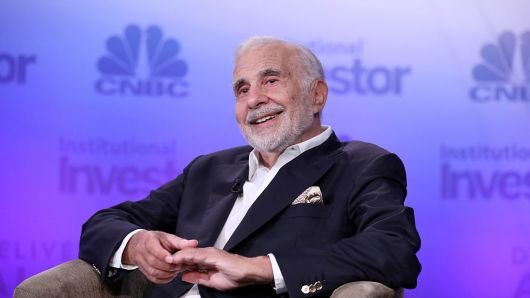

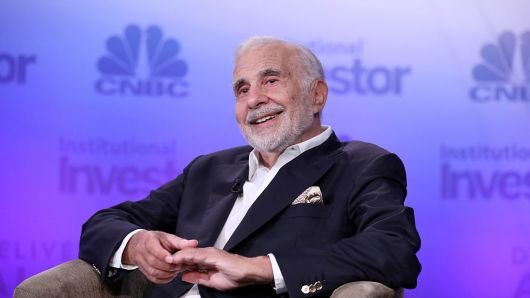

Activist investor Carl Icahn said on Monday that he no longer intended to solicit proxies to vote against the $52 billion Cigna-Express Scripts deal, a turn around from his position last week when he urged the health insurer’s shareholders to vote against it.

Icahn’s comments come after proxy advisory firms Glass Lewis and Co and Institutional Shareholder Services Inc (ISS), as well as hedge fund Glenview Capital Management, extended their support for the deal.

“In light of the ISS and Glass Lewis recommendations in favor of the Cigna/Express Scripts transaction and the significant stockholder overlap between the two companies, we have informed the SEC (U.S. Securities and Exchange Commission) that we no longer intend to solicit proxies to vote against the transaction,” Icahn said in a statement.

Speaking with CNBC about the decision, Icahn took a conciliatory note, saying: “The crossover was too big and given what the advisory firms said we realized there was no way we could win. Sometimes you have to be flexible. There’s no point in fighting just to fight. We won three proxy fights in a row which is really hard to do, so you lose one. It’s the way of life.”

The billionaire investor, who has a long position on Cigna and a short position on Express Scripts, had been vocal in his criticism of the deal and last week said Cigna was overpaying for Express Scripts.

At the time, he urged Cigna’s shareholders to rally against the deal at a vote scheduled for Aug. 24, citing regulatory hurdles and the growing threat from Amazon.

The proposed deal between Cigna and Express Scripts, announced in March, was outlined as a new way for the companies to hold onto profits as the U.S. healthcare industry faces greater scrutiny for rising costs.