After a brutal March wrecked an 11-year bull market, there seems be little doubt on Wednesday that equity markets in the U.S. are returning to bullish form after being rocked by COVID-19.

That at least applies to recent gains for the technology-laden Nasdaq Composite Index, which is on the brink of topping its Feb. 19 all-time closing high.

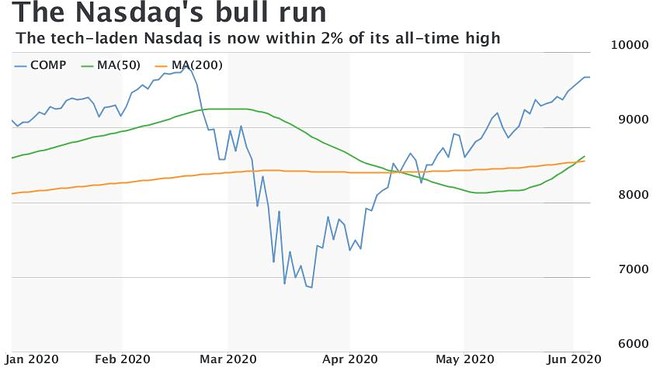

As of Wednesday afternoon, the Nasdaq COMP, +0.77% was about 1.4% from its February all-time high at 9,817.18. On top of that, a bullish ‘golden cross’ has formed in the index, where the 50-day moving average rises above the longer-term 200-day line, with this relatively rare event marking the point where a shorter-term rebound morphs into a longer-term uptrend, according to chart watchers.

The Nasdaq had marked the fastest entry to a bear market, defined as a decline of at least 20% from a recent peak, on record, spanning 16 trading sessions, according to Dow Jones Market Data. Now, the Nasdaq in its 73rd day from its previous high, is on pace for its second-fastest recovery after entering a bear market since March 2009.

The average recovery for the Nasdaq Composite takes 1,018 trading sessions.

Meanwhile, the Nasdaq-100 index NDX, +0.49% QQQ, +0.45%, which tracks the biggest companies within the Nasdaq, is 0.2% off its record closing peak at 9,718.73.

From lows hit for much of the major indexes on March 23, the Nasdaq is up 41%, while the Nasdaq-100 has gained more than 38%.

To be sure, gains in technology have been concentrated in a handful of names, including so-called FAANG names, like Facebook FB, -1.10%, Amazon.com Inc. AMZN, +0.24%, Apple Inc. AAPL, +0.55% Netflix NFLX, -1.25% and Google parent Alphabet GOOGL, -0.21% GOOG, -0.19%, which have been seen as more resilient, and even benefiting from, to stay-at-home orders that had been in place to curb the deadly contagion.

The rise in those large-capitalization stocks have helped push the market higher.

However, the broader stock market has begun to experience a more diverse rally outside of tech-related names, with the Dow Jones Industrial Average DJIA, +2.04% trading 12% from its Feb. 12 closing high at 29,551.42 and the broader-based S&P 500 index SPX, +1.36% which was less than 8% from its recent peak at 3,386.15.

Gains for the market have come despite some concerns that the recovery from the business closures and layoffs won’t result in a so-called V-shaped, or quick recovery, from an economy that has fallen into recession.

Markets also have managed to ignore rising tensions between China and the U.S., and national protests, alongside riots and looting, sparked by the death of an unarmed black man in Minneapolis under the knee of a white police officer.

Some experts have attributed the resurgence in the stock market to the unprecedented amounts of stimulus provided by the Federal Reserve to help prop up the economy and the financial markets, with the central bank’s balance sheet exceeding $7 trillion, as of last week.