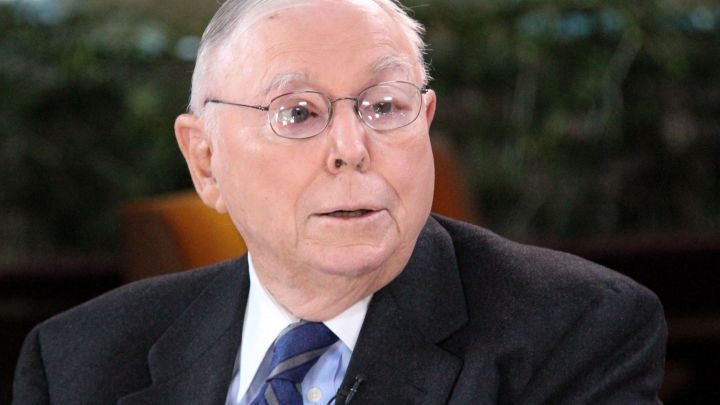

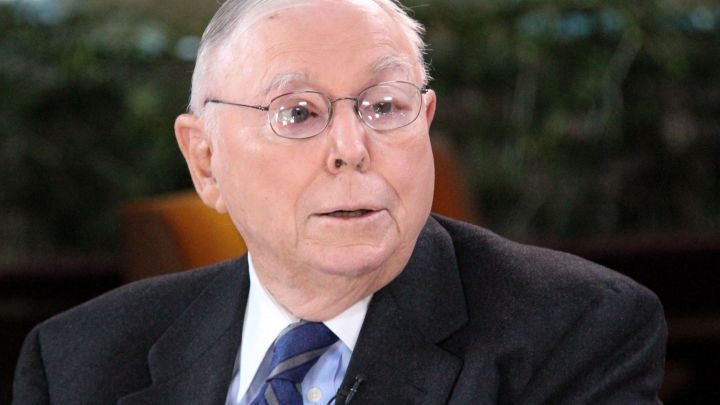

Warren Buffett’s longtime business partner Charlie Munger is not a fan of active investment management and thinks it could harm inexperienced investors.

“If you take the modern world where people are trying to teach you to come in and trade actively in stocks, well I regard that as roughly equivalent to trying to induce a bunch of young people to start off on heroin,” Munger said from the annual Daily Journal shareholder meeting on Thursday.

Munger instead lauded large index funds for the everyday investor who is looking for exposure to the stock markets and said that many active stock pickers are still in a state of denial that their expertise is worth the fees they charge clients.

“They have a horrible problem they can’t fix so they just treat it as nonexistent,” Munger added. “It’s wrong to have all these people in just a state of denial and doing what they’ve always did year after year, and hoping that the world will keep paying them for it even though an unmanned index is virtually certain to do better.”

Money has flooded into index funds and exchange-traded funds during this long-running bull market, while fee-based active strategies have suffered. The market for index funds has reached $6 trillion, while the market for exchange traded funds, which track indexes, has ballooned to $5 trillion since the SPDR S&P 500’s inception in 1993.

Munger himself, however, is one of the most celebrated investors in history and played a crucial role in Buffett’s success. Munger’s investing prowess preceded his move to Buffett’s Berkshire. From 1962 to 1975, Munger’s investment partnership generated 20 percent annual returns versus the S&P 500’s 5 percent. Read more about his investment strategy here .

Still, Munger said it’s alright for investors to maintain a small number of stock positions if they’re looking to outperform the broader stock markets.

“It’s OK if the individual has a few holdings,” he said. It’s “more important to invest where you have extra knowledge.”

“The whole idea of diversification when you’re looking for excellence is totally ridiculous. It doesn’t work. It gives you an impossible task.”

Munger will speak with CNBC’s Becky Quick following his annual speech.