Just when you think you have it all figured out, life throws you a curve ball.

Recently, Sarah Wilson, who lives in College Station, Texas, and blogs at GoBudgetGirl.com, hit the emergency trifecta: a computer repair, an unexpected $500 medical expense and the all-too-common pricey car repairs.

Recalling the time when she still had debt and no savings, she says those events would have ruined her for months.

“Having savings made the emergencies an inconvenience instead of the end of the world,” Wilson said.

If there’s a single financial task that seems like it can be put off indefinitely, it’s the emergency stash.

Today, your car is fine, your pets are healthy, the sun is shining.

Yet roadblocks crop up when you’re least prepared for them. That’s why everyone needs an emergency cushion to soften the blow. More than a third of people, ages 36 to 60, surveyed by PNC Financial Services said they had nothing saved for an emergency.

Make this critical financial goal more fun by choosing a method that suits your personality.

The internet has a wealth of ideas and resources for crafty, creative types. Pinterest can show you vision boards for inspiration. You could knit or crochet a green (or gold) scarf or hat.

It may sound silly — how is drawing a picture going to get you more money? — but it works.

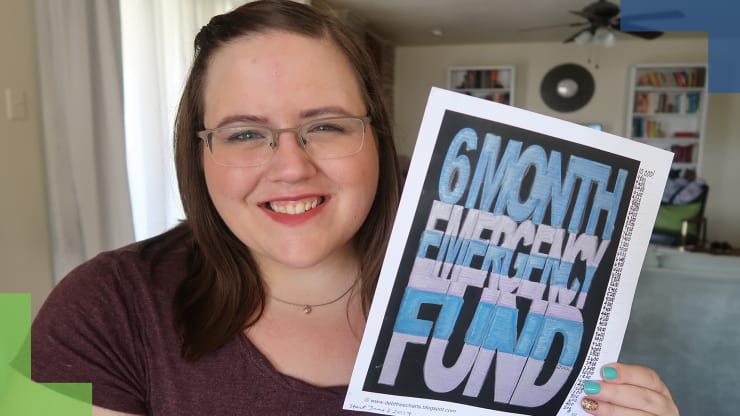

Visualizing a financial goal on a progress chart gives you something to look at that isn’t just numbers, says Heidi Nash, who lives in the Bay Area. Nash started Debt Free Charts after she and her husband conquered their own debt issues.

Filling in the chart motivates people to keep saving. “When you can see yourself starting to win, you want to win more,” Nash said. Check out Instagram for examples of inspiring savings charts.

The internet has tons of financial pictures and forms to chart progress. They are generally created and often given away free or at minimal cost by ordinary people who just want to share.

Things you ignore tend to just disappear, says Jackie Beck, who lives in Phoenix. “What you focus on is what you get,” she said. Beck, 50, and her husband conquered their own financial struggles. Now she counsels people on getting out of debt.

1. Got markers?

Are you a visual person? Love Pinterest and making scrapbooks? Then a financial vision board could be the perfect way to save.

Your board can be digital. Beck used Pinterest to collect inspiring images, such as a picture of her dream vacation spot. If you make a paper board, place it on your fridge or inside your medicine cabinet, or any place you visit every day.

Wilson kept her savings chart on her fridge. “It inspired me to work harder to fill it in faster and see the progress,” she said. “Especially in more difficult or slower times, the chart showed how far I had already come and how much I had accomplished.”

2. Buddy up

Things are more fun when you do them with someone else. That’s why we like book clubs, coffee dates and exercise partners.

So get yourself a money partner. Chances are, you have a friend who has similar financial woes. Like any exercise or fitness plan, saving works better when you don’t go it alone.

The two of you can have a shared goal or complementary ones. Plan to meet regularly and exchange ideas, talk about new ways to save money and high-five each other’s success.

3. Have a savings party

If you know several people who want to save more, spend less or meet some specific financial goal, why not throw a party? Everybody brings an idea and a budget dish.

Even if it’s just snacks and a six-pack, you’ll all do better when you say your goals out loud. “I want to pay off this credit card bill.” “I want to save $1,000 in case of an emergency.” Follow up with one another to stay on track.

4. Give yourself a gold star

Everything I need to know about motivation I learned in kindergarten.To put it simply, every job well done deserves a sticker.

If you don’t have a spare memo book lying around, get one from the dollar store. Also, buy yourself a pack of foil stars or any other stickers.

Each day you meet your goals, whether it’s bringing lunch to work, making your own coffee or walking instead of taking the bus, give yourself a star — in other words, a visual pat on the back for being a money-saving hero.