Now is the time to buy into top-notch tech stocks with robust fundamentals and big growth potential.

Multiple factors are weighing on the sector, ranging from Chinese trade tensions to disappointing iPhone X demand. But when prices are low, interesting entry points develop.

With this in mind, we used TipRanks’ stock screener to pinpoint the most compelling tech stocks right now. These are stocks with support from top analysts – i.e. analysts with the strongest track record of rating success, as well as big upside potential.

Alphabet

Google-parent Alphabet is trading at a highly attractive price following yet another round of stellar earnings results. We are now looking at a jaw-dropping 33 consecutive quarters of 23% year-over-year growth. For the first quarter, Action Alerts PLUS holding Alphabet reported gross revenue of $31.1 billion, easily smashing the $30.63 billion consensus estimate. Core Google drove the upside, with notable strength in Mobile Search, YouTube and Programmatic.

“Growth remains robust and extraordinarily consistent,” commented five-star RBC Capital analyst Mark Mahaney. Despite shares dropping on rising costs (operating profit margins dropped 5% year-over-year), Mahaney isn’t feeling too concerned. “Per GOOGL, what they are seeing in terms of business demand/opportunity gives them confidence to invest aggressively,” he explains.

The best part is the sustainability of this growth, which is why Alphabet is such a compelling investing proposition despite the $1,000 + price tag. Even though Alphabet is a leading player in the ad space, it still only accounts for about 10% of global ad spend. At the same time, the company’s investments in Cloud, Internet-connected Homes, and Autonomous Vehicles could potentially translate into many more years of premium growth and profits.

“We believe Google defines sustainability, in very large part because its value proposition is so compelling – free Search, free YouTube, free Gmail, free Google Maps, etc…,” concludes Mahaney. His take on the stock reflects the bullish outlook of the Street in general. Our data shows that in the last three months, 26 analysts have published buy ratings on Alphabet. During this time, only three analysts have stayed sidelined. Meanwhile, the average analyst price target of $1,275 indicates considerable upside potential of 23%.

Activision Blizzard

This interactive entertainment giant is the name behind classics like Call of Duty, Candy Crush and World of Warcraft. The stock’s highest price target of $87 (35% upside potential) comes from five-star Oppenheimer analyst Andrew Uerkwitz. He sees this ‘strong buy’ stock outperforming peers with revenue growth of 7% in 2019.

“Activision Blizzard’s strong brand and well-recognized game franchises should allow the company to foster deeper engagement with players and reduce its earnings volatility between product cycles,” writes Uerkwitz, before adding that “Also, we believe there is significant upside from its emerging e-sports, media content and advertising initiatives.”

Overall the stock has a stellar rating from the Street right now. In the last three months, there are nine buy ratings vs. just one hold rating. And with an average analyst price target of $80.56, upside potential stands at an impressive 24% from current levels.

Autodesk

Top Oppenheimer analyst Koji Ikeda calls Autodesk his ‘top large-cap stock pick.’ And for good reason. This 3D design company operates as an industry-standard, must-have technology in nearly every industry it operates in. Luckily enough this covers multiple industries from architects and animators, to constructors and engineers.

Following a recent round of construction industry checks, Ikeda is now more bullish on the name. Indeed, his deep dive into the industry “lend support to our long-term thesis that the business is one of the best-positioned software vendors for future share gains of construction industry technology spend.” He noted rising construction industry spending trends, business activity and pipeline momentum were good during the quarter.

In total, 14 analysts have published buy ratings on the stock in the last three months. No hold or sell ratings here. Their confident average price target of $153 means that investors are facing big upside potential of 21% from the current share price.

Zayo Group Holdings

With eight back-to-back buy ratings in the last three months, Zayo Group is firmly bidding goodbye to a challenging 2017. The company- the largest provider of dark fiber in the U.S.- is working to improve margins with a renewed focus on costs, successful realization of synergies and better pricing. Zayo has a key advantage as its dense infrastructure is difficult to replicate without significant expenditure and time.

As a result, analysts see the stock spiking (on average) by over 16% to $42. Most interestingly, both Raymond James and Deutsche Bank have upgraded their Zayo ratings from hold to buy within the last two weeks. So what has prompted their shift in sentiment on this communications infrastructure stock?

Raymond James’ Frank Louthan is anticipating consistent revenue acceleration in the second half of 2018, further boosted by larger infrastructure deals. And longer term, Zayo’s plan to convert to a REIT provides an extra catalyst for shares, adds Louthan. The company is due to elect to convert to REIT status on January 1, 2019, and this could ‘add 2x turns to its valuation,’ cheers five-star Oppenheimer analyst Timothy Horan.

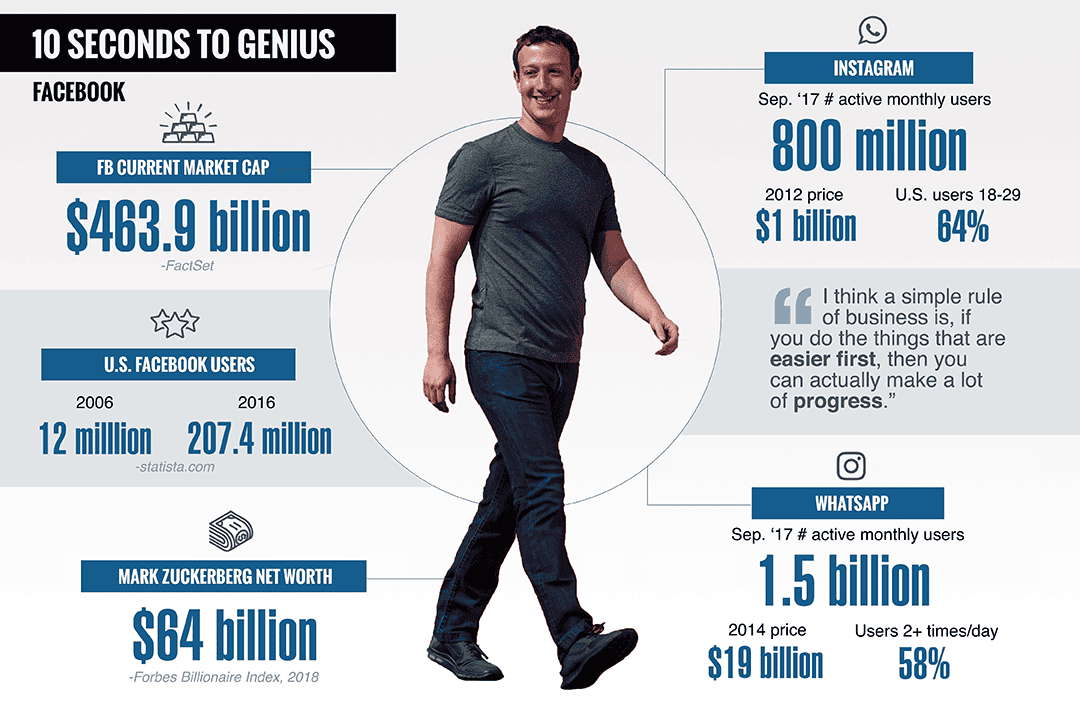

Facebook is back! Shares of Action Alerts PLUS holding Facebook responded well to first quarter earnings, a bullish sign. However even at these elevated levels, the stock still looks highly attractive according to the Street. Bear in mind that earlier this year, Facebook was trading at above $190. Indeed, analysts see prices returning to these levels and above. The average analyst price target works out to $219, with the highest price target coming in at $275 (from Wedbush).

Facebook reported profit of $1.69 a share on revenue of $11.97 billion for the quarter, crushing Wall Street estimates of $1.35 and $11.41 billion, respectively. The company also added 49 million daily users, taking the total number of daily users to a mind-blowing 1.45 billion people. Plus, the company now boasts an astounding $44 billion hoard of cash and equivalents.

“We would characterize 1Q results as a relief and is a sign that so far the damage from Cambridge appears contained although this will be a long 3-6 months ahead to steer through this storm. In a nutshell, overall this should be another step in the right direction for Facebook after a month of navigating these unprecedented data concerns,” writes GBH analyst Daniel Ives. He calls the results ‘a key initial victory’ for Facebook, especially after the maligned news-feed overhaul a few months ago.