Stock Markets

Since the beginning of the year, the markets have rallied partly due to the better inflation outlook in the United States and around the world. The past week, however, equities appeared to hesitate and move sideways as investor sentiment seemed mixed. Economic data released midweek caused some negativity among investors when they pointed to a weaker U.S. consumer and manufacturing sector. Also weighing on the markets was the uncertainty over the ongoing U.S. debt ceiling debate and the mixed earnings results from listed stocks.

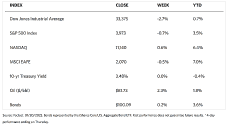

The Dow Jones Industrial Average (DJIA) lost 2.70% for the week while the DJ total stock market slid 0.62%. The broad S&P 500 Index came down 0.66% and the NYSE Composite Index gave up 0.88%. Bucking the trend is the Nasdaq Stock Market Composite, which tracks the technology sector closely, inched up 0.55%. CBOE Volatility gained 8.17% pointing to an increase in perceived risk by investors. The easing inflation fears enabled growth stocks such as those in the technology sector to outperform. The likelihood of lower interest rates hiked the implicit value of future earnings, giving growth stocks a push. Netflix’s earnings report on Friday that showed the company added more subscribers than was widely expected in the fourth quarter boosted sentiment. Google’s announcement that it will lay off about 6% of its workforce also hiked its parent Alphabet’s share prices, further pushing the broad indexes higher. The week was shortened by the observance of the Martin Luther King, Jr. holiday on Monday when the markets were closed.

U.S. Economy

The economy may potentially enter a downturn prompting the Federal Reserve to stall in its interest-rate hiking policy. There were several additional signals that the economy was significantly slowing in response to the Fed’s 2022 aggressive rate increases. On Wednesday, retail sales were reported to contract by 1.1% in December, amounting to roughly triple consensus estimates. Part of it was a drop in sales at gas stations, but there were also notable pullbacks in sales of furniture, electronics, and other discretionary purchases. The sales data for November was also adjusted downward. The encouraging development about the slowing economy was that the inflationary pressures were alleviating. According to the Labor Department, producer prices fell 0.5% in December, a welcome development since it is the biggest drop since early in the pandemic. Prices companies paid for goods, food, and especially energy all recorded declines.

Data released during the week also indicated that manufacturing output dropped by 1.3%, driving industrial production down by 0.7% in December, the most since September 2021. The industrial sector of the economy slowed at an annualized rate of 1.7% for the fourth quarter. Capacity utilization ended at 78.8% in December, its lowest level of 2022. It is also well below consensus expectations as well as its long-term average (79.6%). In this environment, the job market remained unusually light, with weekly jobless claims falling to their lowest level since April 2022. Also falling slightly below expectations were the housing starts and existing home sales.

Metals and Mining

This far into the new year, precious metals have registered a solid performance, particularly the gold market as prices for the yellow metal ended the week close to a nine-month high. Gold has rallied for the fourth consecutive week as it moved up more than 5% in the first month of 2023. There appears to be a strong bullish sentiment among investors, although they have not yet fully jumped into the market, causing some concern among analysts. There is also some concern that silver has not yet seen the same strong rally as gold, considering that silver outperformed gold through November and December. The lack of momentum in silver contrasts with the performance of the markets in other industrial metals such as copper, which currently trades at a seven-month high of about $4.26 a pound. These market divergences will eventually work themselves out, providing greater incentives for investors to see value in holding precious metals.

Gold moved up 0.30% from its close one week ago at $1,920.23 to this week’s close at $1,926.08 per troy ounce. Silver moved down 1.36% from last week’s closing price of $24.26 to this week’s closing price of $23.93 per troy ounce. Platinum slumped 2.18% from its earlier price of $1,069.21 to the recent price of $1,045.88 per ounce. Palladium came from $1,792.81 one week ago to $1,735.81 this week for a loss of 3.18%. The three-month LME prices of base metals were mostly up. Copper closed last week at $9,185.50 and this week at $9,324.00 per metric tonne, up by 1.51%. Zinc went up by 2.90% from its week-ago price of $3,324.00 to this week’s $3,420.50 per metric tonne. Aluminum rose 0.60% from $2,595.00 last week to $2,610.50 per metric tonne this week. Tin came from $28,756.00 one week ago to $29,536.00 per metric tonne this week, gaining 2.71%.

Energy and Oil

Discounting the massive inventory build-up in the United States, the market is beginning to factor in the imminent demand rebound brought about by China’s opening economy. The OPEC and International Energy Agency (IEA) both increased their 2023 global demand forecasts, confident that rapid growth in Asian buying would dominate the second semester of the year. In its monthly oil report, the IEA took note of the easing of coronavirus restrictions in China and saw this as the catalyst that would propel global oil demand possibly to its highest level on record, surging from its current 100 million barrels per day (b/d) to nearly 104 million b/d as 2023 nears its end. The oil bulls have thus appeared to have gained the upper hand, undeterred by some concerning economic data and refinery problems in the U.S.

Natural Gas

The estimated total natural gas consumption in the U.S. lower 48 states attained a daily record high of 141.0 billion cubic feet (Bcf) on December 22, 2022, exceeding the previous daily record high of 137.4 Bcf set on January 1, 2018. Natural gas consumed in the residential, industrial, and power generation sectors comprises total consumption. There was increased demand for residential and commercial heating, as well as for electric power generation, due to below-normal temperatures in mid to late December. These developments contributed to a steep weather-related decline in natural gas production.

For the week beginning Wednesday, January 11, and ending Wednesday, January 18, 2022, the Henry Hub spot price fell $0.24 from $3.35 per million British thermal units (MMBtu) at the start of the week to $3.11/MMBtu by the end of the week. The price of the February 2023 NYMEX contract decreased by $0.36, from $3.671/MMBtu at the start of the week to $3.311/MMBtu at the week’s end. The price of the 12-month strip averaging February 2023 through January 2024 futures contracts declined $19.4 to $3.553/MMBtu. International gas futures prices decreased for this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia dropped by $2.82 to a weekly average of $24.85/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, slid by $1.92 to a weekly average of $20.10/MMBtu. During the corresponding week last year (week ending January 19, 2022), the prices in East Asia and at TTF were $27.38/MMBtu and $27.24/MMBtu, respectively.

World Markets

European equities softened after the European Central Bank (ECB) policymakers indicated that they would continue to hike interest rates aggressively despite contrary moves in the U.S. This sparked renewed fears of a prolonged economic slowdown in the region. The pan-European STOXX Europe 600 Index ended the week slightly lower in local currency terms. The major stock indexes generally weakened. France’s CAC 40 Index fell by 0.39%, Germany’s DAX Index eased by 0.35%, and Italy’s FTSE MIB Index moved sideways. The UK’s FTSE 100 lost 0.94%. Market speculation regarding the slowdown of monetary policy tightening was dismissed by ECP President Christine Lagarde this week in a speech at the World Economic Forum in Davos, Switzerland. She said, “Inflation, by all accounts, is way too high. Our determination at the ECB is to bring it back to 2% in a timely manner, and we are taking all the measures that we have to take in order to do that.” The minutes of the ECB’s December meeting also suggested that future rate hikes might be higher than the recent half-percentage point increases. Many of the members favored 0.75 percentage point increases moving forward.

Japan’s stock markets ascended for the week, with the Nikkei Index climbing by 1.66% and the broader TOPIX Index rising by 1.25%. The optimism was attributed to the prospects of China’s economic reopening boosting the global economy. Positive sentiment was also due to hopes that the major central banks were likely to slow the pace of their rate hikes as inflationary pressures eased. The focus of attention was on the Bank of Japan (BoJ), whose monetary policy remained unchanged at its January meeting after it surprised markets in December by tweaking its yield curve control (YCC) framework. Absent any further YCC modifications, the yield on the 10-year Japanese government bond (JGB) fell to 0.40% from 0.51% at the end of the week before. The yen softened to around JPY 129,81 versus the U.S. dollar, from about JPY 127.88 against the greenback the week before, on the BoJ’s commitment to its ultra-loose monetary stance.

China’s bourses rallied for the fourth straight week ahead of a weeklong Lunar New Year break, following reports of better-than-expected economic growth. The Shanghai Composite Index ascended by 2.18% and the blue-chip CSI 300 rose by 2.63%. The Hong Kong benchmark Hang Seng Index surged by 1.41%. China’s financial markets will be closed from January 21 and will reopen on Monday, January 30, in observance of the Lunar New Year holidays. The country’s gross domestic product (GDP) gained 2.9% in the fourth quarter of 2022 and expanded by 3.0% for the full year. The pace of growth missed the official annual target of approximately 5.5% set last March. It marked the second-worst year for economic growth, of which 2020 was the worst due to the pandemic, since 1976, the end of China’s Cultural Revolution that lasted a decade. Both growth rates still surpassed economists’ forecast following Beijing’s lifting of stringent COVID pandemic restrictions and beginning implementation of a series of pro-growth policies towards the end of 2022. Indicators of output and retail sales for December were better than expected, and fixed-asset investment rose broadly consistent with estimates.

The Week Ahead

The important economic data scheduled for release this week include the leading economic indicators index at the beginning of the week and personal income just before the weekend.

Key Topics to Watch

- Leading economic indicators

- S&P U.S. manufacturing PMI (flash)

- S&P U.S. services PMI (flash)

- Initial jobless claims

- Continuing jobless claims

- Real gross domestic product, first estimate (SAAR)

- Real final sales to domestic purchasers, first estimate (SAAR)

- Trade in goods (advance)

- Durable goods orders

- Core capital goods orders

- Chicago Fed national activity index

- New home sales (SAAR)

- Real disposable income (SAAR)

- Real consumer spending (SAAR)

- PCE price index

- Core PCE price index

- PCE price index, year-over-year

- Core PCE price index, year-over-year

- UMich consumer sentiment index (late)

- UMich 1-year inflation expectations (late)

- UMich 5-year inflation expectations (late)

- Pending home sales

Markets Index Wrap Up