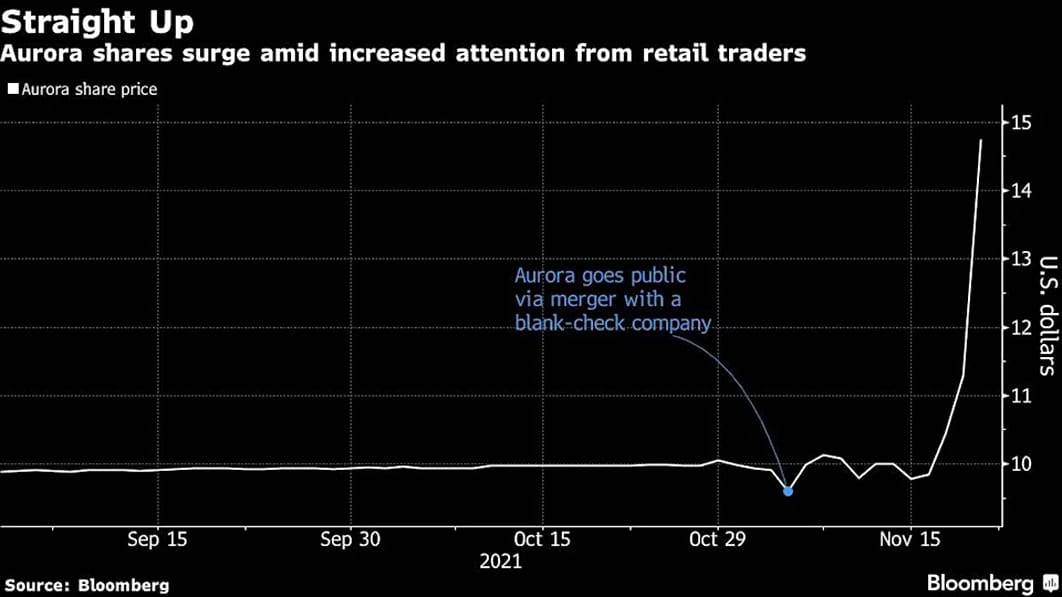

Self-driving technology companies are the latest automotive stocks to become an obsession of retail traders, with firms like Aurora Innovation Inc. surging Friday on high volume.

Aurora, which went public via special purpose acquisition company earlier this month, jumped as much as 50% Friday after the stock was widely cited on social media platforms Twitter and StockTwits. A report that iPhone-maker Apple Inc. is pushing to develop a car with a full self-driving system also helped attract investors’ attention to the group.

Aurora later pared some of the gains to trade up 31% at 02:44 PM in New York. The stock is now up 47% this week.

While Aurora’s advance was the most stark, other stocks also rose sharply. TuSimple Holdings Inc., which makes self-driving technology for heavy-duty and semi trucks, gained as much as 7.9%. The optimism also spread to makers of lidar sensors used in driver-assistance systems, sending shares of Innoviz Technologies Ltd., Aeva Technologies Inc. and Velodyne Lidar Inc. higher.

The moves are reminiscent of gains in electric-vehicle stocks earlier this week, when Rivian Automotive Inc. and Lucid Group Inc. both posted double-digit jumps and surpassed some of their more established peers in market value.

Over 24 million Aurora shares changed hands on Friday, about double the volume of Tesla Inc. An unusually heavy trading volume typically suggests high interest from retail traders.

Since the retiree is “selling low” when they withdraw, they are doing exactly the opposite of what will help them remain solvent through their retirement years. More importantly, this is purely a byproduct of the order of returns, rather than the specific returns themselves. In many ways, it’s a game of luck played between bear and bull markets.

While this is something you cannot control, it is something that you can strategize against to protect your assets.

The Impact of Downturns on Defined Contribution Retirement Accounts

Current retirees aren’t the only ones subject to market volatility. In fact, the movement away from the traditional pension plan means that many people are working with defined contribution retirement accounts instead. There are both pros and cons to this change. While you are in control of your ultimate retirement destiny, you are also likely to have less definitive retirement income to rely on.