Connoisseurs of the Amazon media narrative knew exactly what to expect when the retailer announced its acquisition of online pharmacy PillPack for just under $1 billion: lots of headlines about disruption, combined with breathless reporting about the plunging share prices of Rite-Aid, Walgreens, and CVS. Everything Amazon touches, it seems, gets automatically imbued with industry-shaking potential.

That’s a pity, because it obscures the rather more interesting and down-to-earth reality of the PillPack acquisition. Never mind industrial disruption—Amazon’s PillPack acquisition just makes a bunch of sense on its own merits.

First, and most obviously, it gives Amazon a way to deliver a product—pharmaceuticals—that people spend very large amounts of money on and that lends itself quite naturally to home delivery. It’s not an easy category to break into: There’s much more regulation of pharmacies than there is of bookstores. Buying PillPack, which has laboriously got itself approved in 49 states, solves that problem at a stroke.

PillPack also helps Amazon beef up its recurring subscription revenues, which the stock market loves. Companies like Salesforce and Netflix, which sell the same product to the same customers month after month, receive some of the market’s highest valuations. Amazon itself is no slouch when it comes to such things: Its Amazon Web Services cloud-computing business is enormous. But the company is still in the early innings of trying to get its customers to subscribe to monthly deliveries of physical products, and pharmaceuticals are an obvious place to start, since there’s often little doubt about which quantities are needed when.

Snatching PillPack from the jaws of Walmart has additional strategic value to Amazon, as the rivalry between America’s two largest retailers heats up. Depriving Walmart of PillPack could conceivably be worth more to Amazon than PillPack itself. (Walmart’s market cap fell after the announcement by much more than Amazon paid for the online pharmacy.) Walmart’s own pharmacy business is no slouch, but Amazon can now compete with it head-to-head in a way it never could before.

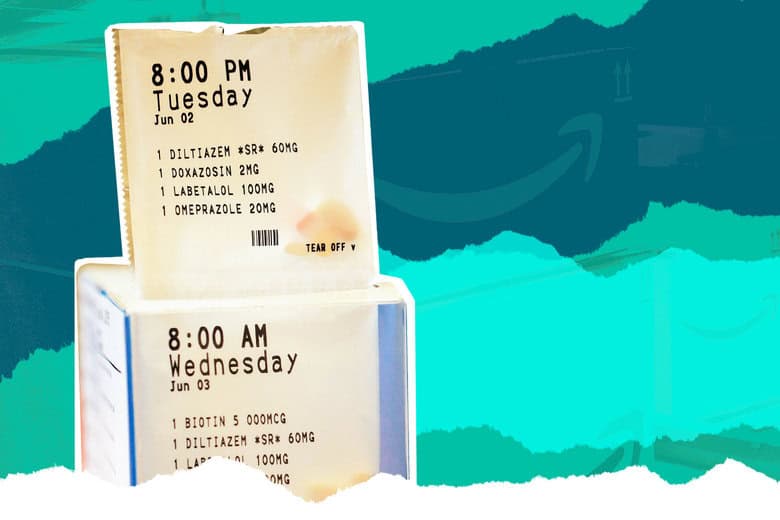

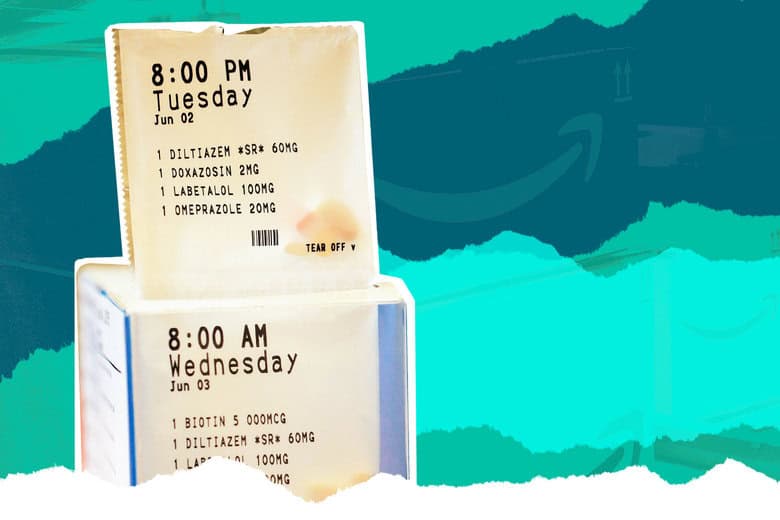

My own favorite lens for viewing this acquisition, however, is just as a recognition of the value of good design. PillPack’s chief designer, Colin Raney, used to run the Boston office of legendary design shop IDEO, and the PillPack itself is a design masterpiece, with its own place in the Cooper-Hewitt design museum. It looks good, but that’s just the beginning: It also helps to solve problems that have bedeviled the medical profession for decades, such as the fact that some 50 percent of Americans with chronic diseases don’t take their medications as prescribed.

Emily Dreyfuss had a great story about PillPack’s design in Wired last year that is well worth reading, but the short version is that because the company can put pills into individual packages, rather than being forced to put them into pill bottles, it’s able to offer a much easier and more intuitive system than anything that has to be cobbled together at a patient’s home. Pills come in a simple chronological roll of tear-off packets, with the earliest packets on the outside of the roll; there’s basically no way to load that roll into the dispenser incorrectly.

Is that design breakthrough worth a billion dollars? Perhaps it is, especially in the hands of a home-delivery powerhouse like Amazon. PillPack might never have earned that much money as a self-standing company. But its design and potential made the company extremely valuable indeed. Let’s hope that venture capitalists learn the lesson, which is that simple, non-internet-connected objects can be worth just as much as anything with a Wi-Fi chip. Or, to put it another way: Your hardware doesn’t need to spy on your customers in order for you to be a unicorn.