The biggest initial public offering (IPO) of all time has unleashed an investor frenzy for the record books.

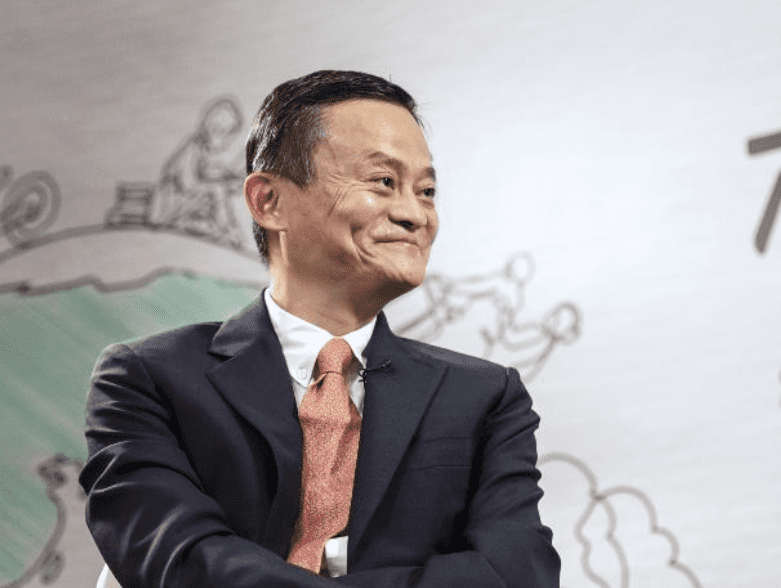

Jack Ma’s Ant Group attracted at least $3 trillion, or about equal to the UK’s gross domestic product last year, of orders from individual investors for its dual listing in Hong Kong and Shanghai, enough money to buy JPMorgan Chase & Co 10 times over. Bidding was so intense in Hong Kong that one brokerage’s platform briefly shut down after becoming overwhelmed by orders. Demand for the retail portion in Shanghai exceeded initial supply by more than 870 times.

Analysts say buyers struggling to secure allocations as fundraising expands to almost $37 billion.

The stampede is fueling predictions of a first-day pop when Ant is due to start trading on November 5, even as skeptics warn of risks including the US election, tightening regulations in China and rising Covid-19 infections worldwide.

Whether Ant surges or not, the Chinese fintech behemoth’s $35 billion-plus IPO represents a major vote of confidence in a company that could end up shaping the future of global finance. It also underscores China’s ability to marshal huge amounts of capital without tapping American markets, a win for Beijing as it tries to reduce its vulnerability to the threat of US financial sanctions. Chen Wu, a 35-year-old software developer, was among those scrambling for a piece of Ant’s offering this week. His brokerage allowed a small number of clients to supercharge their bets using 33 times leverage, handing out allocations on a first-come, first-served basis.

“When it was released at noon, I refreshed my page again and again, clicked and clicked,” Wu said on Tuesday after ordering a HK$5.7 million ($735,322) block of Ant shares, equivalent to more than 80% of his existing equity portfolio. “I got it around 12:01 p.m. and the quota ran out within minutes. I was lucky.”

Ant is no doubt benefiting from the unusually buoyant mood among retail investors globally, but it’s not just the mom-and-pop crowd driving demand.