European stocks finished firmly higher on Friday, rallying in afternoon trade after a solid U.S. jobs report send the dollar soaring against the euro.

An upbeat view on trade talks between the U.S. and China were seen as cooling tensions that have recently hurt markets world-wide, also helping lift stocks into the weekend.

How markets are moving

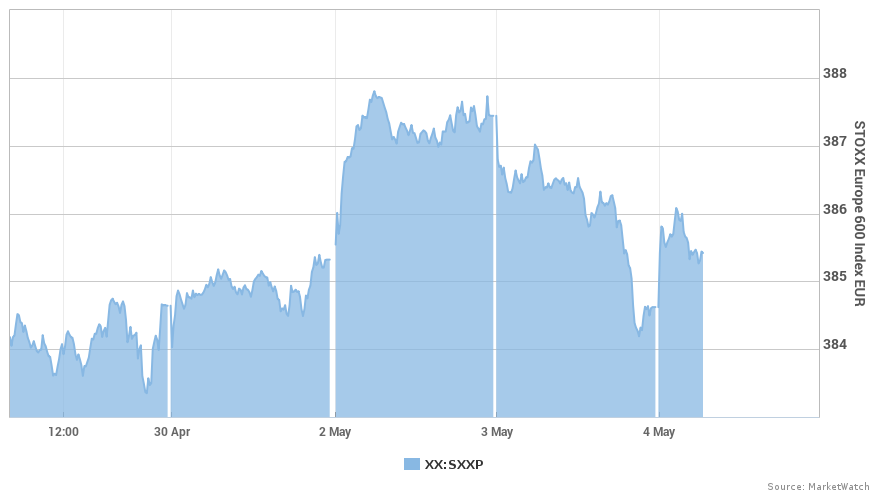

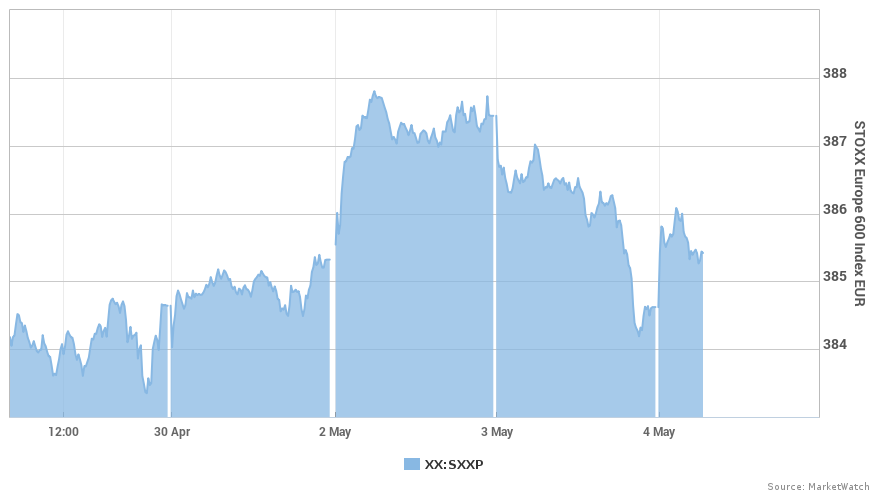

The Stoxx Europe 600 index SXXP, +0.63% picked up 0.6% to end at 387.03, logging a 0.6% gain on the week. That marks a sixth straight weekly advance, its longest run of weekly wins since March 2015, according to FactSet data.

On Thursday, the Stoxx 600 fell 0.7% and printed its lowest close since April 26.

France’s CAC 40 PX1, +0.26% erased an earlier loss and closed 0.3% higher at 5,516.05. Germany’s DAX 30 DAX, +1.02% rose 1% to 12,819.60, and the U.K.’s FTSE 100 UKX, +0.86% climbed 0.9% to 7,567.14.

The euro EURUSD, -0.2086% bought $1.1933, down from $1.1988 late Thursday in New York. The shared currency has fallen about 1.6% against the buck this week.

What’s driving the market

Trade talks between the U.S. and China were a major focus for investors. After the talks wrapped up on Friday, a statement described the meeting led by Chinese Vice Premier Liu He and U.S. Treasury Secretary Steven Mnuchin as “frank, efficient and constructive.” The statement, however, also said there remained “significant disagreements over certain issues.”

The U.S. delegation had earlier presented Chinese officials with a lengthy list of demands aimed at reducing the trade imbalance between the world’s two biggest economies, The Wall Street Journal reported. Worries about heightened trade tensions between the world’s two largest economies have rattled financial markets throughout this year.

Stocks across Europe also got an afternoon boost from U.S. jobs data, showing the unemployment rate in April dropped below 4% for the first time since 2000. That helped send the ICE U.S. Dollar Index DXY, +0.14% up 0.5% and in turn yanking the euro lower. A weaker currency is good news for Europe’s many exporters that make the bulk over their revenue overseas.

European stocks were little changed after disappointing eurozone retail sales data for March, with growth of 0.8% falling short of a 1.9% consensus estimate from FactSet. Separately, the final print of the eurozone services PMI for April came in at 54.7, down from a flash estimate of 55.0 from IHS Markit.