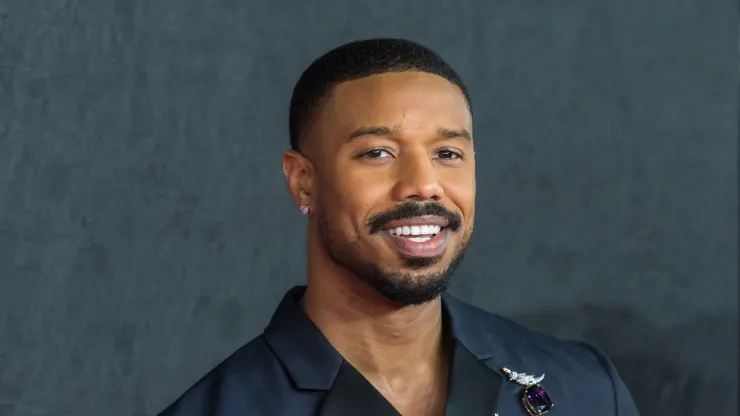

Michael B. Jordan says the biggest lessons he’s learned about money management came from “life.”

However, he wonders where he would be if he had been taught more about money when he was younger.

“I imagine how much more I would have and the better place I’d be in today if I had that kind of knowledge at an early age and knowing how to take care of your money,” he tells CNBC Make It.

That’s one reason he’s aiming to help Black students and student athletes gain access to financial literacy education early.

The actor, director and producer partnered with Invesco QQQ to create the Invesco QQQ Legacy Classic, a men’s college basketball showcase featuring Historically Black College and University (HBCU) student athletes, broadcast nationally on TNT. For its second year, the event was held on Feb. 4 at Prudential Center in Newark, New Jersey, where Jordan grew up.

Getting young people excited about learning how to smartly manage their money was at the heart of the event — and Jordan’s mission.

“There are a lot of things out there telling them to spend their money on this or that,” he says. “So having another system in place to help them start thinking differently about their money is important.”

Equitable access to financial literacy can help close the racial wealth gap

In the U.S., the average white household has a net worth of $875,600, while the average Black household has a net worth of $126,300.

While there’s no simple solution for closing the racial wealth gap between white Americans and Black Americans, improving financial knowledge among Black and Brown students could help bridge the divide, says Yanely Espinal, director of educational outreach at Next Gen Personal Finance, a nonprofit focused on providing financial education to middle and high school students.

Currently, students across the country aren’t getting equal access to personal finance education, according to research by NGPF.

Less than 12% of students are required to take a stand-alone personal finance course to graduate from high school outside of the six states that mandate it, according to NGPF. However, just 7.4% of Black and Brown students are required to take a class.

Without equal access to personal finance educational tools, the racial wealth gap will only get wider, Espinal tells CNBC Make It.

Plus, when financial literacy is taught early, it pays off in the future, research from the Brookings Institution shows.

High school students who are required to take personal finance courses tend to have better average credit scores and lower debt delinquency rates as young adults, according to the Financial Industry Regulatory Authority’s Investor Education Foundation.

Additionally, when students receive access to personal finance education, it can have a ripple effect on their families and communities.

“The students absolutely take this home,” Espinal says. “You see parents asking about Roth IRA accounts and whether they should open them.”