A personal loan is a helpful financial tool when you need to borrow money to cover virtually any expense, like car repairs, home improvements, or medical bills. When you apply for a personal loan, you’ll need to meet the lender’s credit requirements. Having good to excellent credit will typically get you the lowest interest rates, but some lenders specialize in bad credit personal loans.

Learn more about the credit score you need to qualify for a personal loan, why your credit score matters, and what to consider when comparing personal loan lenders.

Credible makes it easy to see your prequalified personal loan rates from various lenders who offer loans for a wide range of credit scores.

What credit score do you need to qualify for a personal loan?

Each lender has its own credit score requirements for a personal loan. Because of this, it’s likely possible to find a personal loan lender that will issue you a loan no matter what your credit score is.

But you generally need at least a good credit score to get a personal loan with a decent interest rate and loan terms. The higher your credit score, the better your interest rate is likely to be and the more loan options you’ll have available.

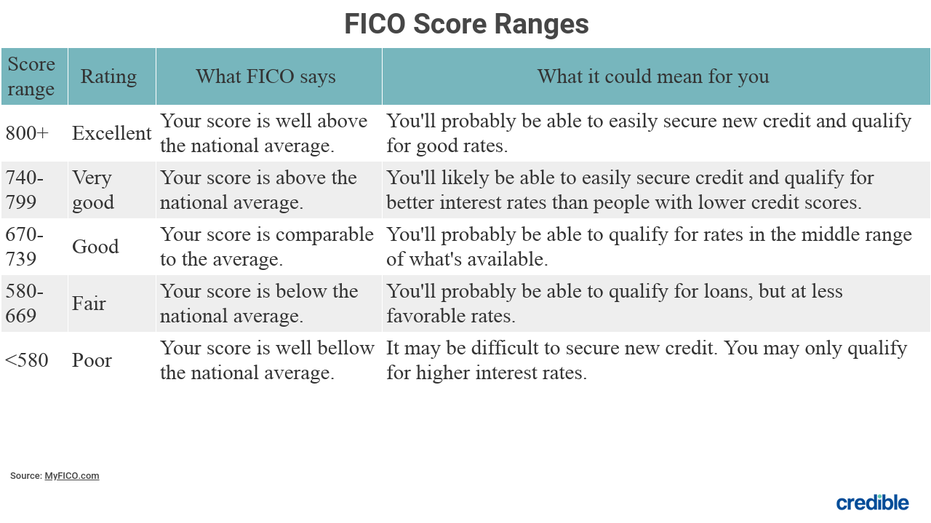

Most lenders use the FICO credit-scoring model when determining whether to approve you for a loan. Here’s how FICO breaks down credit score ranges:

Why does your credit score matter when applying for a personal loan?

Credit scores are three-digit numbers that represent your credit history, which is reported in your credit reports from each of the three main credit bureaus — Equifax, Experian, and TransUnion. The higher your credit score is, the more likely a lender will loan money to you. Because having a higher credit score makes you more likely to repay your loan in the eyes of the lender, they tend to offer the best interest rates and loan terms to borrowers with good credit scores.

If you have a low credit score, you’ll need to do a bit more work to find a lender that will offer you a personal loan. Some lenders will approve you for a loan even if you have a bad credit score or lack of credit history. But you’ll probably pay a higher interest rate for a loan than someone with good or excellent credit.

Factors that affect your credit score

The following factors work together to determine your credit score:

- Payment history — This is the most important factor in determining your credit score, accounting for 35% of your score. When you make your credit card and bill payments on time each month, you improve your credit score. If you make late payments or miss so many payments that you default on a loan, it can harm your credit score.

- Credit utilization ratio — Your credit utilization ratio represents how much of your available credit you’re using and accounts for 30% of your FICO Score. The lower your credit utilization ratio is, the more your score will benefit. Ideally, you want to keep this ratio below 30%.

- Credit history length — If you can establish a credit history from a young age, you’re off to a good start. The longer your credit history is, the more your credit score is likely to benefit. Keeping an older credit account open, even if you don’t use it often, can help you maintain a longer credit history.

- Credit mix — Having a varied mix of credit products in your name, such as a student loan, credit card, and auto loan, can help illustrate to lenders that you’re capable of managing and repaying multiple types of debt at once.

- New credit — Applying for or opening too many new credit accounts in a short period of time can spook lenders, as it signals that you may need to borrow money to get by. If you’re going to apply for a personal loan, try to avoid applying for new forms of credit in the months leading up to your loan application.

You can compare personal loan rates on the Credible platform, and it won’t affect your credit score.

Can you get a personal loan if you have bad credit?

Yes, you can get a personal loan if you have bad credit. Some lenders even specialize in bad credit loans.

Consider a peer-to-peer lender that accepts a lower credit score and focuses on work and education history instead when deciding whether to loan you money. If you belong to a credit union, it may have more lenient borrowing criteria than some larger banks or financial institutions.

If you’re having trouble getting approved for a personal loan on your own, you can apply with a cosigner who has good or excellent credit. Adding a cosigner to your loan application can make it easier to qualify for a personal loan and help you secure a lower interest rate.

How a personal loan can affect your credit score

Taking out a personal loan can affect your credit score in a few different ways:

- Improves your credit mix — Taking out a personal loan can help you improve your credit mix.

- Builds a payment history — As long as you make your personal loan payments on time, you’ll work toward building a positive payment history.

- Creates a hard inquiry — When you apply for a personal loan, the lender will check your credit with a hard credit inquiry. This can negatively affect your credit score, but it’ll typically bounce back after a few months.

What about no-credit-check loans?

No-credit-check loans are a type of loan designed for those with bad credit or who haven’t established a credit history. Since these loans don’t require a credit check, lenders make up for the risk they’re taking on by charging high interest rates or more fees. No-credit-check loans can be easier to qualify for than traditional personal loans — but that ease of eligibility comes at a steep cost.

Payday loans and title loans are two types of loans that don’t require good credit scores. These small, short-term loans come with fees that can equate to sky-high annual percentage rates (APRs) of nearly 400%, according to the Consumer Financial Protection Bureau. These loans can trap you in a cycle of debt and should only be considered as a last resort.

What should you consider before choosing a personal loan lender?

No matter what your credit score is, you’ll want to take the following factors into account when comparing different lender options:

- Interest rate — The higher the interest rate is, the more you’ll pay over the life of the loan. See which lender can offer you the lowest interest rate.

- Repayment term — How long a repayment term is can affect your monthly payment amount. While shorter repayment terms can help you save on interest, they typically come with higher monthly payments. Make sure the lender you choose can offer you repayment terms that work for your budget.

- Loan amount — It’s important to borrow only what you need so you aren’t paying interest on unnecessary funds. Find a lender who will lend you the full amount you need.

- Fees — All lenders charge fees differently. Ask each lender you’re considering what fees you’ll have to pay, like origination fees for processing the loan or prepayment penalties for paying the loan off ahead of schedule.

- Cosigner option — Not all lenders allow cosigners on personal loans. If you want to apply with a cosigner to improve your chances of qualifying and help secure a better interest rate, you’ll need to find a personal loan lender that allows cosigners.

How to apply for a personal loan

Different lenders have different application processes, but when you apply for a personal loan you can generally expect to take the following steps:

- Compare lenders. Before you apply for a personal loan, get prequalified with different lenders and compare each one to see which can offer you the best personal loan to meet your needs.

- Pick a loan option. Once you find a lender, you can choose which of its loan products you want to apply for.

- Complete the application. When you apply for a personal loan, you’ll need to provide personal and financial information, such as documentation that proves your identity, employment status, and income.

- Get your funds. If you’re approved for a loan, the lender will disburse the funds, typically by direct deposit into your bank account.

- Start making payments. After you receive your loan funds, you’ll begin making your regularly scheduled payments (usually monthly) until you pay off the loan in full according to your repayment term.