The era of the hyper-processed food diet is likely coming to an end, as consumer tastes are rapidly changing, and the so-called “frankenfoods” are being turned away the same way children of older generations refused to eat liver and lima beans.

Back in July 2022, the University of Edinburgh released a study showing how children are more likely to prefer foods they believe to be natural compared to lab-grown options.[1]

These findings matched well with a poll released in March 2022 showing a “trust gap” in American consumers over where their food comes from, and how tastes are greatly skewing towards more natural foods diets.[2]

Another poll from Gallup updated and released in July 2022 showed the two most popular food categories were “Locally Grown” and “Natural”, of which most consumers expressed they would be willing to pay more for.[3]

Through intensive research, we’ve identified an incredibly opportunity, through a newly-IPO’d stock with all the tools in place for explosive growth in a rapidly shifting market that’s hungry for better, higher-quality CLEAN LABEL foods.

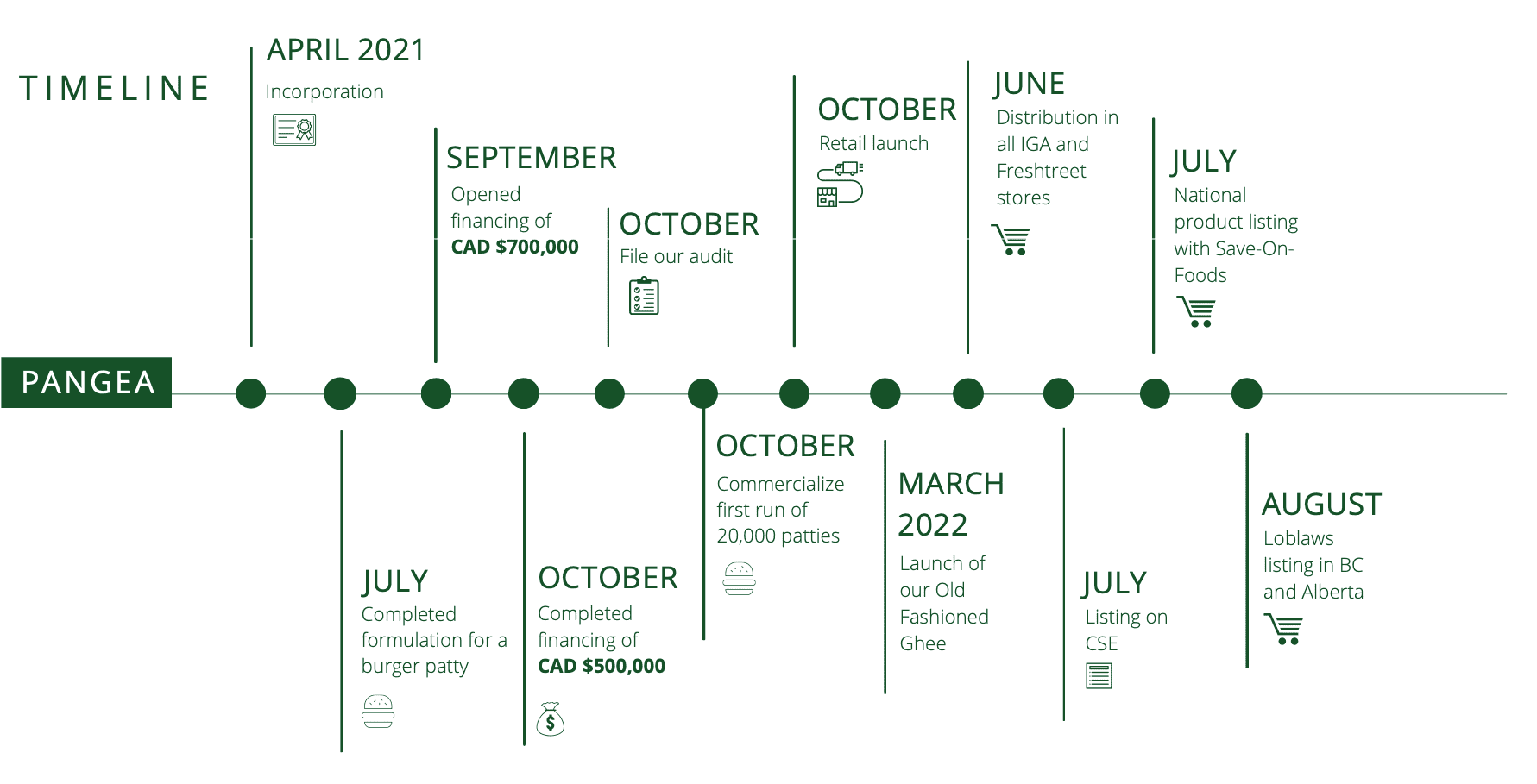

That company is Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF), a high-quality natural food company, that’s “Powered by Plants” and led by a well-connected team that’s already placed products into over 250 retail outlets across Canada and the United States, and now into a 4-Star World Class Airline’s flight network.

A food revolution is underway. Consumers and their tastes have been steadily trending towards healthier choices, with demand surging towards Organic, GMO Free, more natural foods. In short, the industry is calling these types of offerings “clean label”.

We’re witnessing a change, and have identified Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) as a perfect growth-oriented example that’s early enough in its story to provide the potential for HUGE gains.

This clean label ingredient market is forecasted to grow to US$51.14 billion globally by 2024,[4] while potentially growing at a CAGR of +17.5% through to 2030.[5]

The Non-GMO Food Market is projected to be worth over US$1.2 trillion by 2028, growing at a double-digit CAGR of 10.20%.[6]

The Global Organic Foods and Beverages Market is expected to reach US$564.22 billion by 2030, growing at another double-digit CAGR of 13%.[7]

The Plant-based Foods Market is set to hit $162 billion by 2030—the same year global animal and dairy protein demand is poised to reach $1.2 trillion.[8]

Flexitarianism is on the rise, bolstering the bulk of demand for plant-based meat-alternative or dairy-alternative products. Between 36-47% of those surveyed have identified as flexitarians, while 63% said they’re willing to go flexitarian if plant-based alternatives met specific criteria. [9],[10]

So yes, CLEARY there’s a food revolution underway, and we’re here to make sure you don’t miss out on it.

Pangea Natural Foods in 30 Seconds

- Founded by an expert team with successes in food and financing, with a long list of connections in place to quickly achieve their goals

- Simultaneously launched first product, Plant-based Patties, into hundreds of grocery stores across Canada, swiftly signed-on through management team’s previously established connections in the food distribution industry.

- Revolutionary Plant-based Patties are free of GMO ingredients, fillers, antibiotics, hormones, and bioengineered ingredients and are low in sodium.

- Available in Canada through major chains such as IGA Marketplace and Fresh Street

- Expanded into United States through product listing in H Mart locations in Texas

- Old Fashioned Ghee (clarified butter) is the company’s second product to launch

- Made from grass-fed and organic dairy imported from New Zealand

- Most ghee on the current North American market comes from Mexico, whereas some of the world’s best butter/ghee comes from New Zealand[11]

- National distribution started right away in every Save-On Foods location in Canada, as well as IGA, Superstore, and Freshly as well

- Contract in place with Canadian Dairy Association to securely import grass-fed organic dairy from New Zealand—an EXCLUSIVE source

- Made from grass-fed and organic dairy imported from New Zealand

- Munchie Mix is the company’s third product listing, which successfully launched with an exclusive distribution deal to be available on Air Canada’s fleet of airplanes of over 330 aircrafts and serving more than 160 destinations.

RISING FOOD MARKET VALUATIONS

With food security becoming a growing concern in several markets around the world,[12] there’s been a surging interest in food stocks as a safe recession-proof investment.

It’s a growing segment that’s drawn the interest of some of the world’s most prominent billionaire investors.

French telecom billionaire Xavier Niel has gone all-in on organic foods, launching a blank-check special purpose firm, or Spac, 2MX Organic—with the aim of acquiring companies involved in the fast-growing sectors of organic food and sustainable consumer goods.[13]

On its first day of trading, 2MX Organic raised €300 million (US$316 million) in the largest public offering on the Paris market of 2020.

Back in March of 2022, John Catsimatidis, the billionaire owner and CEO of New York City supermarket chain Gristedes, urged Americans to “buy” now, because food inflation will only get worse.[14]

Through steady accumulation, Bill Gates has successfully the largest single owner of farmland in America, now supplying carrots, soybeans, rice, onions and potatoes to the market.[15]

At the end of 2021, food giant McCain Foods invested $55 million in Irish plant-based frozen foods startup Strong Roots.[16]

And now that food shortages are being predicted around the world, those who can maintain supplies seem destined to capitalize.

We can see by the performance of Food ETFs that global tensions and energy crises are pushing these stocks up, including:

- Invesco Dynamic Food & Beverage ETF (NYSE:PBJ) rose by 13% between Jun-Aug22

- Consumer Staples Select Sector SPDR Fund (NYSE:XLP) rose by 12% between Jun-Aug22

- iShares US Consumer Staples ETF (NYSE:IYK) rose by 12% between Jun-Aug22

Several other individual food and agribusiness stocks have performed even better, including:

- MGP Ingredients, Inc. (NASDAQ:MGPI) rose 84% between Sep21-Aug22

- Sprouts Farmers Market, Inc. (NASDAQ:SFM) rose 72% between Nov21-Aug22

- Archer-Daniels-Midland Company (NYSE:ADM) rose 53% between Sep21-Aug22

- Sovos Brands, Inc. (NASDAQ:SOVO) rose 48% between Mar-Aug22

- Seneca Foods Corporation (NASDAQ:SENEA,SENEAB) rose 46% between Nov21-Aug22

- Bunge Limited (NYSE:BG) rose 37% between Sep21-Aug22

- Performance Food Group Company (NYSE:PFGC) rose 37% between May-Aug22

- United Natural Foods, Inc. (NYSE:UNFI) rose 36% between Mar-Aug22

- Farmer Bros. Co. (NASDAQ:FARM) rose 31% between Jun-Aug22

- The Chefs’ Warehouse, Inc. (NASDAQ:CHEF) rose 29% between Sep21-Aug22

- Hormel Foods Corporation (NYSE:HRL) rose 27% between Sep21-Aug22

Pangea’s management team has swiftly prepared and launched multiple products into the market, through their food distribution connections made over decades.

Having only gone public in July 2022, Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) is still at the beginning of its story with plenty of space to grow.

PLANT-BASED PATTIES

Launched in October 2021, Pangea Natural Foods’ (CSE:PNGA) (OTC:PNGAF) flagship product is its Plant-based Patties.

Each vegan patty is handmade using locally sourced whole food ingredients such as leeks, bell peppers, spinach, potatoes, black beans, carrots, chickpeas, mushrooms and bread crumbs, and pea protein is used instead of soy protein.

Unlike most of the competition, Pangea’s Plant-based Patties are handmade (not machine-made). Consumers can confidently know what they’re eating by simply looking at the burger.

When CEP Pratap Sandhu took part in the product’s creation, he wanted consumers to take a bite and taste the leeks, while in another bite also tasting the red peppers.

These Plant-based Patties are made at Pangea’s Fraser Valley, BC production facility, which has been approved by both the Canadian Food Inspection Agency and the Federal Drug Administration. The patties are available in stores across the country, through distribution deals signed with some of Canada’s largest grocery chains.

FOOD MARKETING/DISTRIBUTION DREAM TEAM

Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) is led by a tightknit team of experts with history of successes and a wealth of contacts within the food world.

Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) is led by a tightknit team of experts with history of successes and a wealth of contacts within the food world.

It’s led by CEO and Director Pratap Sandhu, is an entrepreneur with extensive experience in food manufacturing and distribution. He’s currently the Director of Marketing at Prabu Foods, which manufactures and distributes to retail and wholesale outlets across the world. He’s also participated in many investment opportunities within the food and technology industry; he committed over $1 Million of his own money into these ventures. At the current age of 27, Sandhu was recognized by Baystreet Bull in its 30X30, recognizing Canada’s top 30 entrepreneurs under 30.[17]

He’s joined by Directors Nashir Virani, and Mohammad S. Fazil.

In 1979, Virani founded Golden Boy Foods, which started off as a coffee business and led to become much bigger as a wholesaler for peanut butter, baking goods, nuts and dried fruit. Golden Boy Foods was then sold for $500 million (USD) to Kraft Foods. This extensive experience then led him to the opportunity to own and operate First Choice Foods, which generated $25.07(USD) million in sales. He’s also been busy investing in Pre IPO’s and startups such as property, food and tech companies. He’s raised over $6 Million doing so while continuing to operate First Choice Foods.

Fazil has been active in venture capital for over 25 years. During his career he’s raised over $300 Million for venture companies, public and private. He’s the founder and President of Lion Park Capital, a private financial advisory firm helping companies raise funding and list on a Canadian stock exchange. He’s also currently a Director of Comprehensive Healthcare Systems Inc., a US based Healthcare administration company, and the Chairman of the Calgary branch of the TSX Venture Exchange’s Listing Advisory Committee and a member of the National Advisory Committee.

Prior to this, Fazil was also the founder and CEO of a hemp manufacturing and marketing company Harbour Star Capital (now Eastwest Bioscience, listed on the TSXV), the former CEO and Director of Elephant Hill Capital which is now the TSXV-listed, fully licensed eSports betting platform Real Luck Group, and the former President and founder of Scythian Biosciences (now SOL Global Investments), listed on the TSXV) which is active in the US cannabis sector.

OLD FASHIONED GHEE (CLARIFIED BUTTER)

In March 2022, Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) launched its Old Fashioned Ghee successfully across the country, much like the Plant-based Patties launch.

In March 2022, Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) launched its Old Fashioned Ghee successfully across the country, much like the Plant-based Patties launch.

Ghee is a clarified and unsalted form of butter that is caramelized and transformed into pure fat at a high smoking point, with the milk solids remove, meaning even the lactose-intolerant to enjoy the remaining pure ghee.

The Global Ghee Market reached a value of US$45.7 billion in 2021, and is expected to reach US$68.9 billion by 2027, growing at a CAGR of 7.18%.[18]

Old Fashioned Ghee is a healthy fat, that’s a natural source of antioxidants, vitamins, and helps strengthen our immune and digestive system. It’s Organic, Grass Fed, New Zealand Butter.

The company has secured the ability to import its ghee dairy from New Zealand, using strictly grass-fed and organic ingredients.

Through a contract with the Canadian Dairy Association, Pangea Natural Foods is able to import in a unique product, given that much of the ghee currently on the market is made from butter from Mexico. However, in many ways, New Zealand is recognized as one of the best butter markets in the world.

And Pangea has an exclusive source.

It’s recognized as a good source of proteins, vitamins, potassium, phosphorus, calcium, selenium, antioxidants, butyric acids, and essential fatty acids, including omega 3 and 6.

Ghee provides numerous health benefits, such as improving digestion, boosting brain and heart health, lowering harmful cholesterol levels, and transporting vitamins throughout the body.

Shelf-stable, rich in aroma and texture, and not requiring refrigeration, ghee is widely used as a cooking oil in baked goods or for sauteing and deep-frying vegetables.

MUNCHIE MIX

Pangea Natural Foods’ (CSE:PNGA) (OTC:PNGAF) first two original product launches began with national distribution in Canada. However, the connections held by the management team go far beyond just Canada, and already brought them into the United States as well.

Now Pangea’s products will be seen the world over, having signed a deal with Canada’s largest domestic and international airline, Air Canada, with a fleet of over 330 planes, serving more than 160 destinations, and flying up to 438 daily flights between Canada and the United States alone.[19]

Together with Air Canada Rouge and Air Canada Express partners, Air Canada provides scheduled passenger service directly to 51 Canadian airports, 46 destinations in the United States and 67 airports in Europe, the Middle East, Asia, and Africa.

BEFORE YOU GO…

Now that it’s publicly trading, Pangea Natural Foods (CSE:PNGA) (OTC:PNGAF) is poised for big things before the end of 2022 and beyond. The company has not only the impassioned leadership and portfolio in place to strive forward, but also the multigenerational contacts to accelerate growth as the natural, high-quality food industry enters into a big breakout period.

Because their publicly-traded journey has only just begun, we expect Integrated Pangea’s news flow over the next few months to come very fast.

Be sure to subscribe and visit the official Pangea Natural Foods website to learn more.

SOURCES CITED:

[1] https://www.sciencedaily.com/releases/2022/07/220721132036.htm

[2] https://foodinstitute.com/consumerinsights/poll-most-americans-have-trust-gap-over-food-source-information/

[3] https://news.gallup.com/poll/6424/nutrition-food.aspx

[4] https://www.newfoodmagazine.com/article/91202/controlling-contaminants-the-new-facet-of-clean-label/

[5] https://www.foodnavigator.com/Article/2022/07/20/clean-label-claims-boost-sales-but-what-categories-benefit-most

[6] https://www.globenewswire.com/news-release/2022/02/21/2388593/0/en/Non-GMO-Food-Market-to-Worth-USD-1-231-13-Billion-by-2028-Non-GMO-Food-Industry-CAGR-of-10-20-2021-2028.html

[7] https://www.grandviewresearch.com/press-release/global-organic-food-beverages-market#:~:text=Organic%20Food%20%26%20Beverages%20Market%20Growth,13%25%20from%202022%20to%202030.

[8] https://www.bloomberg.com/company/press/plant-based-foods-market-to-hit-162-billion-in-next-decade-projects-bloomberg-intelligence/

[9] https://www.ift.org/news-and-publications/food-technology-magazine/issues/2020/december/departments/news-flexitarianism-on-the-rise-transparency-tops-2021-trends

[10] https://foodinstitute.com/focus/veganuary-2022-coincides-with-growing-flexitarian-trend/#:~:text=GROWING%20SEGMENT%20OF%20SOCIETY&text=A%20One%20Poll%20survey%20commissioned,2021).

[11] https://www.stuff.co.nz/life-style/91550729/making-new-zealand-butter-the-best

[12] https://www.cadtm.org/International-food-crisis-and-proposals-to-overcome-it

[13] https://www.ft.com/content/6180627c-9c12-46ac-b8eb-ec0f010a57ff

[14] https://www.foxbusiness.com/economy/billionaire-supermarket-ceo-oil-inflation-economy

[15] https://www.nbcnews.com/tech/tech-news/mcdonald-s-french-fries-carrots-onions-all-foods-come-bill-n1270033

[16] https://www.forbes.com/sites/joanverdon/2021/12/08/mccain-foods-invests-55-million-in-plant-based-startup-strong-roots/?sh=7b6bb3d372d3

[17] https://baystbull.com/30×30-pratap-sandhu-pangea-natural-foods/

[18] https://www.imarcgroup.com/ghee-market#:~:text=The%20global%20ghee%20market%20reached,7.18%25%20during%202022%2D2027.

[19] https://www.aircanada.com/ca/en/aco/home/about/corporate-profile.html#/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Pangea Natural Foods advertising and digital media from the company directly. There may be 3rd parties who may have shares of Pangea Natural Foods, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Pangea Natural Foods which were purchased as a part of a private placement. MIQ will not buy or sell shares of Pangea Natural for a minimum of 72 hours from the publication date on this September 1, 2022 but reserve the right to buy and sell, and will buy and sell shares of Pangea Natural Foods at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.