Stocks closed higher amid volatile trading Thursday as investors remained concerned about the path of the Federal Reserve’s rate hikes.

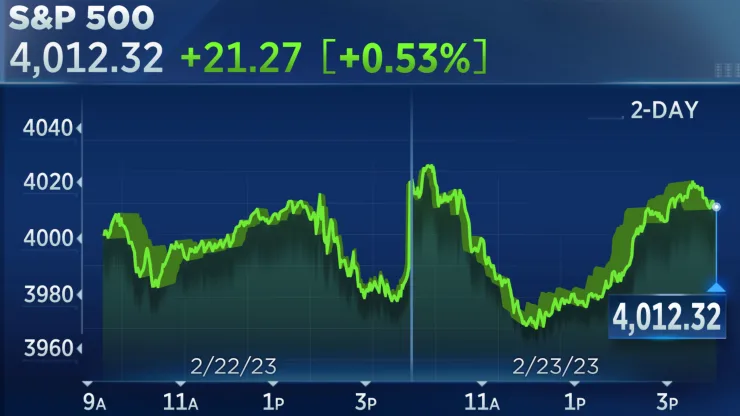

The S&P 500gained 0.53% to close at 4,012.32 and snap a four-day losing streak. The Dow Jones Industrial Average gained 108.82 points, or 0.33%, closing at 33,153.91. The Nasdaq Composite rose 0.72%, ending the session at 11,590.40.

The major averages are still on pace to end the week on a downturn, with the S&P 500 on track for its worst weekly performance since Dec. 16.

The Fed has been a focal point for investors this week since the rollout of its latest meeting minutes. Policymakers indicated that inflation “remained well above” the central bank’s 2% target, even as data has shown “a welcome reduction in the monthly pace of price increases.”

Brendan Murphy, head of core fixed income, North America at Insight Investment, said that a recession is not necessary to achieve the Fed’s 2% target for inflation.

“While a recession would almost certainly hasten the return of inflation to target, it should not be considered a necessary condition,” Murphy said. “While we have seen a significant improvement in realized inflation over the last 6 months, this was largely driven by base effects and the ongoing normalization of supply chains.”

“We are now in a period of low growth and moderating inflation,” he added. “The big question is how far can inflation come down in that type of environment. It is possible that if supply pressures continue to abate in a period of below-trend growth, inflation will eventually return to the Fed’s target. However, this period of below-trend growth might need to be quite long, which is why the Fed is talking about keeping rates restrictive for an extended period.”