Worries over slowing economic growth are weighing on global markets.

Stocks dropped sharply in Asia as investors reacted to disappointing manufacturing data from Germany on Friday and a warning signal that a US recession could be on the horizon. Japan’s Nikkei (N225) closed down 3% on Monday, while Hong Kong’s Hang Seng (HSI) shed 2%.

Fears about a severe global economic slowdown hit stocks in Europe and the United States on Friday. The pain continued Monday, with benchmark indexes in Europe closing with mild losses. US stocks also dropped, though ended the day essentially unchanged.

The new bout of fretting over the health of the global economy follows a big rebound in stock markets.

“Given just how strong equities have rallied this year, it is not surprising that investors were already questioning how much further they could go,” said Kerry Craig, global market strategist at JP Morgan Asset Management.

US stocks on Friday suffered their worst day since early January after the yield on 3-month Treasuries rose above the rate on 10-year Treasuries for the first time since 2007. A flattening yield curve, or the difference between short- and long-term rates, is typically seen as a sign that long-term economic confidence is dwindling.

An inverted curve has been a reliable predictor of a coming US recession for decades. But market experts advised investors against panicking for the time being.

Strategists at the Commonwealth Bank of Australia said that while the inverted yield curve is “an ominous sign,” they aren’t predicting a US recession anytime soon.

Craig said he interprets the US bond market move as a sign of slowing economic growth around the world.

“This means that we don’t expect the market to collapse, but neither do we expect equity returns to be that inspiring from here,” he added.

Trade war: Deal or no deal?

After a brutal December — the Dow’s (INDU) worst since the Great Depression — many stock markets around the world have surged this year as investors have become more optimistic about the health of major economies and the prospect of an end to the damaging trade war between the United States and China.

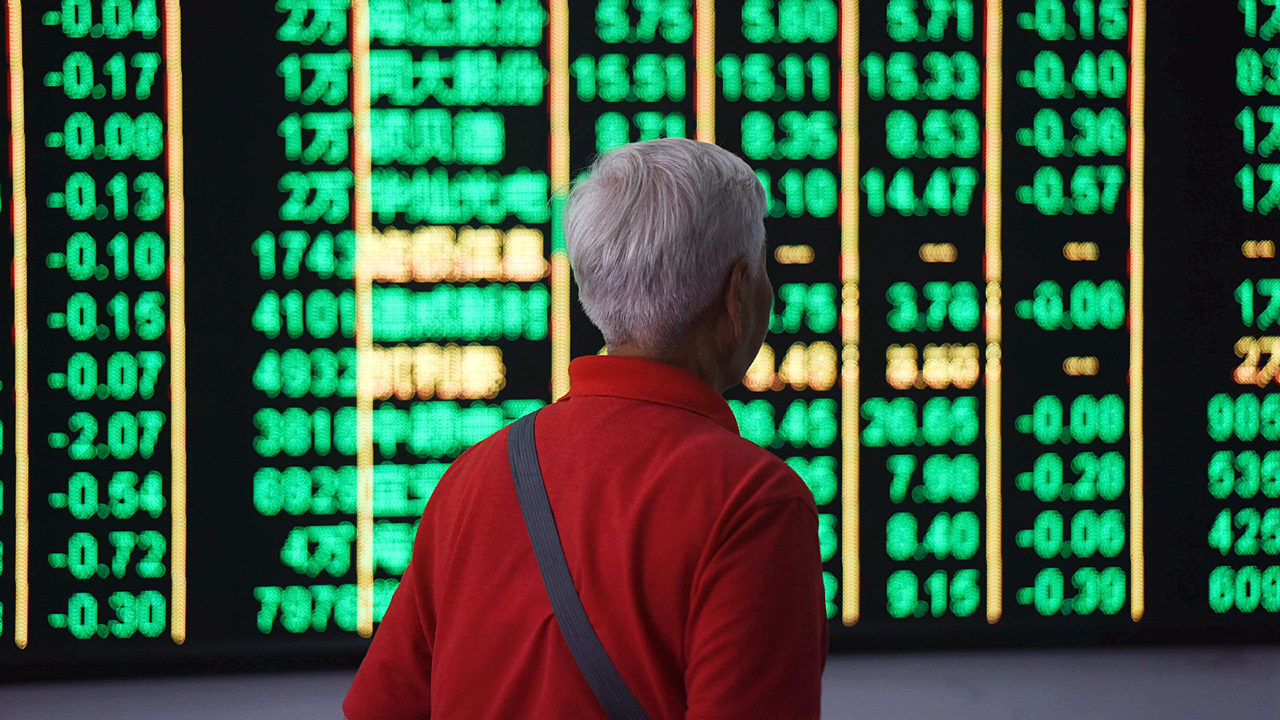

Chinese shares, which had a terrible 2018, have performed particularly well. The benchmark Shanghai Composite (SHCOMP), which had gained about 25% since the start of the year, fell 2% on Monday.

Analysts said that the outcome of trade talks between the United States and China is more significant for stocks in Asia than the shift in the US bond market.

“A couple of basis points inversion between 3-month and 10-year yields does not an impending economic Armageddon make,” Jeffrey Halley, a Singapore-based analyst at online trading platform Oanda, said in a commentary.

“A deal or no-deal” over trade between Washington and Beijing “remains the only real game in town,” he added.

Negotiations between the two governments aimed at resolving the trade war will resume this week.

Top US officials are due to hold talks with their Chinese counterparts in Beijing starting Thursday. A Chinese delegation is scheduled to go to Washington for further talks in early April.

Negotiations had been on hold as the two sides tried to figure out how to overcome disagreements about how the United States would ensure China is abiding by any deal. US concerns about how China goes about getting hold of American technology and trade secrets have also been a sticking point.