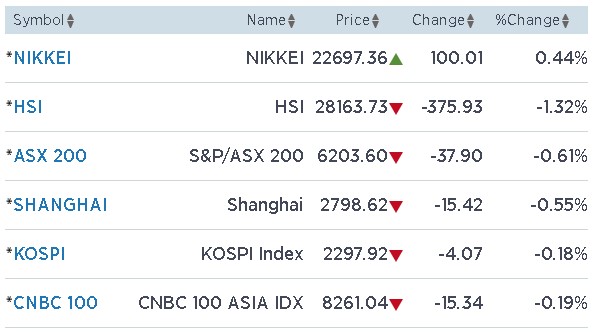

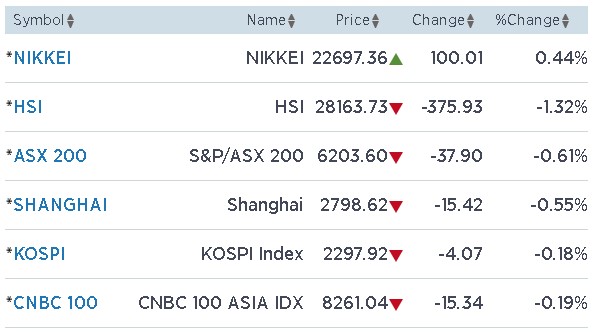

Asian shares closed mostly lower on Tuesday — with Japan the only major market finishing in positive territory — as energy stocks declined amid weakness in oil prices.

Hong Kong’s Hang Seng Index fell 1.23 percent by 3:15 p.m. HK/SIN, with all its sectors in negative territory before the market close. Energy led the declines, with CNOOC dropping 3.23 percent and Petrochina losing 2.97 percent by 3:15 p.m. HK/SIN.

Meanwhile, the Shanghai composite pulled back by 0.55 percent, or 15.42 points, to close at 2,798.62 after earlier falling as much as 39 points. The Shenzhen composite declined 0.17 percent to end at 1,600.08.

The extended slide came a day after the release of China data, which showed economic growth slowed to 6.7 percent in the second quarter, compared to the 6.8 percent seen in the first three months of the year.

Elsewhere, the Kospi closed lower by 0.18 percent at 2,297.92. South Korean auto stocks and retailers rose, but major technology names edged lower. Index bellwether Samsung Electronics finished down 0.43 percent.

Down Under, the S&P/ASX 200 eased 0.61 percent to end at 6,203.60, with the 2.2 percent drop recorded by the energy subindex weighing on the benchmark on the tumble in oil prices. Oil producers traded lower, with Woodside Petroleum declining 2.42 percent and Santos down 2.13 percent by the end of the day.

The lone bright spot among major markets in the region was the Nikkei 225, which edged higher by 0.44 percent, or 100.01 points, to close at 22,697.36 as the yen remained weaker. The index had touched an intraday high of 22,832.22 earlier. Most sectors closed higher, with rail sector rising 2.29 percent and leading the gains. But amid the broader index climbing, miners declined and oil-related stocks fell amid the losses in oil prices.

MSCI’s broad index of shares in Asia Pacific outside of Japan edged down by 0.46 percent in Asia afternoon trade.

“True to form, and in stark contrast to the unusual calm of last year, 2018 has seen a return to more volatile trading conditions in global emerging market equities,” said Nick Payne, Old Mutual Global Investors’ London-based head of emerging markets, in a recent note. Apart from currency woes and oil prices, trade tensions have cast a shadow on the Asian region, he added.

Investors continued to keep a wary eye on recent trade disputes between the U.S. and several of its trading partners, most notably China.

“So far, we have not seen enough in the way of implemented tariffs to derail global economic growth … and that’s why you see earnings estimates continuing to rise for the third quarter and for 2018 overall … However, that could change,” Jeffrey Kleintop, chief global investment strategist at Charles Schwab, told CNBC’s “Squawk Box.”

The International Monetary Fund on Monday warned that there was an increased risk of “worse outcomes” amid recent international trade tensions, although it kept its forecasts for global growth this year the same at 3.9 percent.

Oil extended declines after slumping overnight. U.S. Treasury Secretary Steve Mnuchin said Monday that the U.S. will consider waivers on Iran sanctions for some crude importers. The declines in price also came amid concerns about oversupply in the markets.

U.S. West Texas Intermediate crude futures slipped 0.38 percent to $67.80 per barrel after settling more than 4 percent lower on Monday. Brent crude futures declined 0.42 percent to $71.53 after touching its lowest level since mid-April overnight.

Stocks stateside finished Monday mixed as earnings season shifted into high gear this week, with the financial sector getting a boost on the back of Bank of America reporting expectation-topping earnings and revenue.

On the whole, analysts expect second-quarter earnings to grow 20 percent from one year ago, according to a FactSet poll.

In currencies, the dollar index, which tracks the greenback against a basket of six major currencies, softened to trade at 94.406, compared to levels at the 94.5 handle on Monday. Against the yen, the dollar was steady at 112.33 at 2:55 p.m. HK/SIN.

Those moves came before Federal Reserve Chairman Jerome Powell’s semiannual congressional testimony on Tuesday during U.S. hours.