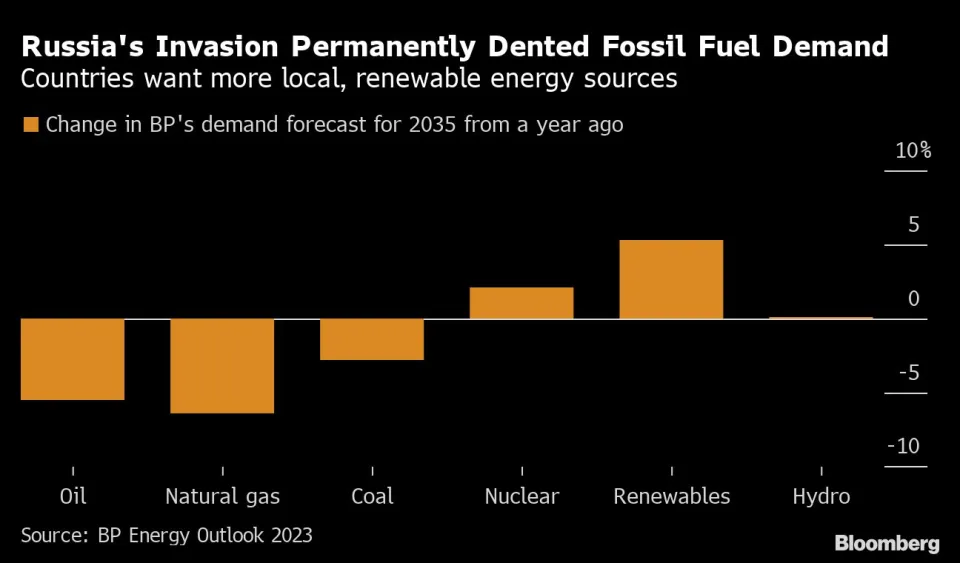

Russia’s war in Ukraine will accelerate the shift away from oil and gas as countries around the world prioritize domestic renewable energy sources as a way to increase security of supply while also cutting carbon emissions.

That’s the conclusion from the latest annual energy outlook from the economists at BP Plc. The oil major sees a much sharper decline in demand for fossil fuels in 2035, compared with its analysis conducted before last year’s invasion.

“The increased focus on energy security as a result of the Russia-Ukraine war has the potential to accelerate the energy transition as countries seek to increase access to domestically produced energy, much of which is likely to come from renewables and other non-fossil fuel,” said Spencer Dale, BP’s chief economist.

Russia’s war will also cause global GDP to be at least 2% lower by 2025, compared with the expectation a year ago, BP said. That means emissions will also be lower than previous projections.

The British oil major’s annual energy outlook posits three potential scenarios that differ in how quickly climate action cuts carbon emissions. All of them see oil and gas demand declining as renewables grow and transport electrifies in the coming decades, but the pace of change is uncertain.

In BP’s most conservative scenario in terms of climate goals, global oil demand would still be around 73 million barrels a day by 2050, down 25% from 2019. To reach net-zero carbon emissions by that year, BP forecasts oil demand would need to be less than a third of that amount.

In all scenarios, the world would rely on the Organization of Petroleum Exporting Countries for an ever-greater share of oil supply, ranging from 45% to 65% by 2050. The group will prove to be resilient because it has lower costs than rival producers such as the US, BP said.