Surrounded by fast-moving gold plays, Australian Goldfields Limited (OTC:GRXXF) (CSE:AUGF) is set to capitalize on a favourable gold era on its 7 new projects.

No matter who is residing in the White House after January 20, 2021, CEO of Euro Pacific Peter Schiff—the man who repeatedly predicted the 2008 crash—doesn’t see a likelihood of Joe Biden nor Donald Trump fixing the American economy.[1]

Two days after the contested election, Schiff stated:

“It’s all about fiscal stimulus. And most people believe we’ll get the biggest stimulus package the quickest if Democrats control everything in Washington DC. The reality is we’ll almost certainly get stimulus no matter who wins. This economy is built on stimulus. The powers that be will ensure the stimulus spigot stays open.”

It didn’t take long for stimulus hopes to make an impact on the price of gold—something Schiff also predicted would happen, as hopes of more US stimulus measures to tackle the impact of rising COVID-19 cases shuffled investors once again towards the precious metal as a hedge.[2]

Regardless of who is left standing once the electoral college votes are made official, Schiff wasn’t the only one predicting that the end of the election cycle would trigger higher gold prices in the coming months. Out of each scenario that could take place, the contested election timeline projected also seemed to be predicted as a catalyst for gold prices to move up.[3]

One need only look at the sentiments of central bankers around the world to see what’s coming over the next 12 months. Earlier this year an anonymous survey of central banks around the world revealed that central bankers typically expect central bank gold holdings to increase over the next 12 months, while not a single one expected a decrease.[4]

No matter what Joe Biden means when he refers to us all going into a “Very Dark Winter”, it’s plain to see that a stimulus of some form is coming down the pipe to the American people, no matter who pulls the trigger. And the smart money is going to be betting on gold.[5]

“Uncertainty increases allure” as the central banks prepare themselves to handle geopolitical, geo-economic and financial uncertainty. Our current historically low-interest rate environment means that holding gold today is less costly than ever before.

But, then again…

How are some of the world’s most prominent billionaire investors reacting to this upcoming gold era?

Peter Schiff has always been notoriously bullish on gold. But so too has mining magnate Eric Sprott, who not only foresees higher gold prices,[6] but instead of gobbling up physical gold, has in 2020 been doing what he does best—pouring tens of millions into many different gold and silver mining companies.

But it wasn’t until the Oracle of Omaha, Warren Buffett decided this year was the year to buck his age-old anti-gold views, stunning the investment world by moving more than half a billion dollars into one of the world’s largest gold miners—Barrick Gold (NYSE:GOLD) (TSX:ABX).[7]

In response to Buffett’s move, BMO Capital Markets declared that the “stars have aligned for gold.”[8]

Both Buffett and Sprott are showing the market that the real smart money is moving into gold mining stocks. If the economic outlook ahead going into 2021 is uncertain, one this is certain… now is the time to seriously consider investment in gold mining stocks.

BIG GOLD MINING MOVES IN AUSTRALIA

Amid the gold run of 2020, some of the biggest developments seem to be coming within one of the world’s strongest mining countries—Australia.

In fact, one of this Australia’s best gold discoveries this year could become one of the country’s top five gold mines is being developed 80km south of Port Hedland in Western Australia.[9]

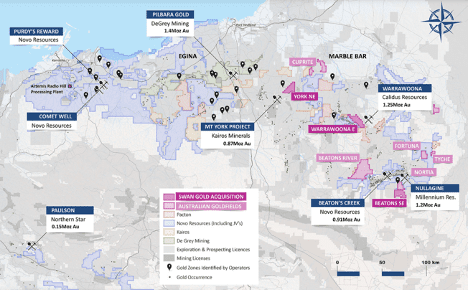

Shares in De Grey Mining Limited (OTC:DGMLF) (ASX:DEG) have risen 24-fold over the past nine months on the news of their discovery.[10] The win for De Grey drew significant attention to the Western Australia mining region of Pilbara.

Other Pilbara plays are starting to come alive.

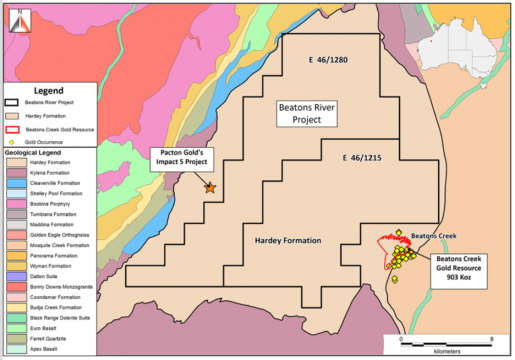

Novo Resources (OTC:NSRPF) (TSX.V:NVO) has on its Beacon Creek Gold project a 43-101 compliance mineral resource of 903,000 ounces of gold in the Pilbara.

Much likeDe Grey, Pacton Gold (OTC:PACXF) (TSX.V:PAC) has garnered a +20x return on its shares in 2020—despite being a much, much smaller outfit.

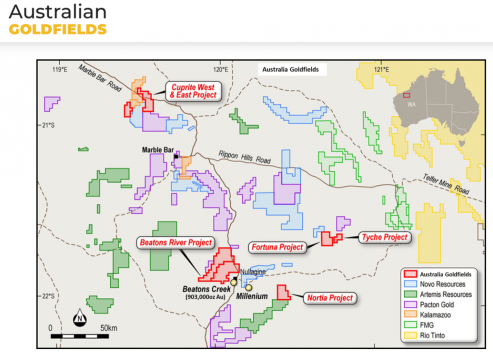

Situated within the Pilbara, and directly between Novo and Pacton we’ve identified a 335km2 gold project with an NI 43-101 Technical Report underway that’s worth a much deeper look.

With a total of 7 significant land packages in play, many of which are historically under-explored and ripe for big news in a short period of time, is Australian Goldfields (OTC:GRXXF) (CSE:AUGF)—an up-and-coming miner led by a winning management team with a highly prospective, sizeable gold footprint in Western Australia’s Pilbara region.

7 Key Facts Showing

Australian Goldfields (OTC:GRXXF) (CSE:AUGF)

Has Established a GOLDEN Opportunity in Australia

- Pilbara historically has had significant iron ore production, however, recent significant high-profile gold discoveries are bringing focused new attention on the region.

- Australian Goldfields has strategically assembled a sizeable prospective gold footprint of 7 tenements split up into 5 distinct projects, all within the Pilbara region:

- Beatons River

- Cuprite West & East

- Tyche

- Fortuna

- Nortia

- Beatons River Project is contiguous to Novo Resources’ (TSX.V:NVO) Beatons Creek Gold Deposit, and totals 335km2—an NI 43-101 Technical Report on the project is underway.

- Within the Cuprite West & East Project are extensive high-grade rock chips up to 57.5 g/t Au and shallow drill intercept 4m @ 2.9 g/t Au from 8m.

- The Tyche, Fortuna and Nortia Projects are all under-explored, yet have geological structures that are highly prospective for gold mineralization.

- Tight share structure of only 17 million common shares, and after pending transaction issued and outstanding shares will only total approximate 47 million shares

- Led by experienced management team with international track record of discovering and acquiring world-class mining projects—Geology team set to commence in-depth project evaluation

Central to the Australian Goldfields (OTC:GRXXF) (CSE:AUGF) story is the flagship Beatons River Gold Project, which is strategically located next to nearly a million ounces of gold.

Let’s now take a deep dive into this flagship project, before moving on to the under-explored upside of the other four properties in Australian Goldfields’ portfolio.

Prized Real Estate: Beatons River Gold Project

Australian Goldfields’ Beatons River Project is comprised of 335km2, that’s contiguous to the Beatons Creek Gold Deposit from Novo Resources Corp. (TSX.V:NVO)—a further developed project that hosts 903,000 oz Au grading 2.53 g/t Au.

By looking at the map above (provided by the Western Australia Geological Survey), it can be seen that both the Beatons Creek Gold Deposit, and the Beatons River Project are enclosed within the SAME formation—the gold-bearing conglomerates of the Hardey Formation.

Located only 2km to the north of Beatons Creak, Australian Goldfields’ Beaton River Project’s target is within the Hardey Sandstone Formation, part of the Fortescue Group, which is a sequence of sedimentary and volcanic rocks.

So far, minimal exploration has been conducted on the Australian Goldfields (OTC:GRXXF) (CSE:AUGF) properties, and the first stage of exploration will comprise mapping and outcrop sampling.

The Beatons River Project Area consists of two granted Exploration Licenses (E46/1215 and E46/1280).

Pacton’s Impact 5 tenement is located approximately 17km northwest of Novo’s Beatons Creek project and lies on the western edge of the Hardey formation plateau and is contiguous with the Beatons River Project’s E46/1280. Pacton has stated that they have established a stratigraphic equivalency between the exposed Impact 5 western plateau edge and the productive stratigraphy at Beatons Creek (Pacton, 2020).

Further Under-Explored Pilbara Assets

Cuprite West & East Project

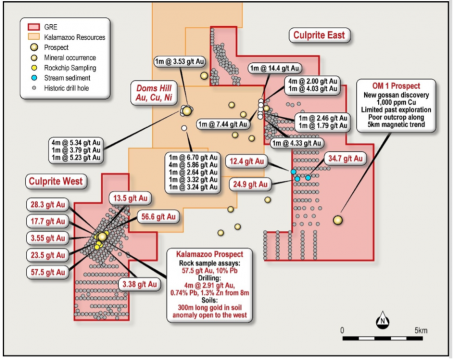

The Cuprite West & East Project comprises two tenements (109km2), circa 50km north-west of Marble Bar, that are deemed highly prospective for gold and base metal mineralization.

Historic work includes a rock chip sample program, which returned gold values ranging from 15.5 to 57.5 g/t Au, and drilling with 1m intercepts ranging from 1.9 to 6.7 g/t Au and 4m intercepts ranging from 1.86 to 5.85 g/t Au.

Overall, the Cuprite West & East Project has the potential to host significant epigenetic gold and syngenetic massive sulphide mineralization.

Tyche and Fortuna Projects

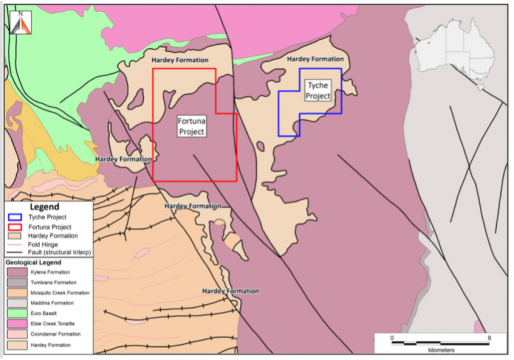

The Tyche Project sits over the two stratigraphic units of the Fortescue Group which comprise the Hardey and Kylena Formations.

Encouragingly, the Hardey Formation, which has been mapped across 90% of the tenure area is typically linked with gold mineralization.

The Kylena Formation, which is present on the eastern boundary, has been known to host elevated gold in quartz veins within basalt.

Meanwhile, within the Fortuna Project, the Hardey Formation is present across 22% of the tenure, which is the first priority target.

Nortia Project

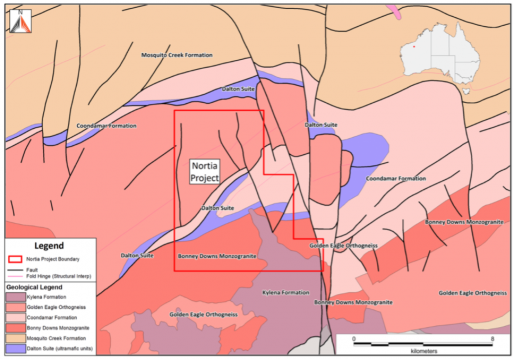

Shear-hosted gold mineralization is the target for the Nortia Project as the tenure contains ancient greenstone / granite assemblages, intersected by multiple faults and shears.

Specifically, the Dalton Suite ultramafic unit is present in the center of the tenure, with several faults and shear zones apparent at the main focus area.

Regionally, there are significant shear-hosted gold occurrences related to ultramafic units, fault and shear zones.

BONUS: THREE NEWLY ACQUIRED PROPERTIES

Through the acquisition of a company called Swan Gold Ltd., Australian Goldfields (OTC:GRXXF) (CSE:AUGF) acquired three projects (all located in the Pilbara region) that compliment and expand on the company’s existing projects.

Beaton’s SE Project

The Beaton’s SE Project is comprised of 101.9km2 and is located near the Company’s Beatons River Project. As a result of this transaction, the Beaton’s River Project (inclusive of Beaton’s SE) will total 436km2. The Beaton’s River Project is contiguous to Novo’s Beatons Creek Gold Deposit, which hosts a resource of 903,000 oz Au grading 2.53 g/t Au. A largely unexplored, major crustal structure runs northwest-southeast through the Beatons SE Project and will be the focus of Australian Goldfields’ exploration efforts within this licence.

York NE Project

The York NE Project consists of 102.6km2 of prospective geology, including numerous regional fault’s intersecting Pilbara Craton greenstone and Cleland supersuite rock units. The southern boundary of the concession lies immediately north of the Lalla Rookh historic gold mining area which produced 6,532 tonnes of ore for 7,602 oz Au in the late 1800’s at an average recovered grade of 1.16 oz/t Au (or 36.3 g/t Au).

The Lalla Rhook West historic mine is located on a NE trending structure that continues onto the York NE concession. The property lies approximately 20 km NE of the Mt. York Project, which hosts an inferred mineral resource of 873,000 oz Au from 19 million tonnes grading 1.3 g/t Au. Significantly, greenstone-hosted gold systems worldwide are often characterized by high-grade lodes, with vertical extent of hundreds of meters. Such systems may have a relatively small surface footprint with robust down-dip exploration potential.

Warrawoona East Project

The Warrawoon East Project consists of 121.6 square kilometres and encompasses multiple regional faults which mark the eastern boundary of the Warrawoona Greenstone Belt. Calidus Resources Warrawoona Project is located 3 km to the east of the concession and is hosted within the greenstone belt. The global mineral resources for the Calidus Warrawoona Project is 1.25 million oz Au from 21.3 Mt at 1.83 g/t Au. As with the York NE Project – the presence of regional structures juxtaposing greenstone rocks of different competency – provides for robust exploration targets.

Case Study 1: Novo Resources (TSX.V:NVO) (OTC:NSRPF)

At its Beatons Creek Paleoplacer Gold Project, Novo Resources (TSX.V:NVO) (OTC:NSRPF) is exploring for gold-bearing conglomerates within the Hardey Sandstone Formation—a part of the Fortescue Group, a thick sequence of ancient sedimentary and volcanic rocks.

Dating back to the late 1800s, historic mines near the town of Nullagine in Western Australia exploited pyritic gold-bearing reefs.

Through a 100% interest in certain tenements and a joint venture agreement with the Creasy Group on others (70% Novo, 30% Creasy Group), the company is performing systematic exploration for gold-bearing reefs across approximately 160km2, utilizing large diameter diamond drilling, 50kg costean sampling and approximately 2 tonne bulk sampling to progress resource definition work.

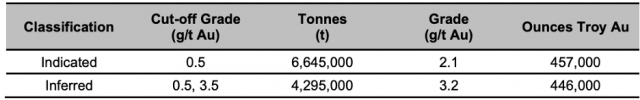

The project already has a valid NI 43-101 compliant resource of 903,000 ounces Au.

HOW THIS APPLIES TO AUSTRALIAN GOLDFIELDS (OTC:GRXXF) (CSE:AUGF):

Both the Beatons Creek and Beatons River Projects are in the same Hardey Sandstone Formation. Australian Goldfields’ Beatons River Projects is located only 2km to the North of Novo Resources’ 903,000-ounce Beaton Creek resource.

NOTE: mineralization on adjacent projects is not indicative of mineralization on the Company’s project.

A National Instrument 43-101 Technical Report on the Beatons River Gold Project is now underway and will be released in due course.

Case Study 2: Pacton Gold (TSX.V:PAC) (OTC:PACXF)

Pacton Gold’s Impact 5 tenement is located approximately 17km northwest of Novo’s Beatons Creek project and lies on the other side of Australian Goldfields’ Beatons River Project, on the western edge of the Hardey formation plateau.

Impact 5 is contiguous with the Beatons River Project’s E46/1280. Pacton Gold has stated that they’ve established a stratigraphic equivalency between the exposed Impact 5 western plateau edge and the productive stratigraphy at Beatons Creek.[11]

Moreover, the Hardey formation within the Impact 5 tenement is intensely fractured with steep dipping faults and multiple networks of low displacement shears that collectively form a pervasive fracture network. The initial Impact 5 exploration program will consist of surface prospecting along the Hardey plateau’s western edge and along dissected drainages.

HOW THIS APPLIES TO AUSTRALIAN GOLDFIELDS (OTC:GRXXF) (CSE:AUGF):

Given that both the Beatons Creek to the east, and the Impact 5 to the west reportedly have established stratigraphic equivalency, further giving credence to the hypothesis that Australian Goldfields’ Beatons River Projects could also contain strategic equivalency.

NOTE: mineralization on adjacent projects is not indicative of mineralization on the Company’s project.

A National Instrument 43-101 Technical Report on the Beatons River Gold Project is now underway and will be released in due course.

What Australian Goldfields’ Peer Group Looks Like

The Pilbara region has highly developed supportive mining infrastructure, with excellent transport networks to key ports. Recent geological analysis of key gold discoveries is drawing a comparison to the Witwatersrand gold reef in South Africa, a major gold producing area.

With this in mind, it’s worth taking a look at other mining companies exploring and operating in the Pilbara, when putting together an idea of the potential in place for Australian Goldfields (OTC:GRXXF) (CSE:AUGF).

Over the course of 2020, these comparable companies have performed quite well. Below are FOUR companies in the region that have seen an increase of more than 100% from their 2020 low points to today (as of November 10, 2020):

| Company | Symbol | Share Price Today | % Increase over 12 months | Mkt Cap |

| Australian Goldfields | OTC:GRXXF CSE:AUGF | $0.23 | N/A | $4.85M |

| Novo Resources | OTC:NSRPF TSX.V:NVO | $2.63 | 98% | $605M |

| Pacton Gold | OTC:PACXF TSXV:PAC | $0.73 | 1,963% | $27.56M |

| Artemis Resources | OTC:ARTTF ASX:ARV | $0.07 | 396% | $70.46M |

| De Grey Mining Limited | OTC:DGMLF ASX:DEG | $0.74 | 160% | $990M |

* All price in USD

** Latest share price taken from Yahoo! Finance on March 17, 2021

Recommendations for Australian Goldfields in the Pilbara

A 43-101 Technical Report was published in September 2020 regarding Australian Goldfields’ Pilbara asset. In order to confirm the resource potential of the gold mineralisation, the report recommended several key recommendations.

BEATONS RIVER PROJECT AREA

The Technical Report recommended constructing a database for the Beatons River Project Area consisting of the available information that’s out there, including all boreholes and geochemical samples with as much data encoded into the database from a variety of sources. As well, they’re to thoroughly review all previous announcement from the Australian Stock Exchange (ASX), and catalogue all notable results.

Next, they’re to employ the services of a specialist consultant familiar with the area and geology to review all of this geophysical data. It’s recommended to consider conducting further geophysical surveys, surface sampling, and in-depth mapping of surface and drilling sampling results based on mineralisation targets.

CUPRITE EAST AND WEST PROJECT AREA

The Technical Report also recommends Australian Goldfields (OTC:GRXXF) (CSE:AUGF) verify historical, company, geochemical sampling and drilling data against original assay data sheets/drill hole logs to confirm accuracy on the Cuprite East and West Project Area. The company needs to normalize and level the adjusted geochemical data using specialty software to take into account different analytical methods, digestion, sampling method, sieve size, etc.

After having a specialist review all of the available data, they’re charged to accumulate more data by conducting geological reconnaissance of the project, along with ground investigations of target areas including detailed geological mapping and sampling.

FORTUNA AND TYCHE PROJECT AREA

The authors of the Technical Report recommend constructing a database for the Fortuna and Tyche Area to host all boreholes and geochemical samples from within tenure and peer deposits, with as much data encoded into the database from a variety of sources. Much like at Beatons River, they’re also recommending cataloguing and reviewing all notable results from earlier ASX announcements.

Should the data warrant it, Australian Goldfields (OTC:GRXXF) (CSE:AUGF) are to consider further geophysical surveys upon geophysical data review to provide additional target information on the subsurface.

Conducting a site visit would help for reconnaissance across the entire project for conglomerate outcrop, investigation for outcrop over the areas of anomalous stream and rock chip

Geochemistry, and surface sampling of any conglomerate, subcrop or float: rock chip, soil etc.

All this leads to potential follow up with Air-core, RAB or RC drilling across anomalous corridors, and in-depth mapping of surface and drilling sampling results based on mineralisation targets;

NORTIA PROJECT AREA

On Nortia, they’re to review historical company reports to capture and digitise data that is not reported by GeoVIEW.WA. After that, Australian Goldfields (OTC:GRXXF) (CSE:AUGF) will need to undertake a geological review of Nortia’s exploration potential, including identification of target areas for follow-up investigations. Follow-up geological reconnaissance of the project should include ground investigations of target areas including detailed geological mapping, rock chip and soil sampling. On the priority areas, ground geophysical surveys such as magnetics, IP or even EM, could be beneficial.

Australian Goldfields’ Management Team

The Australian Goldfields (OTC:GRXXF) (CSE:AUGF) leadership team brings the kind of mining industry expertise that investors look for. In particular, among the team is extensive international mining experience in the Southern Hemisphere.

President & CEO – Adrian F.C. Hobkirk

Hobkirk brings 30 years exploration experience with 25 years in Guyana. Extensive business and political contacts in country. He was central to the acquisition of the Groete Gold Copper Project in Guyana, and managed the exploration that led to the current resource.

Director & CFO – Christopher P. Cherry

Cherry has +14 years of corporate accounting and audit experience, as well as extensive corporate experience, having held senior-level positions for several public mining companies, including director, CFO and secretary. In his former experience as an auditor, he held positions with KPMG and Davidson and Co. LLP in Vancouver, where he gained experience as an auditor for junior public companies and as an initial public offering specialist.

SOURCES:

[1] https://www.rt.com/business/505676-trump-biden-us-economic-destruction/

[2] https://economictimes.indiatimes.com/markets/commodities/news/gold-prices-gain-some-ground-on-stimulus-hopes/articleshow/79141663.cms

[3] https://www.financialexpress.com/money/trump-or-biden-gold-prices-set-to-go-up/2116786/

[4] https://www.centralbanking.com/central-banks/reserves/gold/7706776/gold-reserves-in-central-banks-2020-survey-results

[5] https://www.forbes.com/sites/greatspeculations/2020/10/12/some-are-betting-on-red-some-on-blue-im-betting-on-gold/?sh=6143a1a56023

[6] https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/eric-sprott-gold-silver-obvious-buys/#:~:text=Buy%20physical%20gold%20and%20silver,this%20year%2C%E2%80%9D%20he%20said.

[7] https://www.fool.ca/2020/11/05/warren-buffetts-most-stunning-2020-purchase-buying-gold/

[8] https://financialpost.com/commodities/mining/stars-have-aligned-for-gold-warren-buffetts-berkshire-takes-500-million-stake-in-barrick

[9] https://www.afr.com/companies/mining/de-grey-targets-top-five-gold-mine-20201106-p56c7q

[10] https://www.afr.com/companies/mining/de-grey-targets-top-five-gold-mine-20201106-p56c7q

[11] https://www.pactongold.com/projects/australia/nullagine-beatons-creek/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Australian Goldfields advertising and digital media from the company directly. There may be 3rd parties who may have shares of Australian Goldfields, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Australian Goldfields which were purchased as a part of a private placement. MIQ will not buy or sell shares of Australian Goldfields for a minimum of 72 hours from the publication date on this website March 7, 2021, but reserve the right to buy and sell, and will buy and sell shares of Australian Goldfields at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.