Stock Markets

Light trading prevailed during the week while recording solid gains, raising the S&P 500 Index close to 0.5% of its all-time intraday high that it achieved in the first week of May. It retraced thereafter but remained up for the month. The light volumes were evident with Monday experiencing the fifth-lowest turnover in a non-holiday session from the beginning of the pandemic. Among the week’s best performing indexes are the technology-heavy Nasdaq Composite and the small-cap Russell 2000 index. Value shares were easily outperformed by their growth counterparts, with Facebook and Alphabet, owner of Google and YouTube, spearheaded communication services stocks listed in the S&P 500. Tesla rebounded strongly, thus boosting consumer discretionary shares. The light trading marked the long holiday weekend; markets will remain closed on Monday, May 31, Memorial Day. The lack of directional drivers for the week also contributed to the listless trading as investors were sidelined in the absence of any buying or selling motivation.

U.S. Economy

The previous week’s worries concerning runaway inflation subsided during this week. Some confidence has returned among investors as about 97% of S&P 500 listed companies have released their first-quarter earnings results. It is not surprising that earnings are expected to increase by 50% from year-ago levels since the previous year’s earnings were depressed by the pandemic. The income and spending data for the first quarter indicate that consumers still have significant excess savings that are likely to fuel demand for goods and services as economic activities begin to normalize,

- The strong recovery in profitability is fueled by pent-up demand from the pandemic lockdowns and the buying power enabled by the government’s stimulus packages. There is a slight lag in the pace of hiring which is nevertheless compensated by an increase in the adoption of the appropriate technological systems. Companies took advantage of record-low interest rates and are thereby realizing significantly lower interest expense in financing their operations.

- The US dollar has significantly weakened against international currencies, which is an advantage for multinational companies as U.S. goods and services are now more competitive in the international market. With respect to the adequacy of supply chains, the higher input costs and material shortage may pose challenges to companies’ profitability in the short term. Companies impacted nevertheless appear willing to pass the added costs on to consumers who are not short of buying power to absorb the price increases in the near future. Towards 2022 borrowing costs are expected to rise while the economy expands, and the labor supply tightness currently experienced will ease off as wage growth accelerates and the employment slack is gradually eliminated.

Metals and Mining

Precious metals performed remarkably well in the past week, with gold exceeding $1,900 per ounce for the first time since January. It traded briefly as high as $1,909 on Wednesday before the release of positive U.S. economic data and rising 10-year Treasury yields arrested the flight to value. While the price returned to below $1,900 levels, investors expect gold to again surge in mid-year since in the summer of 2020, gold traded at above $2,000 per ounce. It is, therefore, possible that it will test those highs again this year as continued overspending and poor fiscal policy will provide a catalyst for its continued ascent. As of Friday, gold traded at $1,893.23.

Silver likewise climbed to a three-month high of $28.16 per ounce during the week. The gold/silver ratio reached a multi-week high of 70 as silver neared the $30 level. The ratio has then receded slightly and may decline to the low 60s level during the third and fourth quarters of this year, although some see the metal testing higher levels in the second half of 2021. Silver closed the week trading $27.77 per ounce. Palladium continued to reach fresh ground this week, as platinum also fetched higher prices. Platinum ascended to $1,203 but corrected to end Friday at $1,166.25 per ounce, and palladium traded at $2,724 per ounce at the end of the week.

Base metals also moved northward across the trading week, recovering lost territory during the correction in the previous week. Supply shortage became imminent with the issues in the Democratic Republic of Congo regarding the export of copper and cobalt concentrates. This led copper to rally from $9.868 at Monday’s opening trading to $10,032 by Friday. Zinc neared $3,000 per tonne in late trading but reached resistance and descended slightly to $2,994 per tonne. Nickel slid to $17,000 briefly, thereafter rallying to $17,300. Stainless steel will remain the main application for nickel through the next ten years as it is driven by demand from China. Nickel traded $17,364 on Friday, Lead ended the week at $2,182.50 per tonne, an increase of $50 for the week.

Energy and Oil

The oil industry experienced a memorable week as oil majors appear to be embarking on a new strategic direction. Foreseen restrictions on the supply side appear to add momentum to a bullish scenario in the market, but the impact on the fundamentals is not expected to become evident in the short term. Cuts in greenhouse gas emissions by as much as 45% towards 2030 are expected to cause the rest of the industry to experience a decline in its energy output. A sharp drop in oil and gas sales resulting in a supply crunch may result in the long term due to legal exposure to Scope 3 emissions. Increasing credit risk is foreseen by Moody’s Investor Service for the major oil producers due to climate change concerns. In the meantime, the largest oil producers in the Arab Gulf appear to be considering a shift to hydrogen production, particularly the more sustainable type produced from water electrolysis supplied with electricity from wind and solar energy. The move to hydrogen is gradually gaining momentum among governments and the world’s largest oil companies.

Natural Gas

This report week, May 18 to May 26, natural gas spot price movements ended mixed. The Henry Hub spot price remained unchanged at $2.88 per million British thermal units (MMBtu). On Wednesday, the June 2021 New York Mercantile Exchange (NYMEX) contract expired at $2.984/MMBtu, higher by $0.02/MMBtu from the previous week. During the same week, the July 2021 contract price was unchanged at $3.027/MMBtu. The price of the 12-month strip averaging July 2021 through June 2022 futures contracts ascended to $3.004/MMBtu, higher by $0.01/MMBtu.

World Markets

The European exchanges reacted favorably to the continued signal that the U.S. will continue pursuing a slack monetary policy and a massive fiscal spending plan. The pan-European STOXX Europe 600 Index closed higher for the week by 1.02%. France’s CAC40 climbed 1.53%, Italy’s FTSE MIB Index gained 0.78% and Germany’s Xetra DAX Index advanced 0.53%. The UK’s FTSE 100 Index moved sideways for the week partly due to the UK’s appreciation against the US dollar. The UK currency has been gaining strength for the past five consecutive weeks, encouraged by the reopening of the economy and comments by the Bank of England (BoE) that it may start to raise interest rates by the first semester of 2022. The core eurozone bond yields eased but rose suddenly by the end of the week as U.S. Treasury yields descended. Peripheral European markets’ bond yields closely tracked the core. UK gilt yields countered the core’s direction, however, when it ascended sharply upon the BoE’s announcement of increased interest rates.

The Japanese stock market also gained for the week, as the Nikkei 225 Index ascending by 2.94% and the broader TOPIX Index rising by 2.24%. Japan’s acceleration of its COVID-19 vaccine rollout, which is scheduled for the next three months, met with positive reactions from investors. The enhanced vaccine deployment coincided with the fourth wave of infections, leading authorities to declare states of emergency over a large part of the country, including Tokyo. Fears arose that the Olympic Games might again be postponed from its July 23 starting date, particularly because the U.S. State Department had issued a travel warning for its citizens bound for Japan. The yield on the 10-year Japanese government bond remained unchanged at 0.08% as the yen weakened against the U.S. dollar to around JPY 109.82.

Chinese stocks surged as both the CSI 300 Index and the Shanghai Composite Index registering the best weekly increase in more than three months. As China passed a milestone of more than 500 million COVID-19 vaccinations, tourism-sector stocks and other counters leverage to an economic reopening rose sharply. Financial policy regulators attempted to reduce financial risk by signifying zero tolerance for commodity speculation and cryptocurrency mining. Chinese regulators likewise rejected applications for the issuance of RMB 154 billion of asset-backed securities from several companies, in a further effort to curb financial risk. The yield on the 10-year sovereign bond ended at 3.09% for the week. Short-term rates were consistently low and stable in money markets, as they have been throughout May. The renminbi rose against the U.S. dollar by 1.1%; it is at its highest exchange rate against the dollar since June 2018. Daily net equity inflows from Hong Kong into China reached $3.4 billion in midweek, which is among the largest daily net inflows on record.

The Week Ahead

Among the important economic data to be announced in the coming week are Unit Labor Costs, productivity growth, and the Markit PMI index.

Key Topics to Watch

- Markit Manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- Beige Book

- ADP employment report

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Productivity (revision)

- Unit labor costs (revision)

- Markit services PMI (final)

- ISM services index

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Factory orders

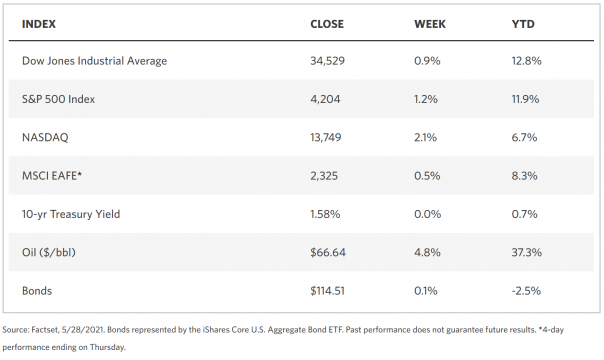

Markets Index Wrap Up