This week, average mortgage rates in the United States have fell to its lowest levels since Septemberproviding some relief to borrowers who have recently been faced with higher than expected repayments.

With interest rates expected to stay below their late-2022 peak, this could be a good time for potential buyers to take the plunge. But to get a good deal on a mortgage deal, it’s crucial that your credit score shows that you’re financially responsible.

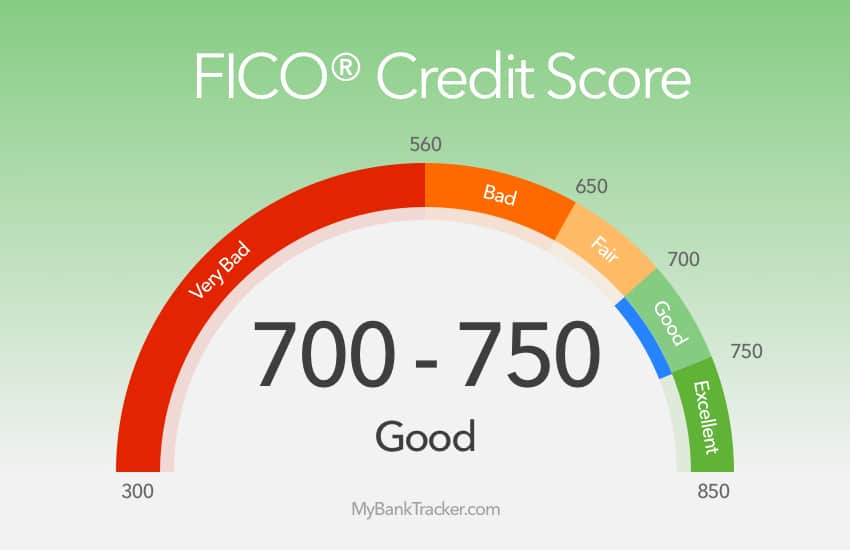

Credit scores are ranked from 0 to 999, with higher scores, meaning you are seen as a more trustworthy customer. The more points you earn, the better chance you have of being accepted for a mortgage at an attractive rate.

The Experian credit rating agency classifies five approximate categories of credit scores:

Great:800+

Fine: 740 – 799

Well: 670 – 739

Just: 580 – 669

Poor: 579 and under

If you fall in the upper category of credit scores, then you have a good chance of getting the best deals on your mortgage with lower-than-average interest rates. However, the further down the ranking you are, the more likely you are to be turned down for a mortgage, or only accepted if you agree to pay high interest rates.

How to improve your credit score

Given the huge impact they can have on your financial prospects, the calculations behind credit scores can be frustratingly vague. There is no list of actions that will guarantee you a superior credit score, but there is one Some key principles to remember that will show potential lenders that you will be able to meet your financial obligations.

Review credit reports – Before you start working on improving your credit score, check to see if you have any outstanding debts that need to be paid. Request a credit report from one of the major national reporting agencies to see if you have old balances that are negatively affecting your score.

always pay on time – Whether it’s a gym membership or car financing, demonstrating that you can always manage your finances is key. Avoid late payments and banks will feel safer lending to you.

Limit your credit utilization rate – Sometimes known as the credit utilization ratio, it is the sum of your entire balance divided by the sum of your credit limits. Essentially, it measures the proportion of your borrowing potential that is already in use. Ideally, you want this figure to be no more than 30%.

Keep old accounts – It may seem counterintuitive, but keeping old accounts open, as long as you’ve paid off the debts, is a good way to increase your score. Rating agencies often check the length of your credit history when calculating a score.