Most people are feeling pretty good about their finances these days. There is, however, room for improvement.

About one-third of all Americans intend to make a financial resolution for the year ahead, according to a new report by Fidelity Investments.

“There’s a connection between overall financial wellness and happiness,” said Ken Hevert, senior vice president of retirement and income solutions at Fidelity Investments.

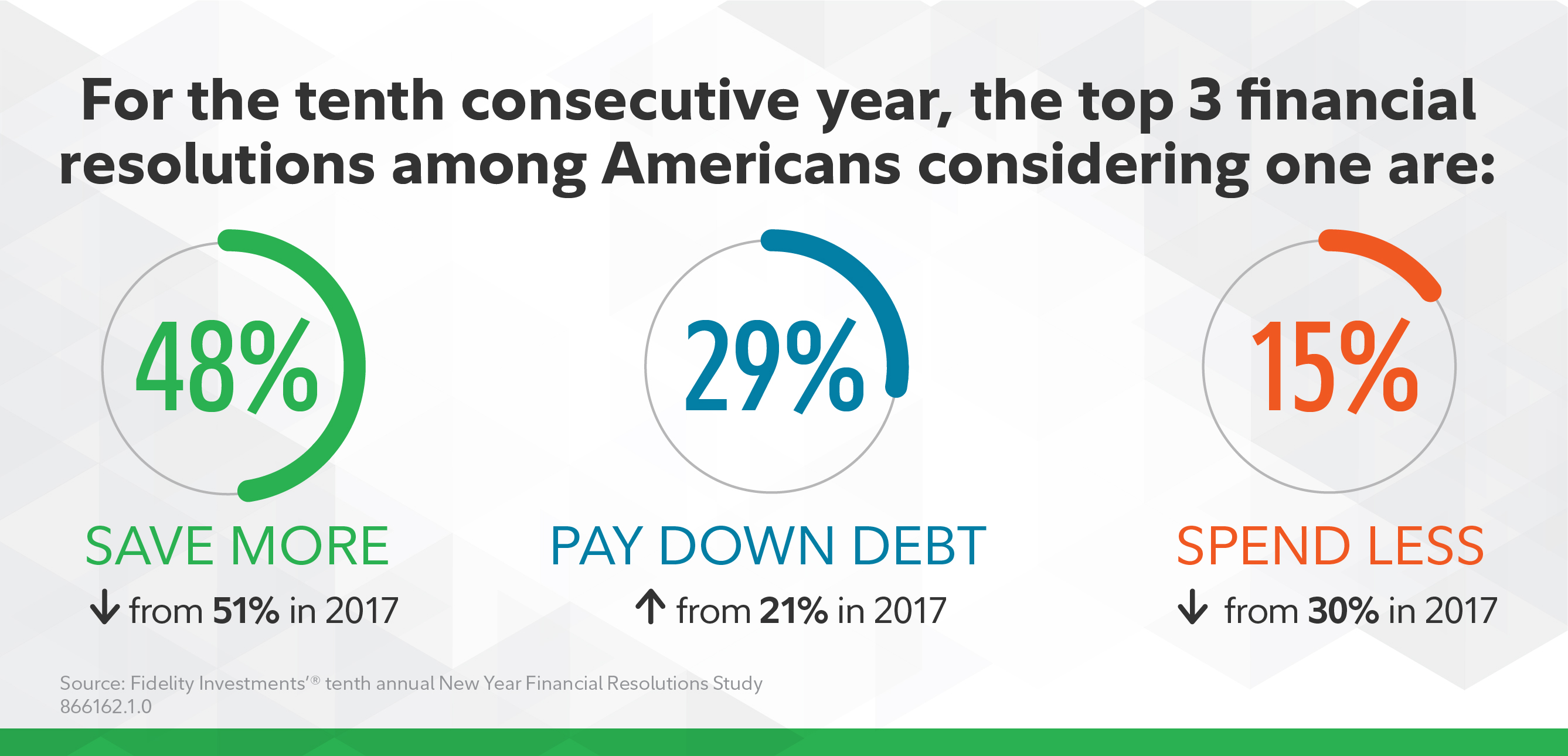

For the 10th year in a row, the most popular money promises include saving more, followed by paying down debt and spending less. Fidelity polled more than 2,000 adults in October.

When it comes to saving more, the majority of respondents aim to sock away an extra $200 a month toward their long-term goals in 2019 such as retirement, college and health care, Fidelity said.

To that end, nearly half said they will boost their contributions to a 401(k) or IRA — helped, in part, by the new, higher limits for 2019.

Of course, unexpected expenses could stand in the way, respondents said. Rising health-care costs, stock market volatility and the economy, as well as higher interest rates, topped the list of financial concerns, Fidelity found.

Nearly 6 in 10 also confessed to making a few mistakes that could derail their progress in the year ahead, such as eating out too often and splurging on something they couldn’t afford.

Despite those setbacks, it is possible to keep your resolutions well into the new year, Hevert said.

“Anytime you want to make a major change, the resolution is simply a way to make explicit your intent. The real key is to make this into a habit.”

Here’s how:

1. Download a budgeting app

When it comes to money matters, most Americans worry about making ends meet, unexpected expenses and health-care costs, according to a separate study by LendingTree, which polled more than 1,000 adults about their resolutions for 2018.

There is no magic formula for being able to make ends meet. You have to live within your means, and to do that you need to budget. Having a budgeting app on your phone makes it easier to accomplish that.

Apps such as Mint or Albert keep tabs on your spending and help find places where some expenses can be cut, such as dining out, recurring subscriptions or streaming services you hardly use. You can even set budgets that alert you when they start to top out.

Pocketguard is a simpler alternative. It tells you how much you have for spending after accounting for bills and savings goal contributions. Then you can see how much money is left “in your pocket” for the day, week or month.

Take the surplus and deposit it into an emergency fund or raise the amount that is taken out of your paycheck for retirement plan contributions. Even a 1 percent to 2 percent increase may not seem like much but can have a significant impact on your savings over time.

2. Look for a better rate on your savings

Rising interest rates can help make the most of the money you’ve set aside.

As the Federal Reserve raised its benchmark rate, yields on savings accounts have increased, as well. While the average interest rate on a savings account is still only 0.2 percent, some top-yielding savings accounts are now as high as 2.25 percent and you can earn even more with CDs, or certificates of deposit.

Switch to a bank that offers at least a 2 percent return, if you haven’t already. With a savings rate, or annual percentage yield, of 0.2 percent, a $10,000 deposit earns just $20 after one year. At 2.25 percent, that same deposit would earn $225.

On the flip side, higher interest rates also mean that it’s more expensive to borrow, so pay down any credit card debt as soon as possible.

The average credit card interest rate is now over 17 percent, according to CreditCards.com’s latest report — near a record high.

Putting purchases on plastic is fine as long as you pay the balance in full and on time every month to avoid racking up such expensive debt.

3. Get ahead of health-care costs

When it comes to medical expenses, this is the time to pay extra attention to what lies ahead.

If you’ve already met your health insurance deductible for 2018, you can save money by scheduling appointments and procedures before the end of the year — rather than waiting until 2019 when you begin a new year and your deductible kicks in again.

Keep in mind, though, your plan may have a maximum number of visits for certain things such as dental cleanings or physical therapy visits.

At the same time, it’s use-it-or-lose-it time for many with flexible spending accounts. Unless your employer offers a grace period or rollover option, the pretax money you have in an FSA must be used by Dec. 31.

You can spend what’s left on contact lens solution, cough medicine, first-aid kits, high-SPF sunscreen or even lip balm. Look to see what qualifies as accepted expenses.

(Health Savings Accounts, or HSAs, work differently than FSAs in that you have an unlimited amount of time to reimburse yourself for eligible medical expenses. Yes, you can still use the money now to cover health-care expenses without depleting your cash on hand, but leaving money in an HSA long-term will enable you to use those funds to cover health-care expenses decades down the road.)