Stocks turned lower just after midday Tuesday, hurt by a 5% decline in shares of Micron Technology (MU). A China court temporarily banned the sale of Micron chips in China, ruling in favor of United Microelectronics (UMC) in a patent infringement lawsuit.

With less than one hour remaining in Tuesday’s shortened session, the Dow Jones industrial average was down 0.3%. Blue-chip components Johnson & Johnson (JNJ), Coca-Cola (KO) and Merck (MRK) led the way with gains of around 1%. The Nasdaq composite was down 0.6%, and the S&P 500 gave back 0.3%. Small caps were a bright spot as the Russell 2000 rose 0.4%.

Meanwhile, crude oil topped the $75 a barrel level for the first time since late 2014 but quickly turned tail. After hitting an intraday high of $75.27 a barrel, U.S. crude oil futures reversed sharply lower. August crude oil was recently trading around $73.14 a barrel, down 1%.

In stock market results today, volume was heavy in ConocoPhillips (COP) as shares rose 2% to 70.03. It’s working on a flat base with a 71.81 buy point.

Stocks On The Move

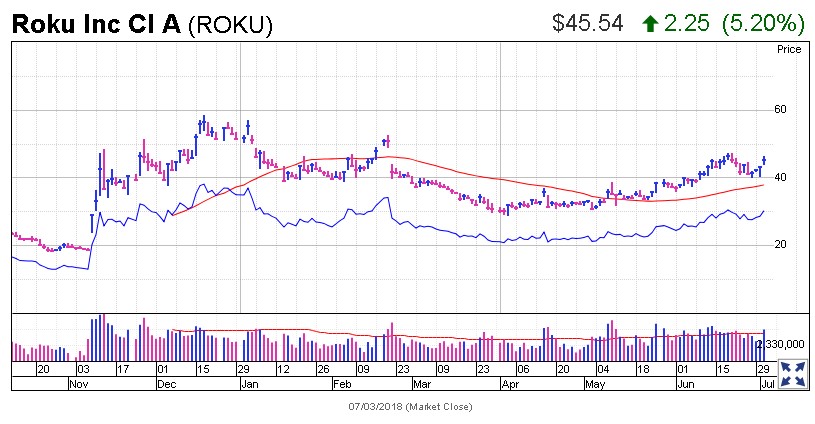

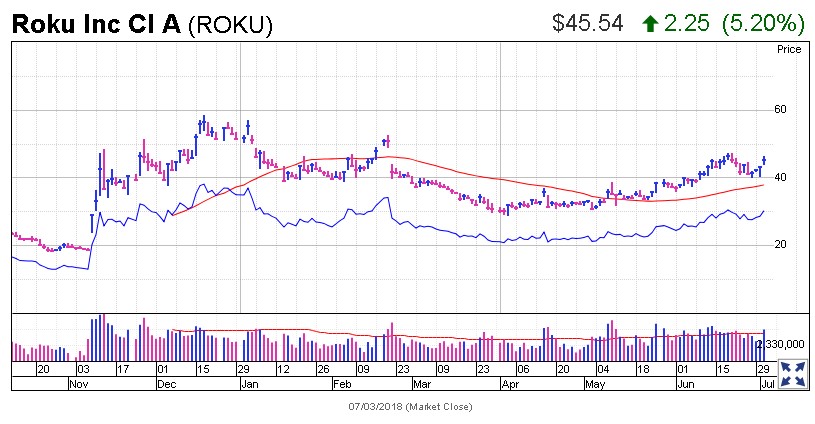

Shares of Roku (ROKU) jumped 7% to 46.50, helped by an Oppenheimer upgrade to outperform. It’s just below a handle entry of 47.74.

Heavy-volume gainers included health care leader Amedisys (AMED). Shares gapped up to a new high, rising 5%, helped by an upgrade from Bank of America to buy from neutral. But Amedisys was well extended in price after a breakout from a base in March.

In the medical software space, MarketSmith Growth 250 name Medidata Solutions (MDSO) looked poised to extend its winning streak to four sessions. Shares rose 0.7%. After a breakout from a cup-with-handle base with a 79.82 buy point, Medidata has formed another handle with an alternate entry of 85.79.

Royal Gold (RGLD) popped out of a lengthy consolidation, rising 3% to 95.66. It bought an interest in Amarillo Gold’s Mara Rosa gold project in Brazil.

Elsewhere, shares of Facebook (FB) were under pressure, down nearly 2%, on news of a widened probe regarding the Cambridge Analytica data scandal. Despite Tuesday’s downdraft, Facebook’s chart still looks OK as it holds above a 188.42 buy point.