Stock Markets

Even though stocks finished mixed the last week of April, the S&P 500 posted its best month since 1987. Synchronized stimulus initiatives globally improved sentiment from the March stock-market bottom. Volatility has subsided some but remains elevated. Economic data, including first-quarter U.S. GDP, point to broad weakness, marking the start of the recession, and companies are pulling full-year guidance due to the uncertainty. Economic activity will worsen because containment measures were expanded in the beginning of the second quarter, but the market is discounting that and focusing on the upcoming reopening of the economy. The Fed held its benchmark rate at 0.0%-0.25% last week and pledged to keep rates near zero until employment and inflation recover. The recent rebound in stocks highlights, analysts say, show that a disciplined investment strategy is the best way to navigate volatility. They believe the economy will start to recover, but the recovery will be phased in and gradual, with periodic setbacks along the way.

U.S. Economy

The S&P 500 ended the month of April with the highest gains since 1987, up 12.9% for the month. April was indeed a quick turnaround to the fastest bear-market decline in 90 years, with stocks up 26.6% from the March 23 low. The month of April is also characterized by the unprecedented stoppage of economic activity and a worldwide shutdown of business and social interactions. In contrast to the previous month, May is likely to be marked by a historic reopening of the global economy, from a sudden stoppage to a new normal, reflecting the still present, though receding, risks. Three key investment themes taking root now that will likely seed the recovery to come:

- The second quarter will reflect more of the economic toll than the first quarter, with green shoots of recovery expected to appear in the second half of the year.

- Central banks are the tillers of the soil, weeding out illiquidity in the credit markets and planting stimulus deeper and wider than ever before to seed an economic recovery.

- Earnings fog clouds the outlook for the year, with a sunnier forecast for a 2021 rebound in corporate fundamentals.

Metals and Mining

The gold price finished the month of April in the red, slipping as low as US$1,671.80 per ounce in pre-trading hours on Friday. The fall ended the yellow metal’s steady ascent, which began after a pronounced period of liquidation in March brought gold as low as US$1,471.

Growing optimism that easing lockdowns will bolster markets and that economic activity will resume weighed on the broader precious metals sector as well this week, with silver and palladium also sliding back from their Monday prices. In the face of this week’s headwinds, gold has still climbed 8.2 percent year-to-date and is nearing historic highs, said CPM Group’s Jeffrey Christian during a World Gold Forum presentation. Describing gold’s movements as a stealth bull market, he explained, “Our estimate is that the average might be US$1,640 to US$1,650. That compares to an annual average of US$1,670 at its peak in 2012.”

For much of April, silver traded flatly between US$15 per ounce and US$15.40, trapped by declining industrial demand. Unlike gold, which gained back its mid-March losses, the white metal has been unable to even approach its February high of US$18.60. That may change as investor demand is projected to grow in the space this year due to renewed safe haven diversification appetite.

Platinum also experienced volatility this session, trending as high as US$764 per ounce and then tumbling to US$746 before the morning bell on Friday. The autocatalyst metal has slipped 22.3 percent year-to-date and is likely to continue to face price pressure from a disrupted auto manufacturing sector. Palladium is facing similar challenges as broken supply chains and global lockdowns ended its steady 18-month ascent. The sector also faces challenges down the line, as substitutions in the auto sector see the amount of palladium used in catalytic convertors reduced for an increase in platinum.

The base metals sector saw some positivity this week, with copper and zinc pulling out small gains, while nickel stumbled lower. Copper began the period at US$5,165.50 a tonne and gradually edged higher. Looking ahead, the red metal is projected to play an important role as society emerges from stoppages. Confidence that an end to economic slows could be in sight also benefited zinc this week. The metal was able to climb US$1,891 per tonne to US$1,930 on Wednesday. Renewed tensions regarding trade talks between China and the US on Thursday were reflected in a slight decline. Nickel faced its own demand decline challenges this week, which weighed on its price. After plateauing at the US$12,250 per tonne range, prices slid mid-week. Lead also fell lower after climbing to US$1,623 per tonne on Tuesday, its highest value this week. The metal then continually fell lower for the remainder of the period.

Energy and Oil

Oil is set to post its first weekly gain in more than a month as production cuts and some relatively positive news regarding the coronavirus boosted sentiment. The OPEC+ deal began Friday, while shut in wells have begun to pile up in meaningful volumes. The U.S. Federal Reserve revised its Main Street Lending Program to allow larger and more indebted companies to qualify for lending. The announcement received criticism from multiple corners. “The major changes announced today mirror the top requests of the oil and gas industry,” a congressional watchdog said. “That raises questions about how the changes promote the broader public interest — especially when these companies will still have no real obligation to retain or rehire their workers.” Even the powerful American Petroleum Institute spoke out. “You can’t have capitalism on the way up and socialism on the way down,” an API executive said.

With U.S. storage about to hit tank tops in a matter of weeks and the world deep in the throes of the biggest economic challenge in modern history, the inevitable has begun to unfold: The arduous and costly process of well shut-ins. ExxonMobil reported a first quarter loss of $610 million, compared to a profit of $2.4 billion a year earlier. It was the first quarterly loss in 32 years. The loss was made worse by $3 billion in write downs. Chevron said it would shut down 400,000 bpd and scrap 60 percent of its drilling rigs. In the Permian, Chevron cut rigs from 17 to 5. Latin America has a nameplate refining capacity of 7.5 mb/d, but they are operating significantly below that level. Many facilities are aging and were operating below capacity before the downturn but plunging demand has substantially curtailed output.

Natural gas spot prices are mixed at most locations this week. The Henry Hub spot price fell from $1.87 per million British thermal units (MMBtu) last week to $1.70/MMBtu this week. At the New York Mercantile Exchange (Nymex), the May 2020 contract expired Tuesday at $1.794/MMBtu, down 15¢/MMBtu from last week. The June 2020 contract price decreased to $1.869/MMBtu, down 18¢/MMBtu from last week to this week. The price of the 12-month strip averaging June 2020 through May 2021 futures contracts declined 7¢/MMBtu to $2.535/MMBtu.

World Markets

European equities rose as investors welcomed announcements that lockdown measures will soon start being lifted. However, the European Central Bank’s decision not to inject more stimulus into the economy eroded gains. The pan-European STOXX Europe 600 Index ended the week 2.60% higher. Germany’s Xetra DAX Index surged 5.08%, France’s CAC 40 climbed 4.07%, and Italy’s FTSE MIB Index gained 4.93%. The UK’s FTSE 100 Index rose 0.73%.

The European Central Bank (ECB) left its key deposit rate at a record low of -0.5% and reaffirmed its plan to buy more than €1 trillion of bonds to shore up financial markets. It also expanded its loans to banks through targeted longer-term refinancing operations (TLTROs), offering them at an interest rate as low as -1% from June. The bank further announced a round of fresh lending starting in May with a rate of -0.25% “to support liquidity conditions in the euro area financial system and contribute to preserving the smooth functioning of money markets by providing an effective liquidity backstop.” ECB President Christine Lagarde said the central bank was “fully committed to doing everything possible within its mandate to support every citizen of the eurozone” but that “an ambitious and coordinated fiscal stance is critical.”

Financial markets in China were shut on Friday for an extended Labor Day holiday and were set to open again on Wednesday, May 6. Over the shortened week, the CSI 300 large-cap index rose 3.0%, beating the Shanghai Composite, which gained 1.8%.

In an attempt to boost consumer spending, the Labor Day holiday is one day longer than last year. Most analysts believe a mood of caution will prevail, however, as workers worry about job security, global recession, and a potential fallout from the current crisis. Per capita disposable income fell by 3.9% in the first quarter, so any rebound due to pent-up consumption may be brief. Cinemas remain closed, and shopping malls are imposing social distancing and frequent temperature checks. While a few travel restrictions remain, with some local governments discouraging travel between provinces, signs suggest that economic and social activity continue to normalize across China.

The Week Ahead

The earnings season continues this week, with about one-third of the companies in the S&P 500 reporting first-quarter results. Important economic data being released include factory orders on Monday, the non-manufacturing Purchasing Managers’ Index (PMI) on Tuesday, and April’s jobs report on Friday.

Key Topics to Watch

- Factory orders

- Trade deficit

- Markit services PMI

- ISM non-manufacturing index

- ADP employment report

- Initial jobless claims

- Productivity

- Unit labor costs

- Non-farm payrolls

- Unemployment rate

- Average hourly earnings

- Wholesale inventories

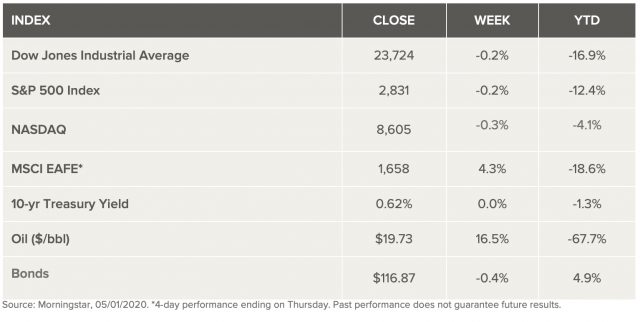

Markets Index Wrap Up