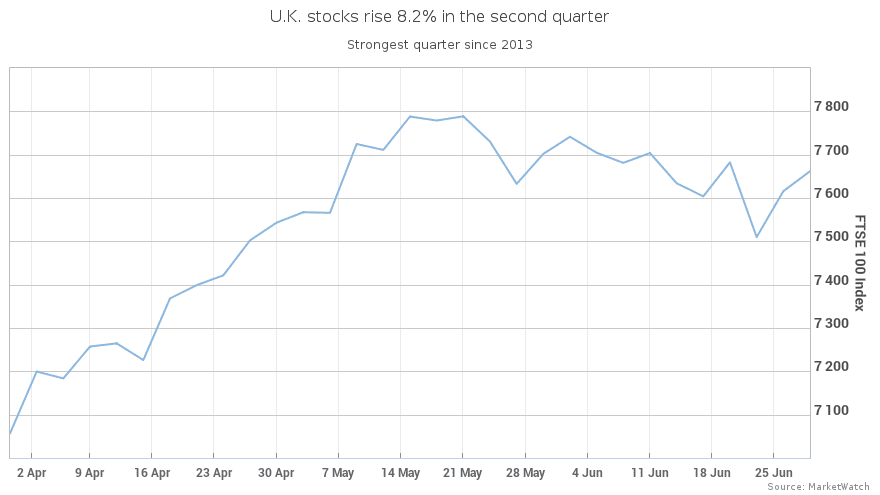

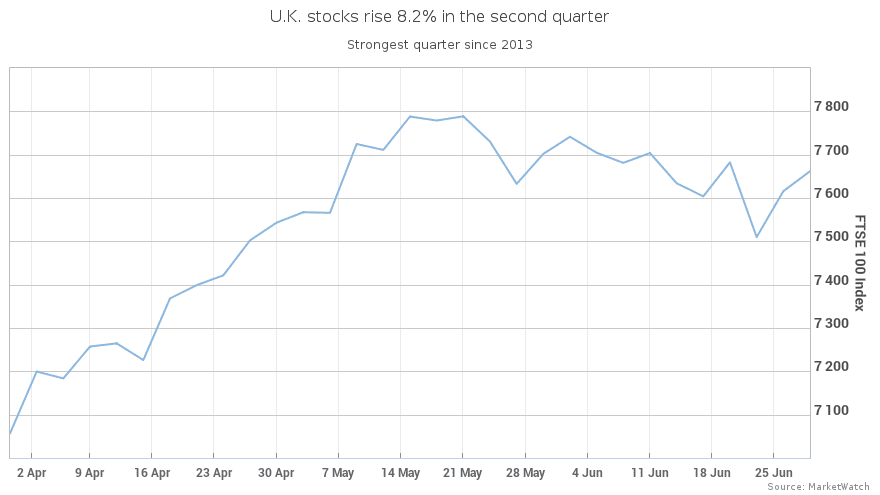

U.K. stocks climbed on Friday, with the benchmark index scoring its best quarter in more than five years, as European political risks receded for now and China took a step toward easing trade tensions with the U.S.

The pound climbed after data showed U.K. economic growth in the first quarter was stronger than initially expected.

What are markets doing?

The FTSE 100 index UKX, +0.28% gained 0.3% to close at 7,636.93, trimming its weekly loss to 0.6%.

For the second quarter, which came to an end after the closing bell on Friday, the London benchmark scored an 8.2% rally. That marks its biggest quarterly advance since the first quarter of 2013, when it jumped 8.7%.

For the full first half of 2018, the FTSE ended down 0.7%.

The pound GBPUSD, +0.9711% jumped to $1.3201 from $1.3078 late Thursday in New York. For the quarter, sterling is on track for a 5.9% slide, its biggest quarterly drop since the third quarter of June 2016—the period that included the U.K.’s Brexit referendum.

What is driving the market?

Stocks in the U.K. tracked a wider rally across Europe that came after European Union leaders knocked out an agreement on refugees following an all-night meeting in Brussels. The deal is seen as removing political risk that had been hanging over equities and raised confidence for the continued leadership of German Chancellor Angela Merkel.

Merkel has been under pressure from the key partner in her coalition government to come back from Brussels with a plan to stem the migration that some lawmakers consider too great a strain on Germany. Analysts feared a failure to reach an agreement would bring Merkel’s fragile coalition under so much pressure that new elections would be needed in Germany and spark a fresh wave of political uncertainty in Europe.

Global stocks were also supported by news late Thursday that China is easing restrictions on some foreign investments. While the move is only a small step in resolving a whole host of trade disputes with the U.S., the announcement is still seen as easing concerns over a trade war, analysts said.

Stocks in Asia closed mostly higher, with the Shanghai Composite Index SHCOMP, +2.17% ending 2.2% higher and the Hong Kong Hang Seng Index HSI, +1.61% rising 1.6%.

U.K. data

The pound extended its gain in midmorning trade after a revised estimate of U.K. first-quarter economic growth showed the economy expanded by 0.2%, up from 0.1% recorded previously.

What are strategists saying?

“Bearish sentiment and price action seems to have exhausted itself for the time being, and the buying this afternoon looks solid across the sectors and geographies. Many stocks have been knocked back to attractive near-term levels, giving investors the chance to step in once more rather than chasing returns at the elevated levels of a few weeks ago,” said Chris Beauchamp, chief market analyst at IG, in a note.

“This is still a bull market, and this kind of dip-buying is not just an ingrained habit of the past years—it makes sense given the still-strong global outlook,” he added.

Stock movers

Shares of BAE Systems PLC BA., +2.34% rose 2.3%, adding to a 1.3% gain from Thursday when the stock was boosted by a $26 billion deal in Australia.

Mining shares were also rising after China’s moves on foreign investments. Shares of Anglo American PLC AAL, +3.59% rose 3.6% and BHP Billiton PLC BLT, +1.07% BHP, -0.02% BHP, +0.27% added 1.1%.

Shares of Diageo PLC DGE, -0.51% DEO, +0.01% dropped 0.5% after Bernstein cut the spirits maker to market perform from outperform, according to Dow Jones Newswires.