Being “broke” can mean different things to you depending upon the stage of life you’re in. A college kid who views themselves as broke may have no money, but still have access to food and a roof over their head. To an adult, broke may mean that the cash available to them won’t cover their core bills, or will do so with no cushion.

Regardless of your exact definition, being broke is something the vast majority of Americans say they’ve experienced, according to a new survey of 1,050 adults conducted by CreditLoan.com. In the study, 86% of respondents said they’d been broke at some time in the past — or consider themselves broke right now.

That sobering number shows that money problems are nearly universal. On the positive side, if you’re in the subset of the 86% who are running on fiscal fumes today, that figure shows you’re not alone — and it suggests there’s hope.

The many routes to broke

Based on the study, most people don’t require someone to have literally no money to their name to be viewed as broke.

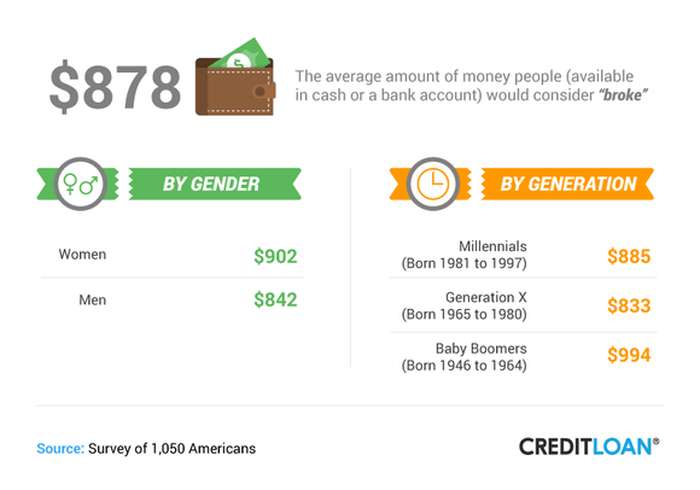

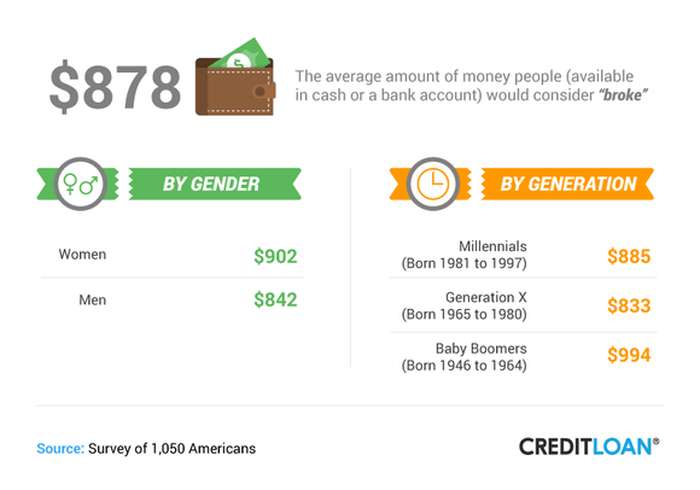

“Our survey revealed, on average, people considered having $878 available to them in cash or a bank account to be ‘broke,'” wrote CreditLoan.com Founder Daniel Wesley in a blog post on the survey. “Close to $900 in the bank might seem far from destitute, but considering it’s 71.3% of the average national rent, that little nest egg can evaporate quickly, especially if you’re living on your own.”

It’s important to note that neither gender nor age made much of a difference in the answers that survey respondents gave. The reasons why people wound up broke, however, varied by age.

The top three reasons millennials (born 1981-1997) gave were “spent my money on food” (28%), “spent money on unnecessary items” (25%), and “quit my job” (17%). Generation Xers (born 1965 to 1980) had the same two top answers, albeit at 21% and 19% respectively, but followed those with “spent my money helping someone else” (15%) and “had to wait on significant other or roommate to get paid” (14%).

Baby boomers (born 1946 to 1964) had spending money on others as their top answer at 21%. That was followed by “spent money on unnecessary items (13%), with “spent my money on food” and “fired from my job” in a tie for third place at 11%.

Being broke is something most people have experienced. Image source: Getty Images.

Do you know where your money is going?

The best first step anyone can take to stay away from the financial edge is to make a budget. It’s hard to avoid overspending if you don’t know how much you have, or where your money is going. Once you have a handle on your income versus your expenses, consider where you can trim that later category so you can start setting more aside. Task No. 1 in that vein is building up an emergency fund sufficient to cover at least six months of your household expenses — assuming you don’t have one already.

Saving that much cash likely won’t happen quickly, and may require you to make more changes to your life than simply spending less. You might need to start volunteering for more overtime (if you can), take on another job, or develop a side hustle. But it’s hard to beat the peace of mind provided by having a robust cushion between you and being broke.