You want to be an energy saver and are interested in going green as much as possible through new energy efficient appliances, home modifications, and perhaps even building a brand new energy-efficient home. Every level of the U.S. government also wants you to be an energy saver, and is willing to back it up with programs and tax incentives that encourage energy-saving efforts.

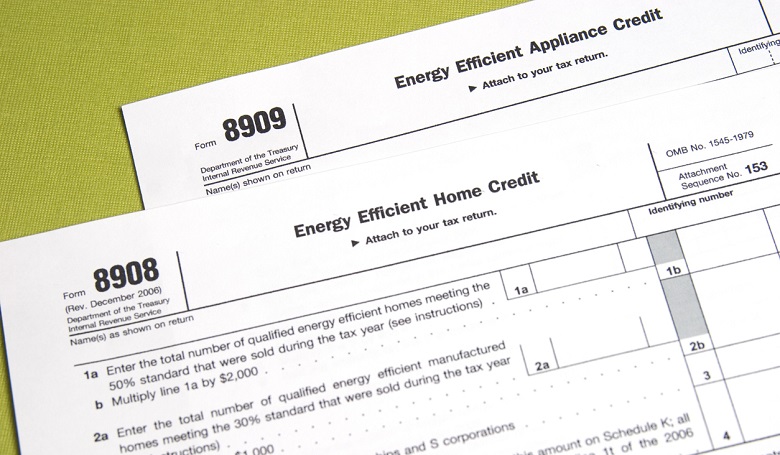

Tax Incentive for Energy Efficiency

These tax incentives are not just for individuals. Businesses can also reap tax benefits while helping to save the environment. Applied over a large scale, these credits can save thousands of dollars and make a real difference to your business’s bottom line.

How do you find these tax-saving programs? The Internal Revenue Service has information for federal tax incentives, such as those in the American Recovery and Reinvestment Act. Also, several clearinghouse websites can help you find the programs that are most relevant to your needs.

Energy.gov has a handy search menu that allows you to filter through current programs using eligibility criteria (residential, commercial, agricultural, etc.) or by more narrow savings categories such as heat pumps, lighting systems, and air conditioners. A further filter allows you to narrow your search by state or keyword.

For more details, click on any of the programs meeting your search criteria. The site will connect you to a detailed summary of the program, its history and amendments/changes, eligibility and availability requirements, and links to supplementary information.

The Database of State Incentives for Renewables and Efficiency (DSIRE) contains a state map with links showing all of the available programs in any selected state. Applicable federal tax incentives are included in every state’s list. Such incentives include the Residential Energy Efficiency Tax Credit , which has been reinstated through 2019 and then phased out through 2021 by the recent Congressional budget deal.

As with Energy.gov, you can narrow down the possibilities using filters such as technology, program type, and categories. Clicking on any individual program name leads to a comprehensive project summary.

The Energy Star website has a rebate finder that allows you to locate rebates for energy-efficient appliances and heating/cooling systems by zip code. However, that is only a small part of what the site offers.

Energystar.gov also contains a product finder for products that meet Energy Star standards, ideas for building energy-saving homes and making existing ones more energy efficient, and a separate section to help businesses integrate energy savings into their facilities. The business section contains educational materials to help sell both management and employees on energy-efficient products and practices.

Do not forget to consult your local government (county, city, or planning entities) for other programs that target local green efforts. Ask for advice whenever you shop around for contractors, as they often have knowledge of local programs that may apply to your situation and how to handle the corresponding paperwork.

It is important to read the details on any published tax incentive to verify that the information is still valid, especially for federal programs. Energy efficiency tax initiatives are constantly changing and often allowed to expire, and then get retroactively reinstated by Congress, as in the budget deal that President Trump signed recently. The budget, which was agreed upon less than two months after the Tax Cuts and Jobs Act (TCJA) became law, revives many breaks through tax year 2017, so you may apply them to the tax return you file now.

Who knows what the status of those tax cuts will be next year, so this tax season may be the last year you can claim them. Check the DSIRE and Energy.gov websites and with the IRS to see if any credits are available to you.

Thanks to these government tax incentives, you can now go green while getting some green. If you are considering new appliances or home improvement projects, please look over your options for tax incentive programs. It is a win-win situation for both you and the environment.