On five of six days this year following U.S. central bank interest rate decisions, bitcoin’s price has reversed course from its previous direction.

BTC’s price has fallen on three occasions after rising sharply on the day of Fed rate hikes, and it has risen on two other days after falling when the Fed also raised interest rates. On one occasion, BTC’s price rose on the day of a Fed rate hike and continued its upward momentum the next day.

Analysts say that the quick reversals underline investors desire to take profits quickly or extricate themselves from riskier assets amid a volatile macroeconomic environment. These investors have been trying to anticipate crypto markets’ direction further afield following Fed decisions, which can have a deep impact on the economy.

“A lot of the times, the very first move is not the move that sustains because that’s the position adjusting mode,” Bob Iacchino, Path Trading Partners co-founder and chief market strategist, said. “In other words, people have positions based on what they think the result is going to be, and when they get the exact result, they exit positions.”

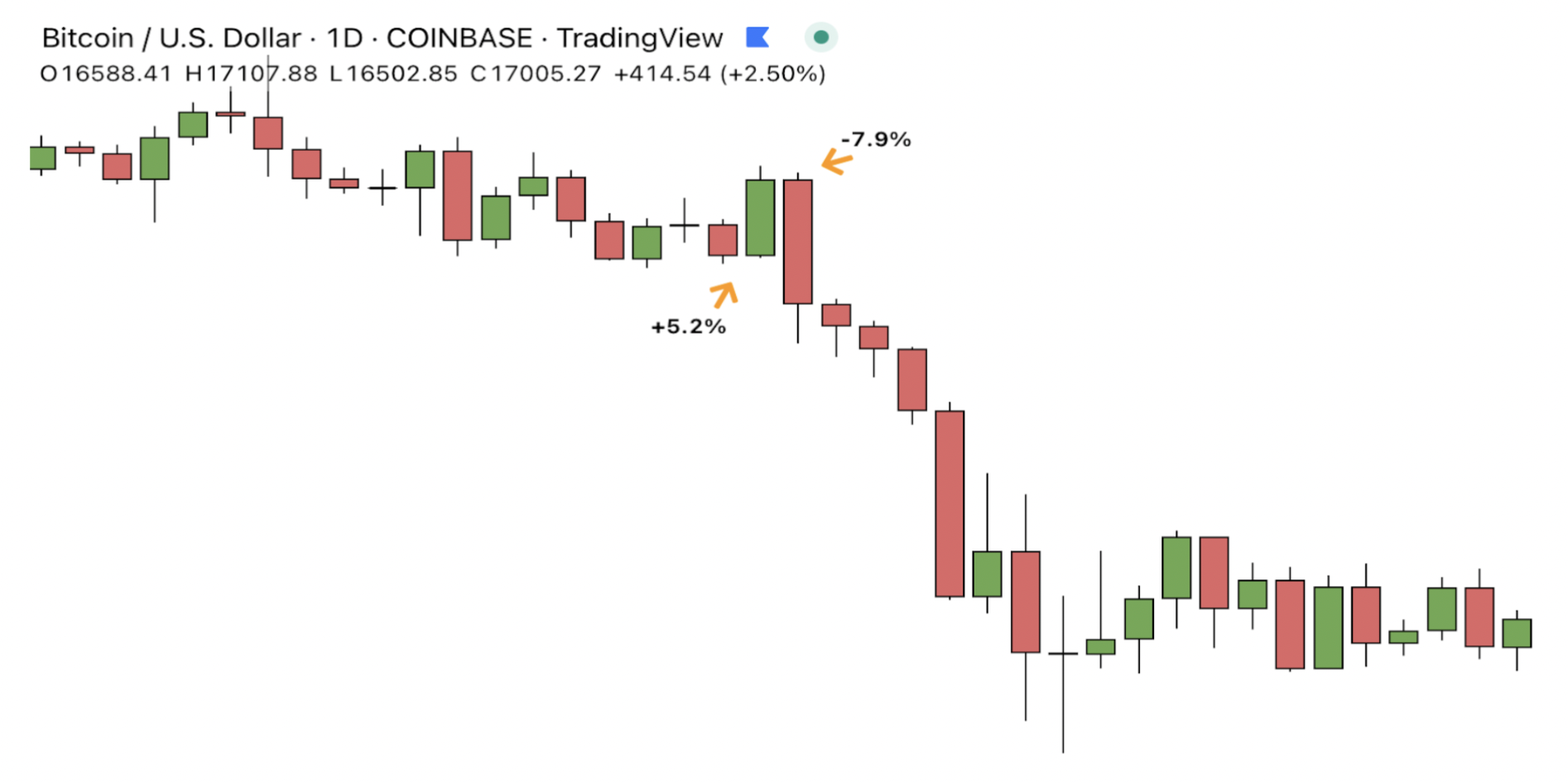

On May 4, for example, when the Federal Open Market Committee (FOMC) announced that it would raise interest rates by 50 basis points, or a 0.5 percentage point, bitcoin jumped 5.2% as traders welcomed the Fed’s hawkishness in its ongoing attempt to tame inflation. However, the following day, bitcoin dropped 8%.

Bitcoin’s price on and after the day the Federal Reserve raised interest rates on May 4th. (Source: TradingView)

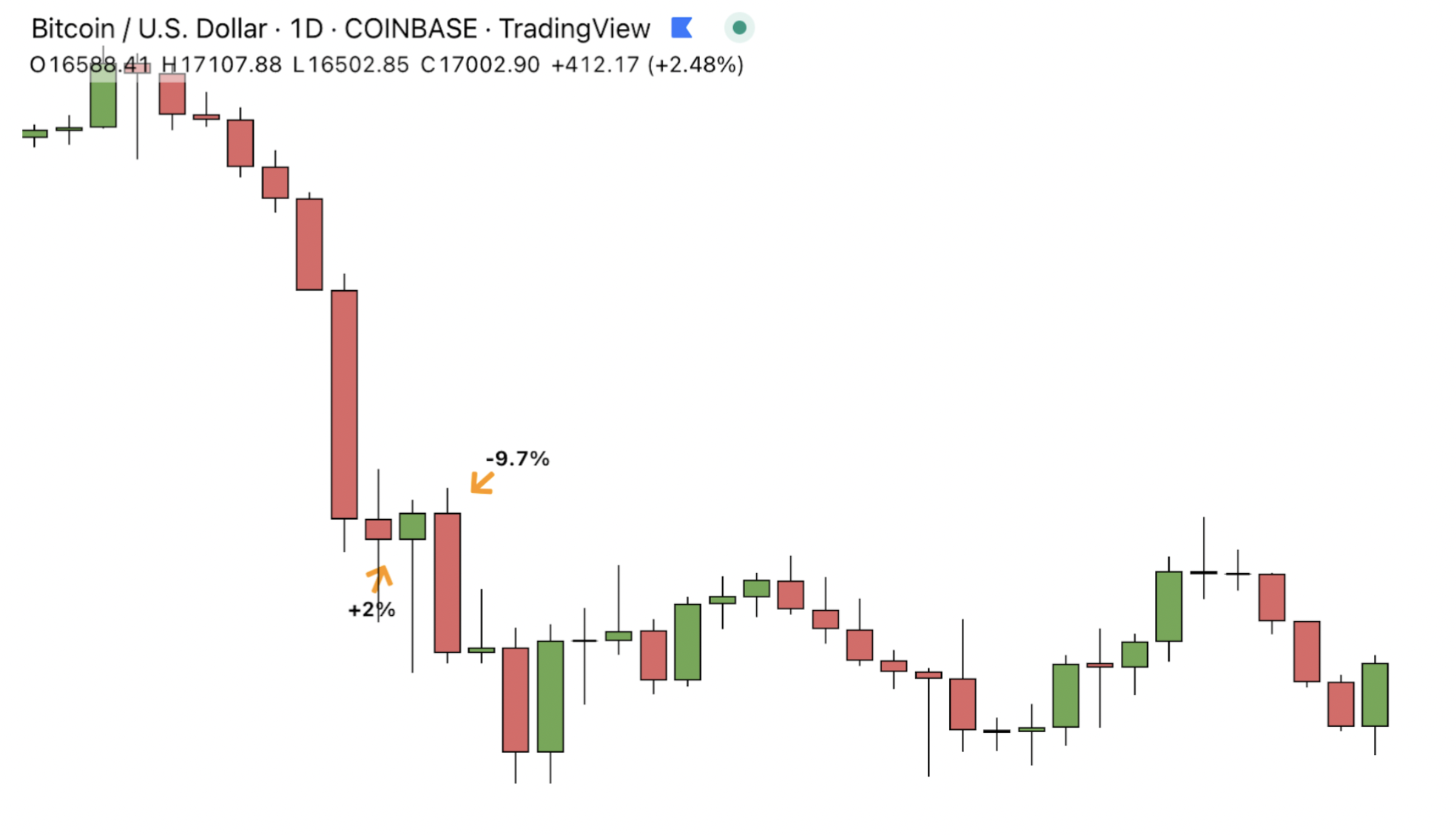

On June 15, bitcoin surged 2% after the Fed boosted rates by 75 basis points, escalating its inflation-fighting efforts. But on June 16, BTC dropped 9.7%.

Bitcoin’s price on and after the day the Federal Reserve raised interest rates on June 15. (Source: TradingView)

Crypto markets’ reversals on days following Fed rate hikes have veered from equity markets’ performances on these days.

For example, on only two of the six Fed decision days this year, in June and July, did the S&P 500 reverse the next day. Otherwise, the S&P has followed its previous course.

“The S&P 500 is much more absorbed into day-to-day investing, so there’s a lot less volatility,” Iaccino said. Crypto traders, on the other hand, are “entrenched emotionally in what this asset is,” he said.

In general, volatility before and after Fed days has been more intense than typical for all asset classes, Oanda Senior Market Analyst Edward Moya said. “Normally, we see limited posturing before Fed decisions, but this year was different as everyone was trying to get ahead of when the Fed pivot will happen,” he said.