter valued at about $26,000. Parkside Financial Bank & Trust increased its holdings in shares of Match Group by 88.2% in the 3rd quarter. Parkside Financial Bank & Trust now owns 557 shares of the technology company’s stock valued at $26,000 after purchasing an additional 261 shares in the last quarter. Finally, Institutional & Family Asset Management LLC increased its holdings in shares of Match Group by 42.1% in the 2nd quarter. Institutional & Family Asset Management LLC now owns 577 shares of the technology company’s stock valued at $40,000 after purchasing an additional 171 shares in the last quarter. Institutional investors and hedge funds own 93.53% of the company’s stock.

Match Group Price Performance

MTCH stock traded up $0.35 during mid-day trading on Wednesday, reaching $41.77. The company had a trading volume of 1,865,843 shares, compared to its average volume of 4,222,342. The stock has a 50 day simple moving average of $45.48 and a two-hundred day simple moving average of $48.33. The company has a market capitalization of $11.67 billion, a price-to-earnings ratio of 33.67, a PEG ratio of 0.72 and a beta of 1.28. Match Group, Inc. has a 52 week low of $38.64 and a 52 week high of $114.36.

Match Group (NASDAQ:MTCH – Get Rating) last released its quarterly earnings results on Wednesday, February 1st. The technology company reported $0.30 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.47 by ($0.17). The firm had revenue of $786.15 million during the quarter, compared to the consensus estimate of $787.34 million. Match Group had a net margin of 11.35% and a negative return on equity of 146.76%. The business’s revenue for the quarter was down 2.5% compared to the same quarter last year. During the same quarter last year, the firm earned ($0.60) earnings per share. On average, equities analysts predict that Match Group, Inc. will post 2.1 EPS for the current year.

Analyst Ratings Changes

Several research firms recently issued reports on MTCH. Piper Sandler raised their target price on shares of Match Group from $20.00 to $27.00 in a research report on Tuesday, February 7th. KeyCorp lifted their price target on shares of Match Group from $74.00 to $75.00 and gave the stock an “overweight” rating in a research note on Thursday, November 3rd. Loop Capital lifted their price target on shares of Match Group from $45.00 to $50.00 in a research note on Tuesday, January 24th. Jefferies Financial Group lifted their price target on shares of Match Group from $60.00 to $65.00 and gave the stock a “buy” rating in a research note on Tuesday, January 24th. Finally, Oppenheimer downgraded shares of Match Group from an “outperform” rating to a “market perform” rating in a report on Wednesday, February 1st. Nine equities research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of “Moderate Buy” and a consensus target price of $74.44.

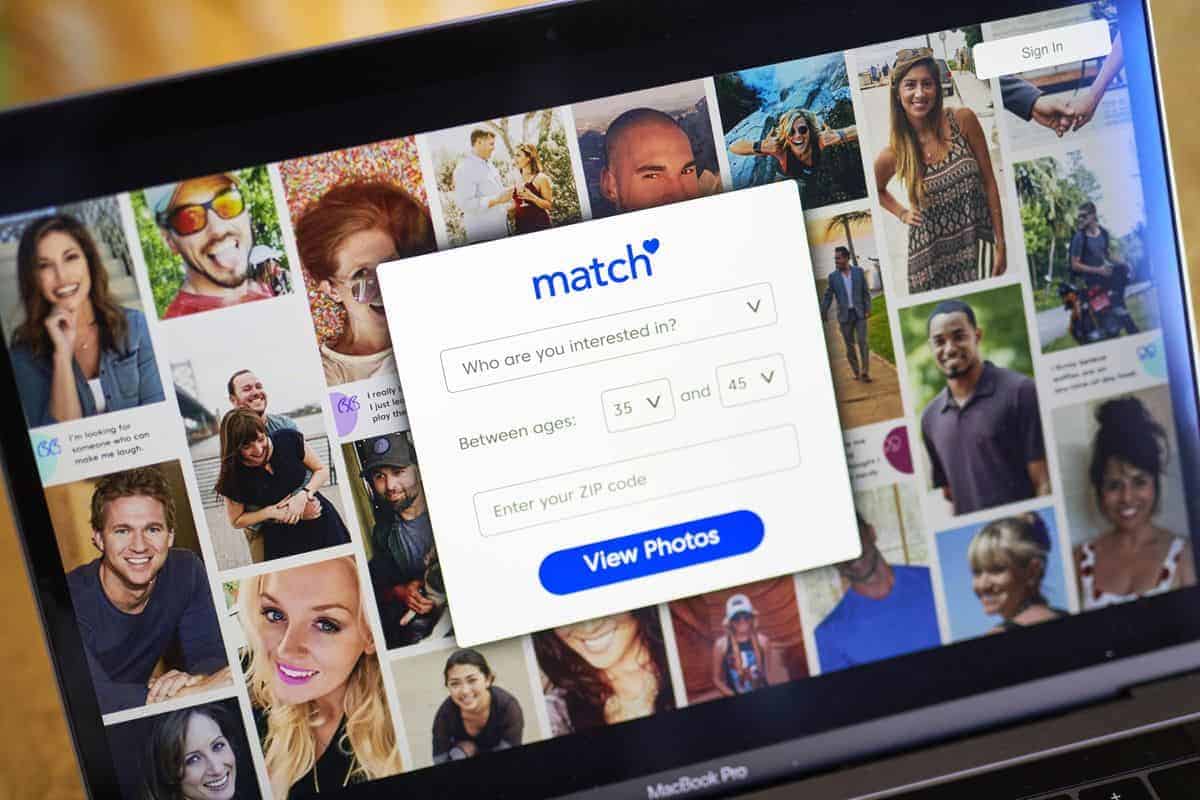

Match Group Profile

Match Group, Inc engages in the provision of dating products. It operates under the brand name Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime. The company was founded on February 12, 2009 and is headquartered in Dallas, TX.