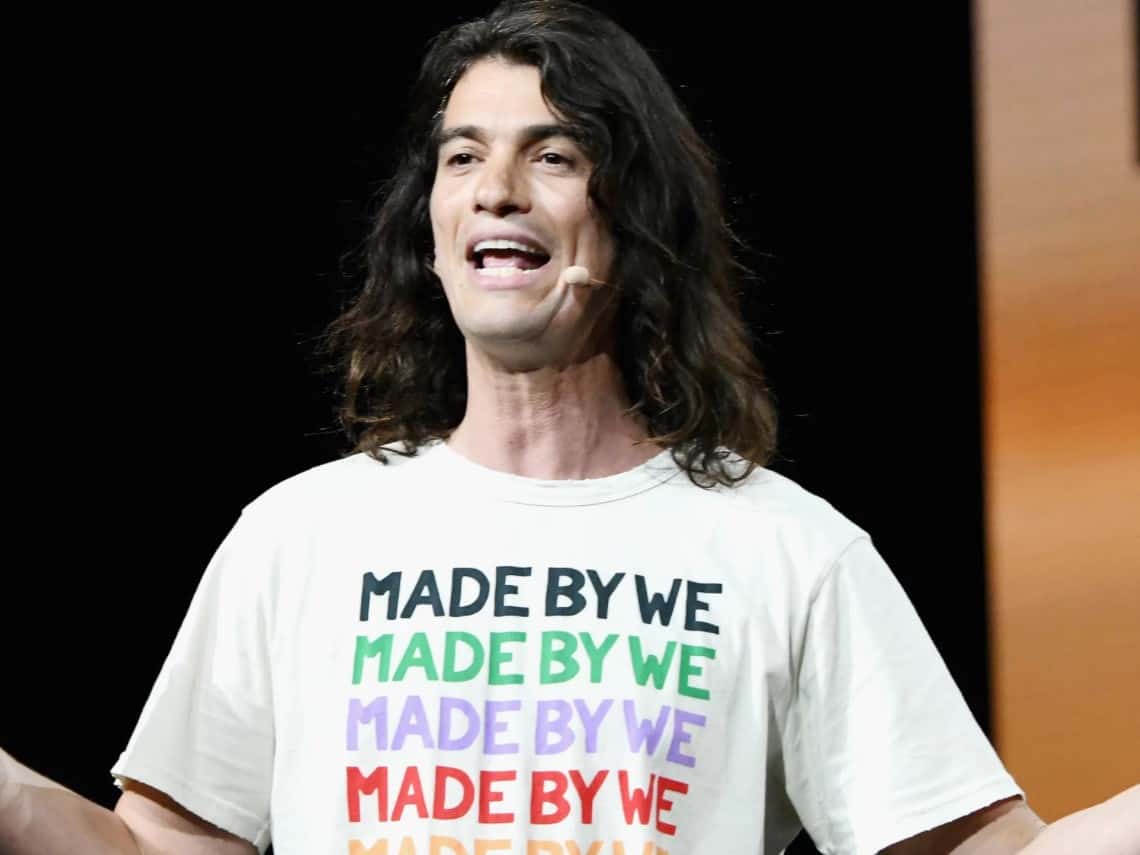

Say WeWork and one person comes to mind: Adam Neumann, the lanky founder and former CEO with flowing black hair and a rock-star persona who would carry on about the “energy” of the company’s communal work spaces.

He also embraced a “party-boy life style,” said Eliot Brown, whose new book with co-author Maureen Farrell, The Cult of We: WeWork and the Great Start-Up Delusion, was published on Tuesday.

Well before noon, Neumann was known to offer potential investors shots of tequila from a bottle he kept behind his desk.

“He had a cigar-bar-type vent installed in his office to suck out the marijuana smoke,” Brown said in an interview.

What emerged out of the haze? A company that investors, from Japanese juggernaut SoftBank to major U.S. firms like Goldman Sachs, said was worth $47 billion.

“He created the country’s most valuable startup, but it was essentially just a mirage,” Brown said. A mirage that eventually disintegrated.

Now, WeWork is in the midst of a second act. After ditching Neumann, the company hired a seasoned real estate executive as CEO and scaled back operations. It’s making a big bet on the rise of remote work and planning to go public this year, after the first attempt in 2019 under Neumann ended in a debacle.

From ‘dumpster fire’ to ‘righting the ship’

Here’s how WeWork’s business model is supposed to work: Land good deals on long-term office leases and then make a profit by subleasing the spaces out on short-term contracts, mostly to freelancers, gig workers and other creatives.

But Neumann saw the mission “in almost messianic terms,” said Brown. “He thought this was going to be a world-changing company, the most valuable company on earth, a company that would play a role in geopolitics.”

He left unanswered the mundane, yet critical questions, such as: How would WeWork make sure all of that office space be occupied for years to come? And what if a recession hit?

When WeWork first released its paperwork to go public in 2019, a “dumpster fire” emerged, Brown said. It came out that Neumann had taken out hundreds of millions of dollars for himself; he had restructured the company to give himself a tax break; and he had rented his own properties to WeWork.

As investors, journalists and others scrutinized the company, its valuation kept sinking. It nearly went bankrupt.

Now, WeWork has a new boss: former real estate executive Sandeep Mathrani. And his path is familiar in Silicon Valley. Like Uber CEO Dara Khosrowshahi, he is the grown-up cleaning up the mess that a mercurial founder left. In an appearance this spring on CNBC, Mathrani was asked about Neumann.

“It’s noise in the background as far as I’m concerned,” he replied. “My focus is to right this ship.”

WeWork’s second act: Admitting it’s a real-estate company

Those waters now appear choppy. Many employers sent workers home during the pandemic. Some are now making those arrangements permanent, at least to some degree. That has led companies to cancel some office leases and downsize others, said Barbara Denham, an economist at Oxford Economics.

“It’s one of the most uncertain times for the office market probably since the ’70s, when so many corporations left major cities,” she said.

WeWork, too, has downsized. In the past two months alone, it has left 17 buildings and renegotiated leases on more than 50 others, according to a company spokesperson.

But Denham says the company, which offers space literally by the hour, is well-positioned to capitalize on the changing nature of office work.

“The demand for the WeWorks of the world, the co-working space, the flexible office leasing market, is huge,” she said.

On the other hand, Brown notes, if more people return to the office, WeWork might struggle to maintain its hundreds of leases around the world.

“WeWork is positioning itself as a company that is capitalizing on the changing world of office space, but they really don’t know and neither do we,” Brown said.

WeWork is also hitching its appeal on people like Sameer Kapur, a Perdue University student who has launched a startup aimed at helping students learn to code. Right now, he does his work from a WeWork space inside a downtown San Francisco skyscraper.

“I get to see other founders, get to see other people who are working. Never know who you’re gonna meet,” Kapur said.

He also gets stunning views; kombucha on tap; even nooks to nap in. (WeWork spaces tend to have the vibe of a Brooklyn cafe or, as The New York Times put it, “decor inspired by gentrification.”)

But if something else came along, Kapur said, he’d be fine to ditch WeWork.

“I don’t have any brand loyalty,” he said. “If there was a cheaper alternative with just as many locations, I’d be happy to go with them.”

Neumann’s second act: Still in real estate

WeWork no longer says its goal is to “elevate the world’s consciousness.” It now admits that it is, indeed, a real estate company — which critics of the company, over Neumann’s objections, have said since its founding.

After the WeWork implosion, Neumann and his wife Rebekah hunkered down in Tel Aviv. Now, they’re back in the U.S., living with their six children in the Hamptons.

And Neumann is at it again, reportedly investing in various startups tied to the real estate world.

“His focus would be the future of living,” Brown and Farrell wrote in their book. “He was eager and full of energy. He was yearning to get back in the game.”