Outside of megacap Taiwan Semiconductor Manufacturing Co., Taiwan’s equity universe looks increasingly unappealing to Howard Wang.

Wang, who oversees JPMorgan Asset Management’s Greater China fund, has cut its Taiwan holdings to 18 percent of the total from 25 percent two years ago, even as the island’s shares rallied. Almost half of that allocation is TSMC, which makes chips for companies such as Apple Inc.

“We’ve gotten to the stage where other than TSMC, Taiwan has really hit a plateau,” Hong Kong-based Wang said in an interview. “You have a very export-driven economy whose currency just appreciated 7 percent this year against the dollar — that’s not very helpful. You also have an aging workforce and I think something that can’t be quantified is corporate fatigue in Taiwan. I see too many Chinese companies gaining market share from Taiwanese competitors.”

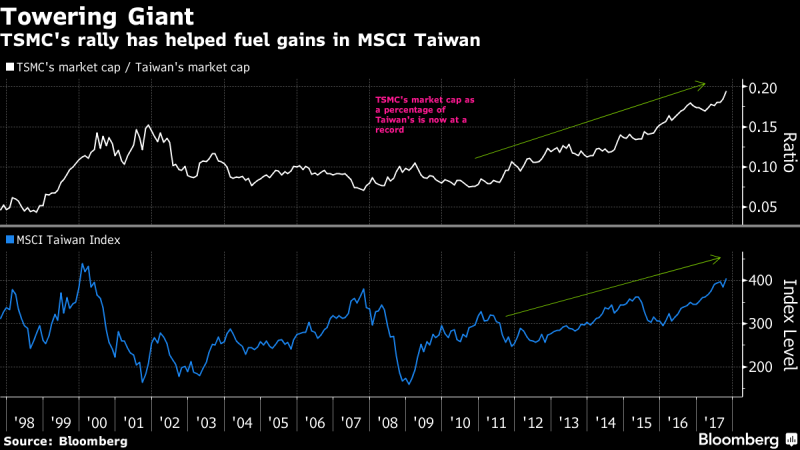

With a market capitalization of $205 billion, TSMC is one of the world’s largest companies. It alone accounts for more than half of the MSCI Taiwan Index’s 45 percent advance since January 2016. The shares trade near a record high, even as concern over demand for Apple’s products weighs on other suppliers. Foreign investors own 80 percent of the stock.

While jitters over Apple sales spurred net outflows of $2.2 billion from Taiwan equities last quarter, the island’s shares remain a favorite destination for international funds. For the year, inflows stand at $8.4 billion, the most among 10 Asian markets tracked by Bloomberg. A tax benefit means Taiwanese shares also tend to pay higher dividends — another draw for investors.

There are still areas where Taiwan can win, said Wang, the former head of Goldman Sachs Group Inc.’s Taiwan office. JPMorgan Asset’s Taiwan fund favors stocks in export niches such as high-end auto parts, textiles and precision components, he said.

“Taiwan has the ability to do a lot of workshop, high-complexity type of items and do those well,” he said. “When Taiwanese companies are in spaces where you can apply a lot of capital, a lot of cheap labor, they’re just getting slaughtered right now by the Chinese.”