Sometimes it pays to look beneath the surface.

The Nasdaq’s nearly 23% gain this year is higher than the S&P and Dow’s 19% and 15% rise, respectively, but unlike the other indexes, the Nasdaq hasn’t hit a record since April. This has prompted some investors to question whether the tech trade is rolling over.

But TradingAnalysis.com’s Todd Gordon says that just looking at the Nasdaq Composite doesn’t tell the whole story since the index is composed of a range of stocks including financial and retail companies. After looking at tech-specific ETFs, he argues that this is still very much a “tech-driven rally.”

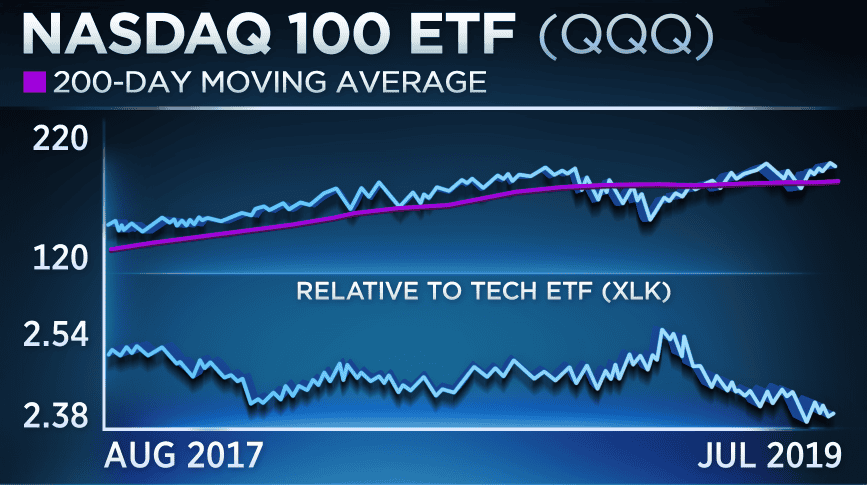

On Tuesday’s “Trading Nation” he pointed to the divergence between the XLK — a tech-heavy ETF — and the QQQ, which tracks the Nasdaq 100 and includes a wider range of stocks, as evidence that investors should be picky when choosing vehicles to track the tech trade. The XLK is “way through the high,” says Gordon, while the QQQ is “weakening.” The XLK has gained 26% in the last six months, compared to the QQQ’s 18% rise.

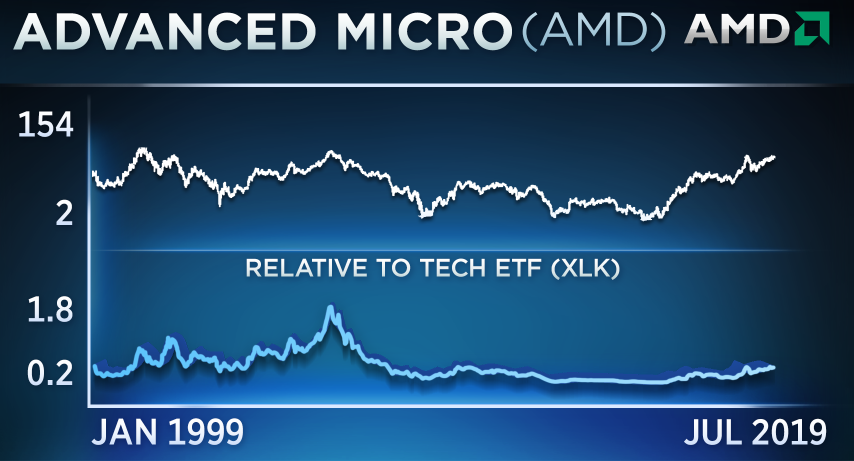

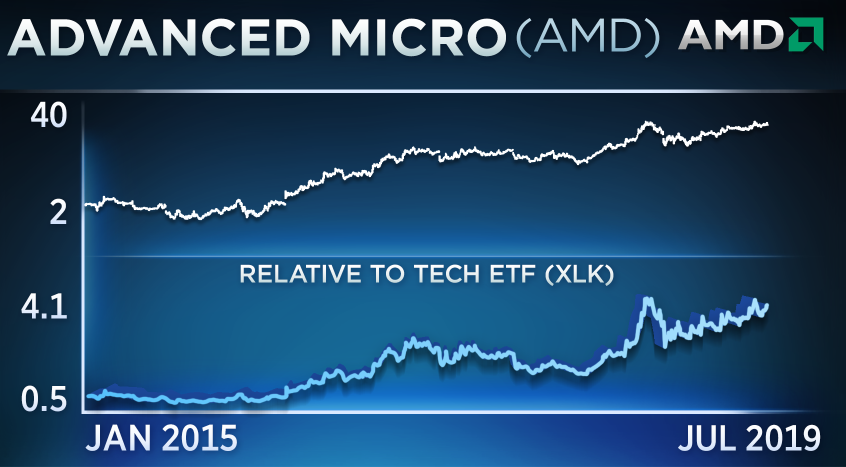

Within tech Gordon is specifically watching AMD, which he says is on the cusp of a breakout 20 years in the making.

“I just love, love” this chart, he said of AMD, noting that it’s been stuck in a trading channel for two decades that it looks ready to “eject” from. He argues that if the stock can break through $38 — which could come from a positive catalyst such as a trade deal with China — it’s heading back to old highs. $38 is about 15% higher than where the stock was trading on Tuesday, but still about 32% below its January 2000 all-time high of $48.50.

He also notes that AMD is an outperformer even within the high-flying semi space, noting that it’s “eating Intel’s lunch ” after gaining almost 80% this year compared to Intel’s 1% rise. By comparison, the XLK has gained 28% this year.

“I’m going to look to leverage up, sort of do some longer-term options [in AMD] if we can break through the $38 mark…We’re coming up on these old highs…If we can get through there, that’s a 20-plus year channel that’s just been broken and we could go a lot higher in AMD so I’m watching this one,” he said.

Steve Chiavarone of Federated Investors echoed Gordon’s bull case for semis, adding that software stocks are also an attractive sub-sector within technology.

He believes that “growthier sectors” like tech still “have the ability to lead in this market,” and that within that backdrop semis are “well positioned.”

“From a long-term perspective, there’s a secular trend towards the digitization of the economy. Semis are an integral part of that and we think any cyclical downturns can be viewed as opportunities for longer uptrends,” he said.

He believes that investors should use any pullbacks as buying opportunities, and says that “software and disruptive technologies” are also attractive stocks to own.