Mortgage rates are slumping toward a two-year low, making homeownership a bit more affordable.

The 30-year fixed mortgage rate has gone down to 3.82%, from 3.99% last week. Rates on a 15-year fell to 3.28% from 3.46% last week, according to Freddie Mac.

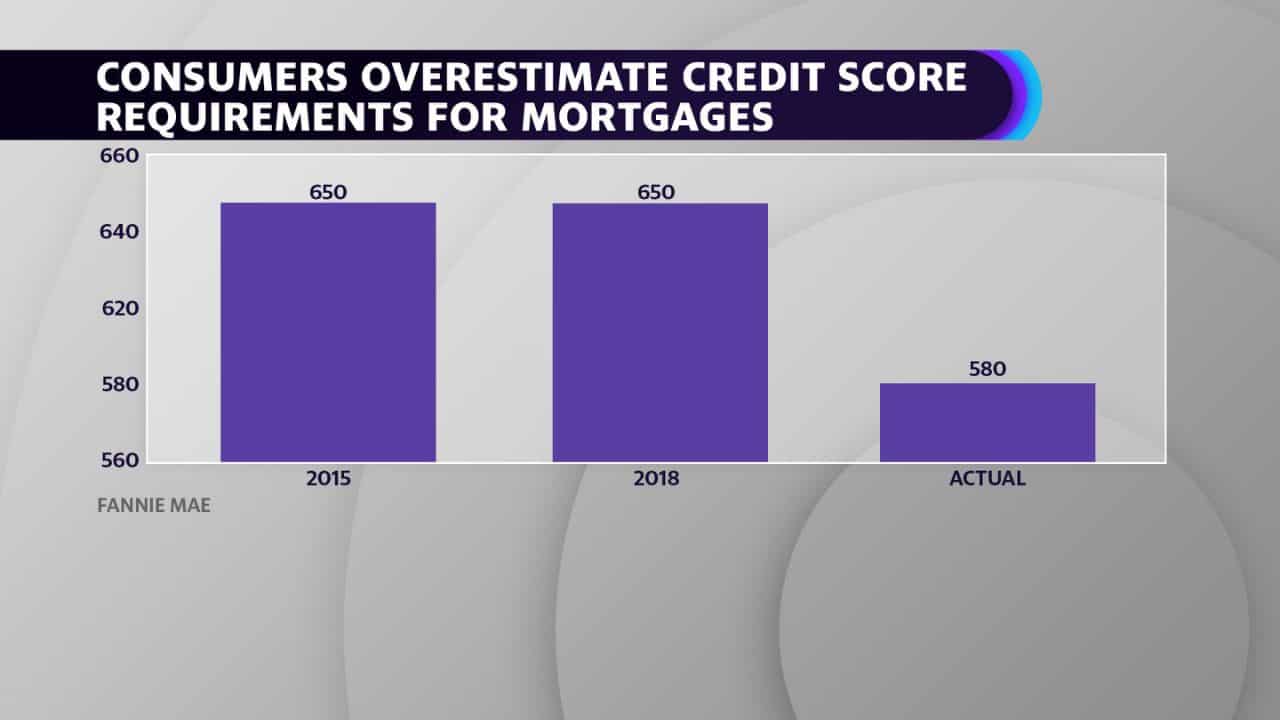

But if you think you know the basic financial requirements it takes to secure a mortgage, you might want to take a closer look. A new study by Fannie Mae shows that consumers broadly lack an understanding of the basic thresholds to qualify for a mortgage. Many potential homeowners are overestimating both the minimum credit score and minimum down payment needed, as well as the debt-to-income ratio percentage required for mortgage qualification. Additionally, fewer than 1 in 4 consumers know that low down-payment programs exist.

As Yahoo Finance reported, alongside the drop in mortgage rates was a drop in housing value in April vs. March – of 0.1%, according to Zillow. This was the first monthly decline in housing value in 7 years. However, inventory is 1.7% lower than last year, meaning buyers could have trouble finding a home to buy. The average price of a home in April was $226,800, up 6.1% from last April’s average value of $212,000, according to Zillow.

Since Fannie Mae’s last study on trends in consumers’ understanding of mortgage qualifications in 2015, more consumers report seeing their credit score recently, but close to half still cannot recall what it is. And even if they have it, they don’t know what to do with it in terms of pursuing a home mortgage. The report says that while viewing one’s credit score is a good start, consumers need to understand what to do with that information – like pay down credit card balances on time, for instance, to boost their score.

Even people who might seem to be more knowledgeable, such as current homeowners or those planning to own a home in the next three years, aren’t much more knowledgeable than the rest of the population about mortgage requirements.