While some investment professionals believe that the bull market in U.S. stocks is about to run its course, and that investors should look abroad for the best potential gains in equities, Rebecca Patterson, the chief investment officer (CIO) at Bessemer Trust, disagrees. “We’ve found over the last few decades, when you have market panic, even if the U.S. causes the panic, the U.S. tends to outperform,” as she told CNBC. “Some of that is Americans bringing money home in times of stress,” she continued, while noting that “capital repatriation lifts the dollar.”

Large-scale repatriation of cash held abroad already is underway as the result of tax reform, and a rising dollar means diminished returns from foreign securities held by U.S. investors. Besides purely defensive reasons for going overweight in U.S. stocks, Patterson sees “a tidal wave of stimulus that is not fully priced” by the market. In addition to tax reform, she cited the spending package passed by Congress in February as another factor that should spur further U.S. economic growth.

Upbeat Jobs Report

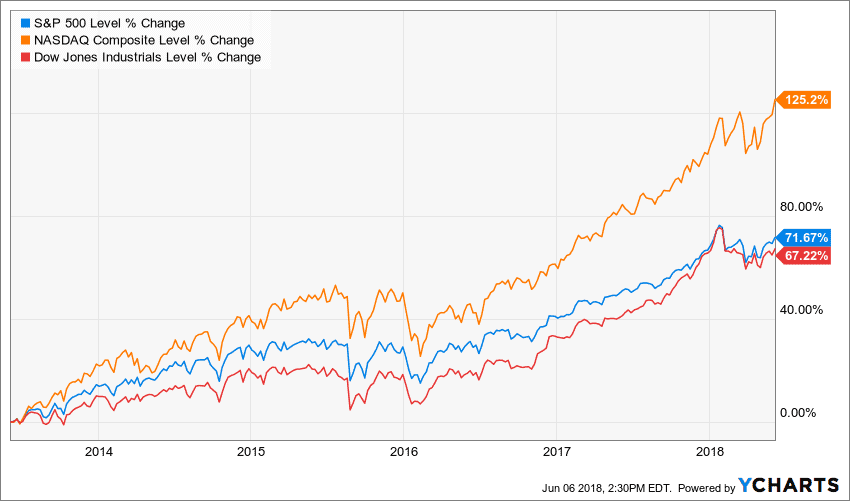

Spurred mainly by robust jobs growth in May, the S&P 500 Index (SPX) posted a 1.1% gain on Friday, June 1. Total nonfarm payroll employment grew by 223,000 in the month, and the unemployment rate fell to 3.8%, per the U.S. Bureau of Labor Statistics. The index has tacked on an additional 1.4% gain from the close on June 1 through the close on June 6.

Nonetheless, the S&P 500 remains 3.5% below its record high close on Jan. 26. But several foreign stock indices are much further below their 2018 highs: Italy’s FTSE MIB Index is down 8.6%, Brazil’s Bovespa Index is down by 13.3%, while Japan’s Nikkei 225 is down by 5.1%, per Yahoo Finance.

Picks and Pans

Patterson’s views of select stock markets, as discussed with CNBC on May 30, are summarized below:

She’s bullish on China because, as she describes it, the government sees its own stability as linked closely with economic growth, and thus is highly supportive of industry. Her concern with Italy is “If you get a populist government, it would be very hard for the ECB, the central bank, to continue buying Italian bonds as part of its quantitative easing program.” This leads her to be cautious in general about European stocks, CNBC adds. (For more, see also: Italy ETF Thrives After Controversial Election.)

‘Still Money to Be Made’

While Nobel Laureate in Economics Robert Shiller has been warning of high U.S. stock market valuations by historic standards, based on his CAPE ratio, he nonetheless recognizes that investor optimism, spurred by President Trump’s strong pro-business stance, may give the bull market yet more room to run, according to another CNBC report. Unlike Patterson, however, he believes that investors who are “overexposed to the United States” would be wise “Not to pull out, but to balance things…Europe is cheaper than the U.S.” He also was optimistic, as of his May 29 interview, that Italy would avert a crisis.

Meanwhile, economist Ed Yardeni, president of Yardeni Research, believes that “There is still money to be made in this market,” per a third CNBC report. His main reason is that “Earnings are just fabulous.”

The Bearish View

“If a bear market is to unfold, this will probably start outside of the U.S.,” according to Charles Gave, founder of Hong Kong-based asset management consulting firm Gavekal Research, Bloomberg reports. Europe is the most likely source, in his opinion, because the euro “has now been destroying southern European economies for 20 years and local populations are increasingly unwilling to take the beating.”

Joe Zidle, an investment strategist at The Blackstone Group, is concerned about rising inflation, partly driven by higher energy prices, and reflected in wage increases, both of which will crimp profit growth, according to a fourth CNBC story. “As we get into 2019, this earnings cycle is going to run its course,” he said, adding, “When you’ve got slower earnings growth and higher interest rates, that’s going to knock down equity valuations.”