The stock market has gone from record-low volatility and a steady march upwards to turmoil and full-on correction territory in less than a week. What’s an investor to do? As a starting point, don’t get too caught up in trying to time the market, since it’s nearly impossible to accurately predict when the market will move one way or the other.

But in-the-know investors realize one important thing: Over time, the market will almost certainly go up more than it will go down, and it will go up much more often. That puts the odds of success in your favor if you simply buy great companies and hold them, as time is on your side.

In-the-know investors also know that growth stocks can be more volatile, but can also deliver the best long-term gains. With that in mind, we asked three Motley Fool investors which growth stocks they like, and they identified vehicle-automation technology leader Aptive PLC (NYSE: APTV), Google parent-company Alphabet Inc (NASDAQ: GOOG)(NASDAQ: GOOGL), and electronic-payments giant Mastercard Inc (NYSE: MA).

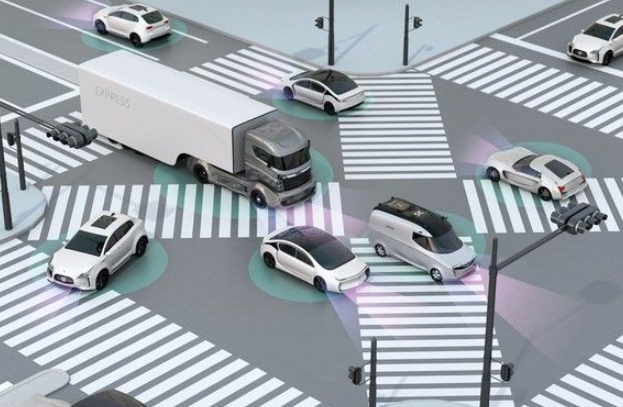

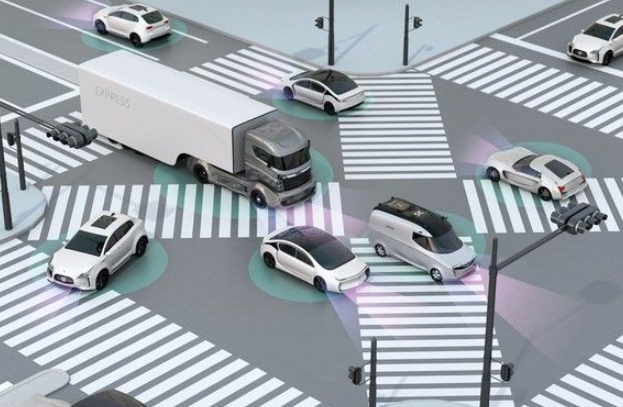

The driverless future is now

Daniel Miller (Aptiv): Most investors have heard that driverless cars are the future and are already in development, but only in-the-know investors are aware that Aptiv is one of the most direct ways to invest in a driverless growth stock. For those unaware, Aptiv is a global-technology company with one vision: Usher in the next generation of vehicle-safety products and autonomous vehicles and connect them all through smart cities. This is an ambitious and lucrative vision.

Management has put the company on a solid path that’s winning today, as well as building a foundation for the future. Currently, Aptiv’s 2017 bookings for active safety — which represent lifetime gross-program revenues awarded — grew 66% and represent $3.7 billion. Its infotainment and user-experience bookings were up 15%, to $1.5 billion, and its high-voltage electrification segment was up 54%, to $1.4 billion. The increased bookings suggest that business is booming in the near term.

As great as the increased bookings are for investors eyeballing the near term, Aptiv’s move to spin off its powertrain business to focus on higher-margin products revolving around driverless vehicles is a strong long-term strategy. The move to focus on driverless-vehicle technology was bolstered with Aptiv’s acquisition of Movimento and Nutonomy, which will bring in some top engineering talent and further the company’s role in developing leading driverless-vehicle technology.

Going forward, Aptiv looks to be a key way for investors to tap into driverless car growth as the company will be involved in developing software, sensing and computing, signal and power distribution and connectivity — pretty much everything that’s going to make the driverless car a reality.

The king of search (and so much more)

Steve Symington (Alphabet): When Alphabet announced fourth-quarter 2017 results late last week, shares of the parent company of Google plunged 5% in response — so you’d be forgiven for thinking its performance was subpar. But you’d be wrong.

Keeping in mind that Alphabet doesn’t provide specific quarterly financial guidance, quarterly revenue climbed a better-than-expected 24% year over year, to $32.32 billion. But Alphabet’s adjusted net income of roughly $6.84 billion, or $9.70 per share, fell just short of the average prediction on Wall Street for $9.98 per share.

Sure, Alphabet conceded that the costs of running its core businesses at Google have climbed, thanks to a combination of data-center investments, fostering its “Made by Google” hardware products, and content acquisition at YouTube. But as management reminded listeners during the subsequent conference call, those investments are being made with a long-term mind-set in the interest of driving a “second wave of growth.”

This will occur through Google’s Cloud business (which is now generating $1 billion in sales per quarter), its hardware products (which sold tens of millions of units over the holidays), and YouTube (which now boasts over 1.5 billion monthly active users). And that’s not to mention the promise of Alphabet’s “Other Bets” segment, which is comprised of early stage businesses like Google Fiber (high-speed internet), Verily (life sciences), Nest (connected home), and Waymo (self-driving vehicles).

If you’re willing to watch Alphabet continue to play the long game, I think the pullback is a perfect opportunity to open or add to a position.

The future of money is now, too

Jason Hall (Mastercard Inc): It may seem like plastic has completely replaced cash, especially if you stand in a checkout line just about anywhere these days. But it may be surprising to know that a substantial portion of global transactions are still cash-based. And in-the-know investors understand that this is a multibillion-dollar opportunity that’s set for many years of growth to come.

It’s especially true with the global middle class — especially those people who live in urban areas — set to grow by 1 billion people within two decades. Factor in the increased globalization of the economy, and payment processors that span global borders will be increasingly important.

One of the oldest and most-established companies in electronic payments — Mastercard — is already winning in the switch to cashless transactions. Revenue increased 20% in the fourth quarter, an acceleration of the 16% growth for the full year. Earnings (adjusted due to one-time charges related to the Tax Act) were up a very strong 21% for the full year and an incredible 33% in the fourth quarter.

It gets even better: The recent stock market correction has also given investors a slightly better entry point, with Mastercard shares down over 8% from its peak. That’s not to say it won’t fall even further in the short term: If the market keeps falling, Mastercard will almost certainly drop, too. If it falls even further, investors will have a chance to buy more of this amazing company at an even better price.