All that glitters is apparently not gold.

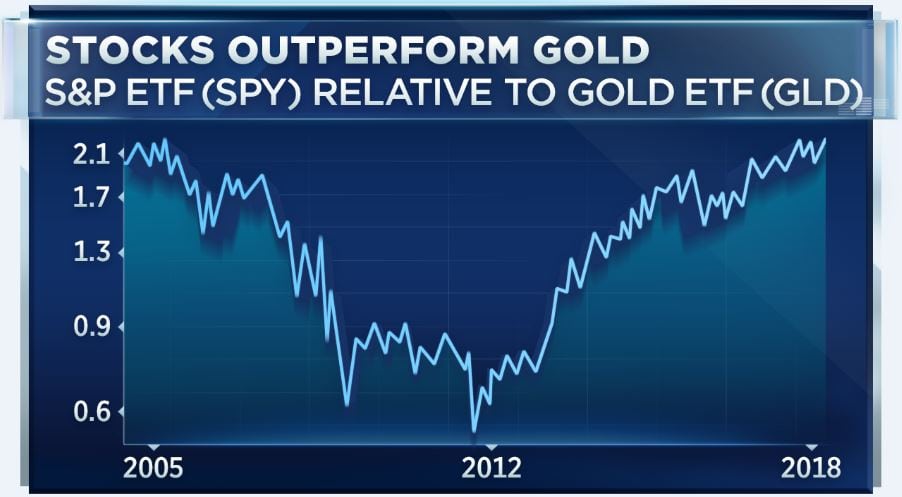

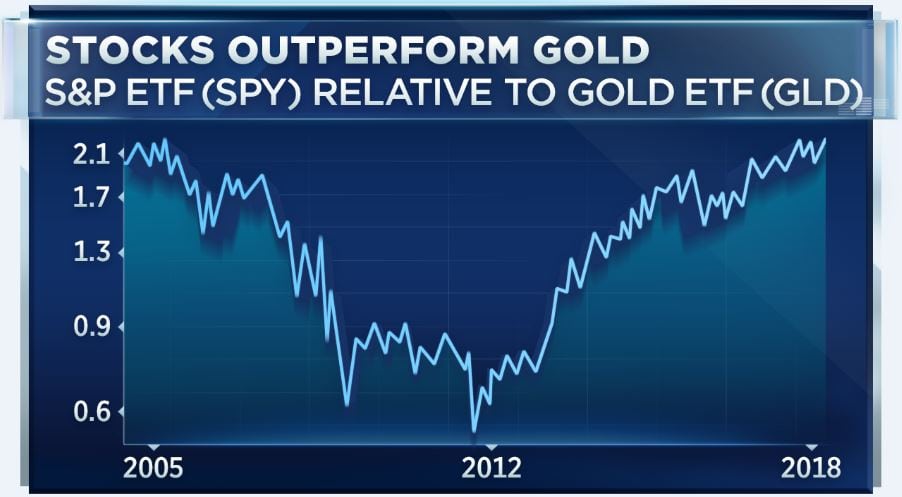

By one measure, gold is trailing stocks by its widest margin in 13 years, and some market watchers expect the trend to continue. The ratio of the S&P 500 to gold has touched its highest level since mid-2005, according to an analysis of the popular S&P 500-tracking ETF (SPY) and a gold-tracking ETF (GLD) from Pension Partners. In other words, stocks are outperforming gold by a wide margin.

While the GLD has fallen about 0.6 percent this year, the SPY has risen 4.5 percent in the same time period.

Gold bugs point to the rally in the dollar as the chief culprit for the precious metal’s woes, but there are other factors weighing on gold, too.

“Let me put this in a big-picture context; the direction for gold is ultimately down,” Gina Sanchez, CEO of Chantico Global, said Tuesday on “Trading Nation.”

“Ultimately, we see interest rates higher. Ultimately, we see the dollar stronger. And ultimately, volatility should be more or less contained. It’s that last one that has been giving us some opportunities in gold,” Sanchez said, adding that gold may in fact look like a trade here, rather than a longer-term investment.

Others are similarly pessimistic on gold’s long-term direction.

“Gold has been a tough one. The reason is that it’s held its own over the last few years, the problem is that we’ve been at these points before. Each time, we’ve failed. I think there’s no real rush to buy gold, because think about how many other asset classes have been doing well, outperforming, even making new highs,” Frank Cappelleri, head market technician at Instinet, told “Trading Nation” on Tuesday while examining a chart of the GLD.

As an alternative to gold, he’d suggest investors consider taking a look at the broader metals and mining space.

Gold prices turned higher Wednesday after the Federal Reserve hiked interest rates.