A study of analyst recommendations at the major brokerages shows that Ternium S A (Symbol: TX) is the #16 broker analyst pick, on average, out of the 50 stocks making up the Metals Channel Global Mining Titans Index , according to Metals Channel . The Metals Channel Global Mining Titans Index is comprised of the top fifty global leaders from the metals and mining sector. The companies listed in the Metals Channel Global Mining Titans Index are not fixed, but instead variable – updating on a continuous basis to reflect the changing market environment with respect to commodity prices, government policy and market volatility.

From the other direction, when companies have a low rank among analysts, it isn’t necessarily the case that investors should conclude that the stock will perform poorly. It can, of course, but a bullish investor could also take the contrarian angle and read into the data that there is lots of room for upside because the stock is so out of favor.

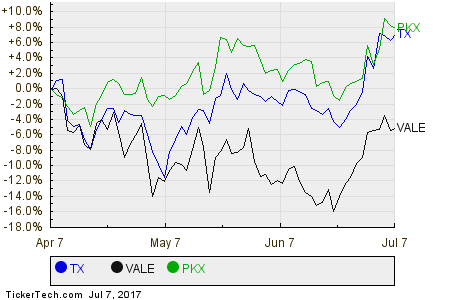

According to the ETF Finder at ETF Channel, TX makes up 8.62% of the Steel ETF ( SLX ) which is trading lower by about 1.6% on the day Friday.TX operates in the Non-Precious Metals & Non-Metallic Mining sector, among companies like Vale SA ( VALE ) which is down about 1.3% today, and POSCO ( PKX ) trading up by about 0.2%. Below is a three month price history chart comparing the stock performance of TX, versus VALE and PKX.

TX is currently trading off about 1.1% midday Friday.