Putting money away can be really tough. How much do you save? What are you saving for? Local personal finance professional, Layne McDaniel, breaks down how to better save money now for a future rainy day.

“The biggest thing is to pay yourself first,” said McDaniel.

Before you dole out your hard-earned cash, keep some for your future self. McDaniel works with the JumpStart Coalition for Personal Financial Literacy Louisiana Chapter, where his goal is to teach people to be financially literate.

Saving money is a good way to start.

“Saving a small amount even weekly or monthly, or per pay period, goes a long way,” said the finance expert.

Putting away cash starts with a goal, whether that’s retirement, a new house, or an emergency fund. While all of these are good goals, the pandemic has taught many that a rainy day can sneak up on you.

“I think people have learned during this particular pandemic of what they can give up, what they can live without,” said McDaniel.

He says that rainy day fund should have enough money in it to pay for three to nine months of your necessary expenses.

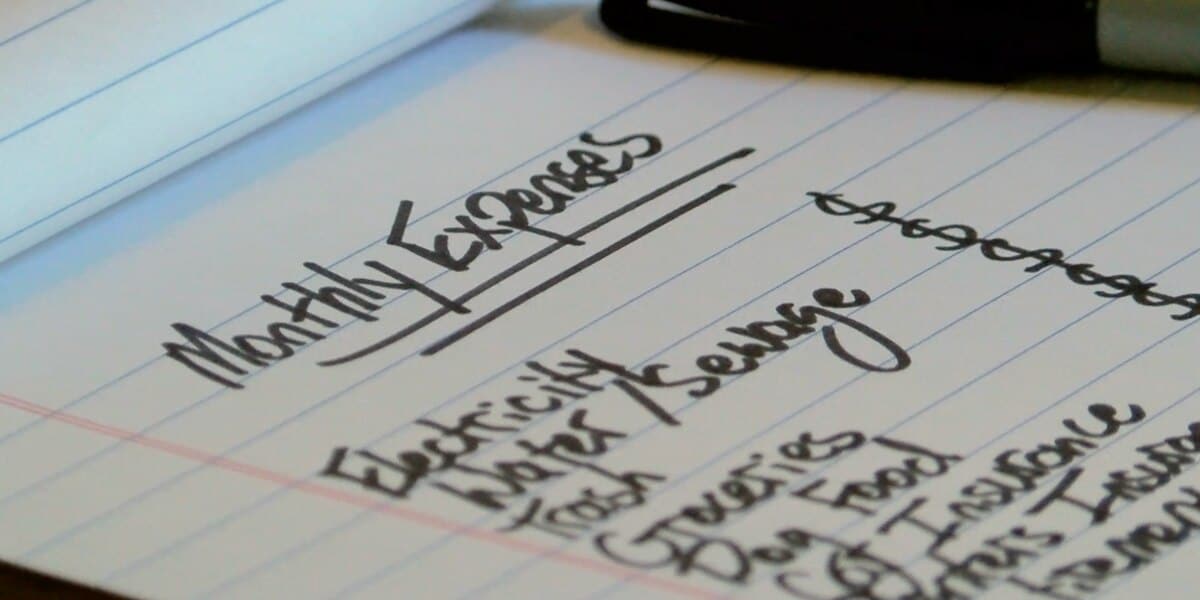

“What are your basic necessities to live in a month? Those are your rent, utilities, insurance, groceries,” he said.

Knowing how much it costs to live in case something happens to your job is the best way to prepare for any future economic crisis.

“That’s probably the key to recession-proofing,” he said.

However, any way you can reduce those monthly expenses will help you in the long run too.

McDaniel says call up your subscription services or utilities and try to negotiate for a better price. That could put a few extra bucks in your pocket or help you pay down your debts.

“The biggest obstacle to saving for most people are debts,” he said.

McDaniel explains that debt gets in the way of saving more money, so he says pay off your highest interest debt first, like your credit cards. Then, work your way down to the low interest debt, which may be a student loan.

Another way to know where you stand financially is to check your credit reports. Now until April 2021, the three major credit unions will give you a free weekly report on annualcreditreport.com.