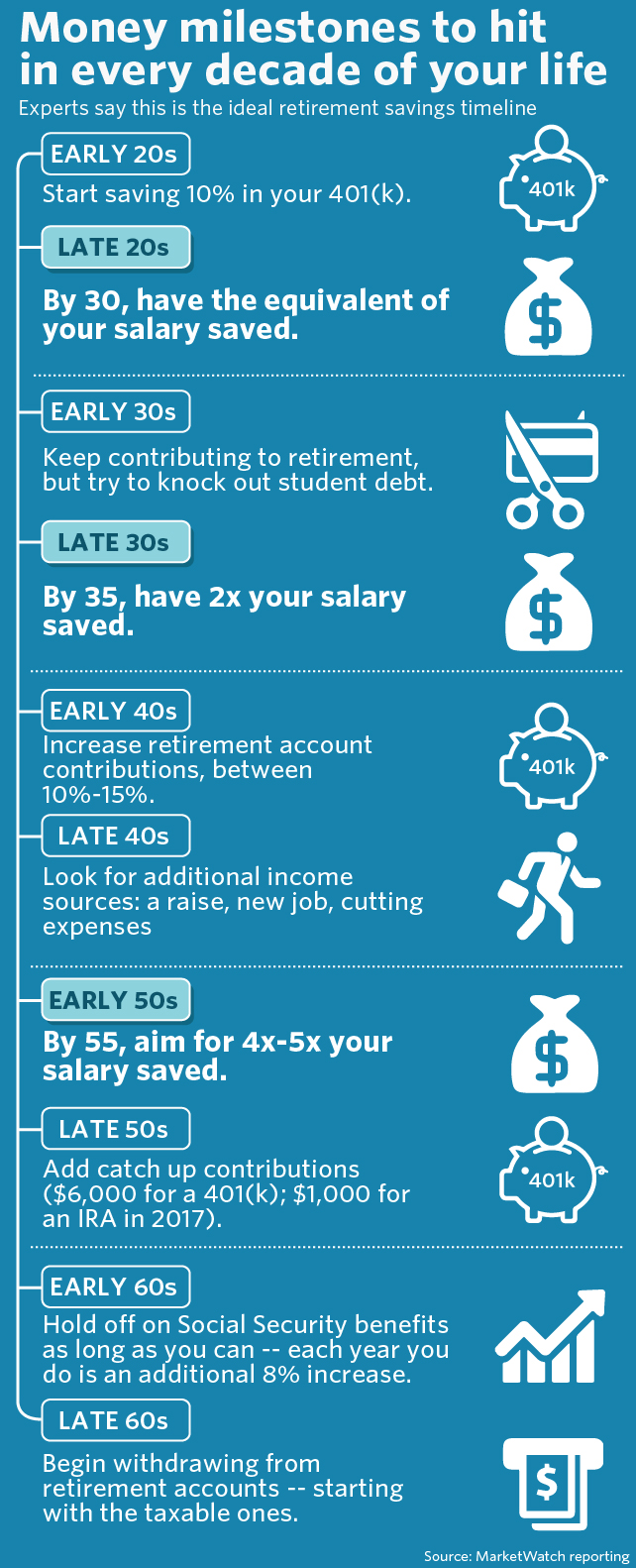

Experts say this is the ideal retirement savings timeline.

Planning how much to save for retirement, let alone actually putting away the money, can be overwhelming. Knowing is half the battle, but it can be difficult to wade through all the advice out there and get a clear answer to the question, am I where I should be?

Many studies and experts provide guidelines on how to save for retirement, depending on where you are in your life. We’ve compiled the best of those guidelines into one graphic that lays out an ideal timeline for your retirement savings:

Americans as it stands are drastically undersaved for retirement. Only a third of employees contribute to a 401(k) plan, and that’s if their employers even offer such an account (only 14% actually do, according to U.S. Census Bureau researchers). The typical working-age American couple only has $5,000 saved for retirement, according to an analysis of the Federal Reserve’s 2013 Survey of Consumer Finances done last year, and not many baby boomers are financially prepared for retirement just yet.

Employees are beginning to take saving for retirement more seriously, though. Two recent studies, one from Fidelity Investments and the other from Bank of America, suggest the balances for 401(k) plans and individual retirement accounts have reached an all-time high, and that more people are enrolling in these plans and contributing more than they did a decade before. Millennials, in particular, seem to be very interested in saving for their futures, likely a result of watching their parents and grandparents suffer from the financial crisis from the late 2000s, experts say. Still, many young Americans struggle with seeing themselves in retirement, or wonder if it’s worth it to put away $5 or $10 a month until they can contribute more. (The answer: yes, it is).

People in their 20s should start saving for retirement, no matter how much they can actually contribute to their accounts, and 30 year olds shouldn’t let mortgages, marriages and babies deter them from continuing, if not ramping up, contributions to their retirement accounts. The 40s are a critical time to save for retirement, as it’s when many people reach their peak income, and for those who couldn’t save as much as they wanted or needed, the 50s are a great time to catch up, because some financial responsibilities like raising kids and mortgages are dwindling down while contribution limits of 401(k) plans and IRAs are increased. Then of course, there’s the 60s decade, when people decide if they have enough to retire, or if they need to keep working just a little longer.